Risk assets continue to recover from Monday’s sell-off with Asian stock indices gaining between 1 and 4% today following a strong session on Tuesday. European index futures are also firmer in early morning trade with the €-Stoxx 50, Dax and FTSE advancing more than 1% after a lacklustre Tuesday. US equity benchmarks are also a touch higher in overnight trading after a positive session yesterday.

Wall Street ended 1% higher last night with all sectors advancing and real estate as the outperformer. A notable mover was Uber (mcap $135bn) which jumped 11% from a seven-month low after beating Q2 revenue ($10.7bn, +14% YoY), gross bookings ($40bn) and profit ($1bn, +157% YoY) estimates.

In Europe, indices ended mixed and little changed with Bayer (mcap €25bn) falling 6% to a 19-year low after reporting a 16% drop in profits due to weak demand for its farm products. Europe’s largest co, pharma Novo Nordisk (mcap €404bn) was the best-performing blue-chip stock with a 4.6% gain ahead of today’s earnings release.

There were no major moves in forex markets yesterday but the ¥ is reversing sharply today as it loses 2.5% against the $ and €. The catalyst was a Bank of Japan remark that it did not plan another rate hike while markets remained volatile.

In rate markets, the highlight was an upward shift for the US Treasury yield curve by 10bp with 10-year bonds closing at 3.89%. Gilt yields moved higher by a lesser amount and 10-yr yields are at 3.92%.

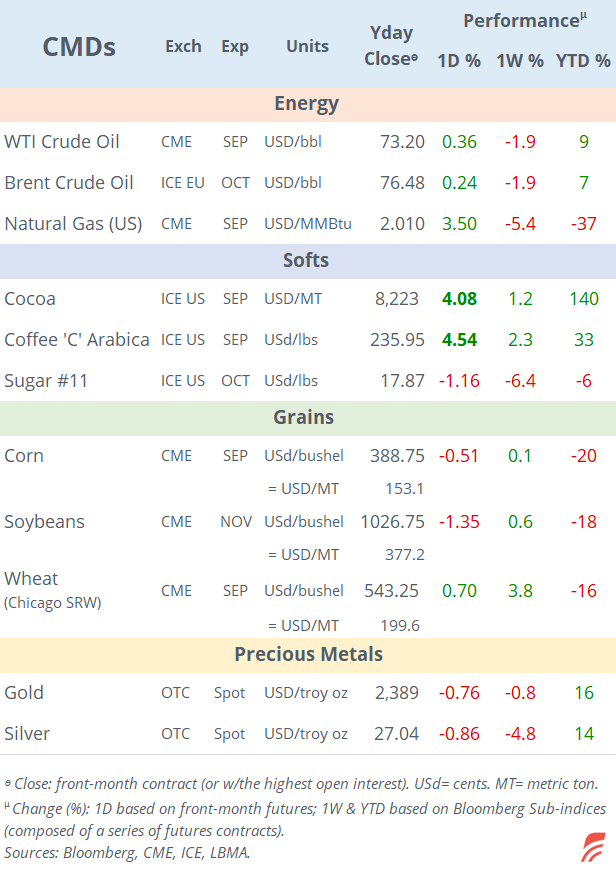

In commodity markets, the notable mover was coffee with a 4.5% gain for Arabica beans after data in Brazil showed a deterioration in crop conditions. Crude oil markets were little changed yesterday after a steep fall to a 7-month low due to fears of a recession in the US that triggered Monday’s sell-off. WTI is now at 73.30 and Brent at 76.60.

In economic data, Germany’s industrial orders for June surprised analysts with a solid +3.9% print, much better than expected. Retail sales in the €-zone dropped 0.3%, both in June and on an annual basis, much weaker than expected while in Switzerland they declined by 2.2% in the last twelve months.

In corporate deals, French beauty products giant L’Oreal (mcap €206bn) will buy a 10% stake in smaller rival Galderma Group (Switzerland, mcap €18bn) for an undisclosed amount from a consortium of private equity funds. Galderma shares rose 5%.

In monetary policy today, Romania’s central bank is expected to cut rates by 25bp to 6.50%.

On the earnings front: Novo Nordisk, Glencore, Ahold, Disney and Softbank Group.

There are no significant data releases with industrial output and trade figures in Germany and house prices in the UK as the main updates.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.