Good morning,

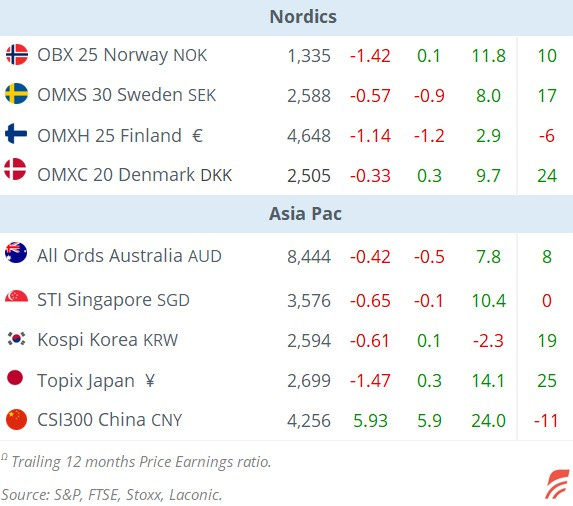

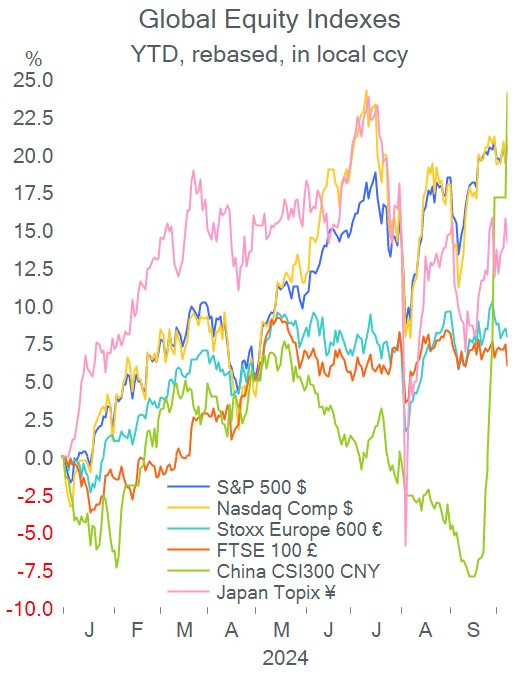

Global markets sentiment continues to be driven by headlines on China’s stimulus measures and whether these are enough to revive the economy. Mainland stocks rallied 6% yesterday as they returned from a week-long holiday but Hong Kong’s benchmark plunged 10%, its worst day since the 2008 crisis. Asian markets remain weak with mainland China selling off another 5% on Wednesday. However, this reversal in stock prices comes after a sharp rally for Chinese markets with the CSI300 index showing similar returns to the S&P 500 this year.

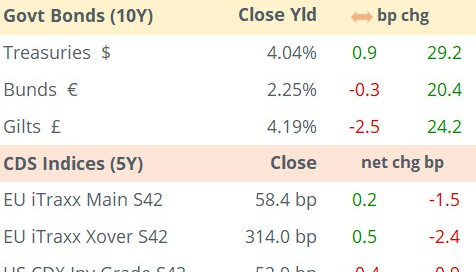

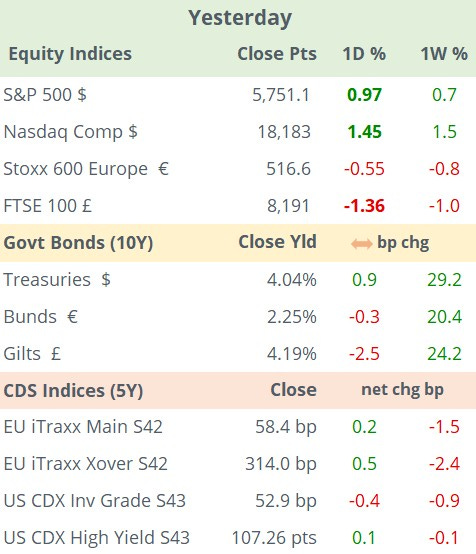

Wall Street closed higher by 1% last night driven by the Magnificent Seven tech stocks while the energy sector was the clear underperformer as crude oil plunged. In Europe, the FTSE 100 was the main loser with a 1.3% decline on weaker mining stocks.

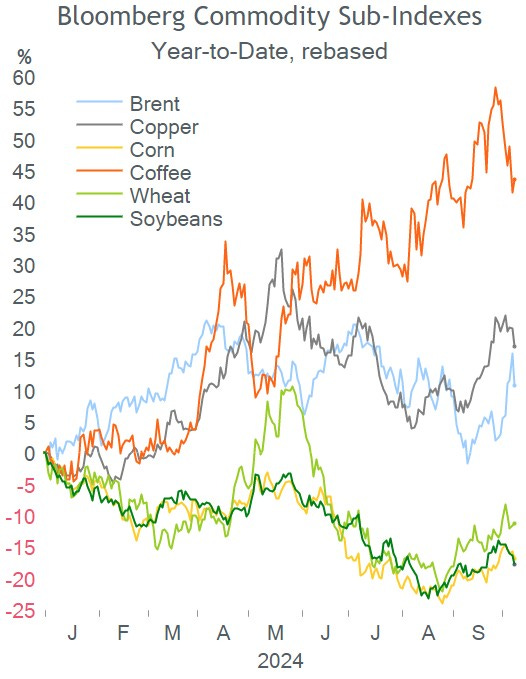

Commodities remain volatile with oil dropping almost 5% on Tuesday and base metals also trading downwards as traders worry that the stimulus announced by Beijing may not be sufficient. Brent is trading at $77.50 this morning. European equity futures are pointing to a flat open while U.S. futures are a touch lower in overnight trading.

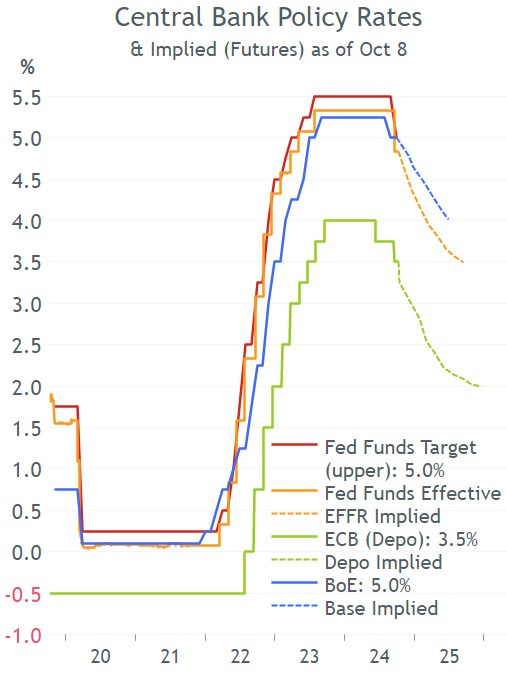

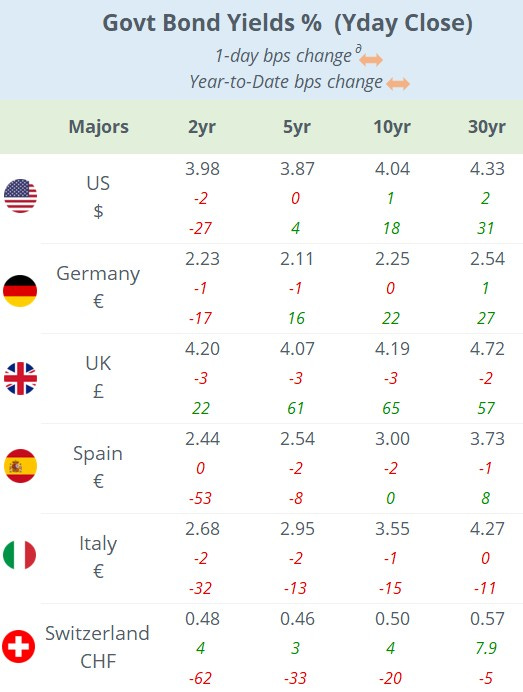

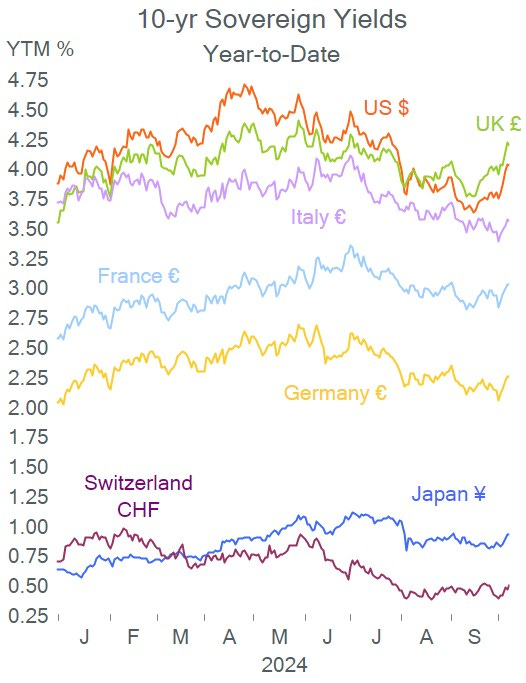

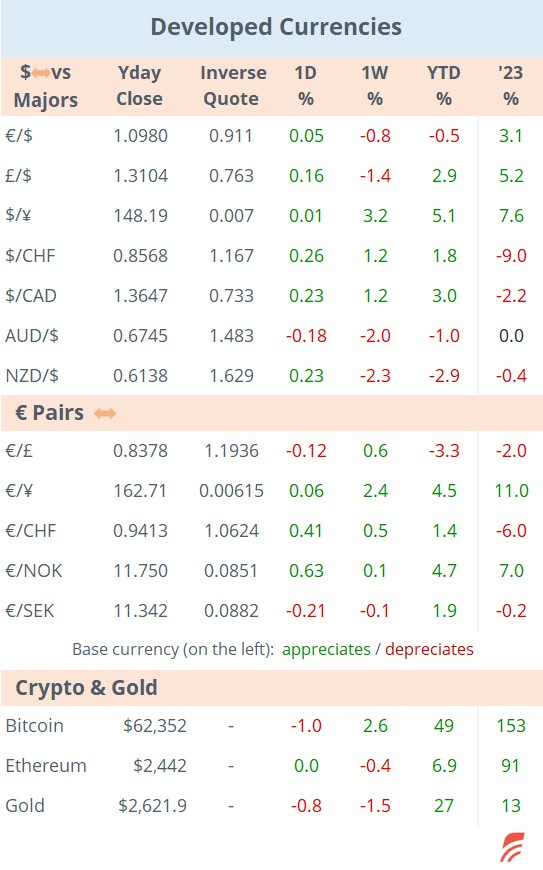

Tuesday was an uneventful day for bonds and currencies following two weeks of $ appreciation and a rise in benchmark yields as traders lowered their expectations for large policy rate cuts by the Fed. Tomorrow’s U.S. inflation update will be a key data point for sentiment.

The president of the New York Fed, John Williams, said the central bank was well positioned to accomplish a soft landing for the U.S. economy following the latest employment report and signalled support for 25bp cuts. The Fed’s ‘dot plot’ is forecasting two more 25bp rate cuts by year-end. Yesterday, the implied probability for the Fed maintaining rates steady at the Nov 7 meeting, rose marginally to 12%, against an 88% chance for a cut.

Israel is intensifying its ground offensive in Lebanon to fight Hizbollah and Tel Aviv urged the Lebanese to take back control of their country from the terrorist group.

The U.S. government demanded West Florida citizens evacuate the region as Hurricane Milton is expected to make landfall near Tampa tomorrow evening as a Cat 4 or 5.

The Reserve Bank of New Zealand cut its cash rate by 50bp as expected to 4.75%, its second straight cut, and said that policy remains at restrictive levels despite inflation falling to its target (1-3%). The central bank signalled further easing in a dovish message that is pulling the Kiwi dollar down by 0.8% today.

Also, the Reserve Bank of India left its repo rate steady at 6.5%, a six-year high, as expected.

In data updates yesterday, Germany’s industrial output rose more than forecast, +2.9% MoM in August, a steep reversal from a month earlier, driven by the volatile automotive sector.

It will be a light day on the economics front with German trade figures as the only highlight. Israel’s central bank holds a policy meeting (exp unch at 4.5%) and it’s a market holiday in Korea.

See you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.