Morning,

At 6 AM London and 1 AM New York time, Donald Trump leads the presidential race in what, so far, looks like a Republican sweep across America. Trump has already won in at least two swing states, North Carolina and Georgia and is leading in all others.

In Pennsylvania, the most important battleground state, Trump is leading with 92% of votes counted. In Michigan, he is winning by a wide margin with 62% counted. Republicans will control the Senate and the House of Representatives. Kamala Harris said she will not speak until every vote is counted. Trump will address his followers briefly but no victory or defeat announcements are expected overnight.

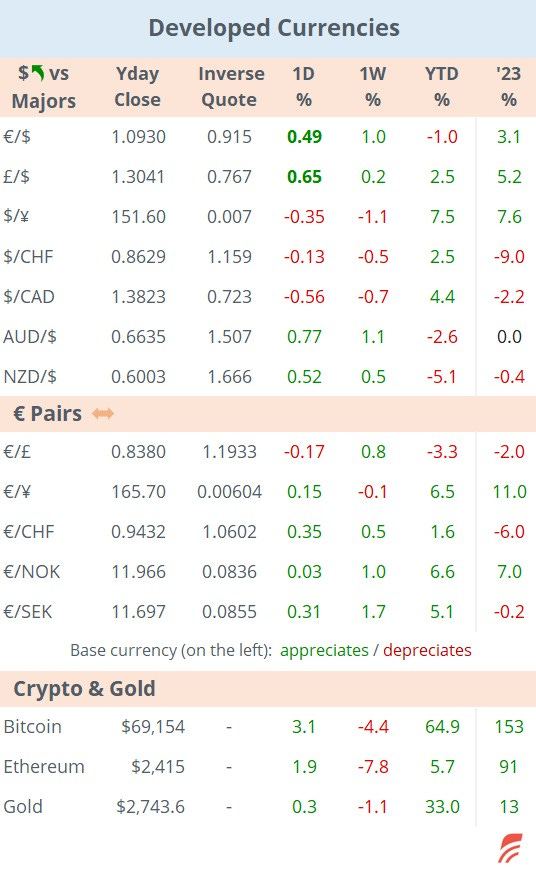

Onto markets reaction. The $ is rallying sharply with the DXY index adding 1.4%, the € dropping 1.6% to 1.0750 and cable down 1.2% to 1.2880. Treasury futures are sharply down. Bitcoin is climbing 8% to a record high of $75k. US equity futures are up by 1.2% while European futures are 1% lower this morning. In Asia, stocks are rallying except for Hong Kong which is down nearly 2%.

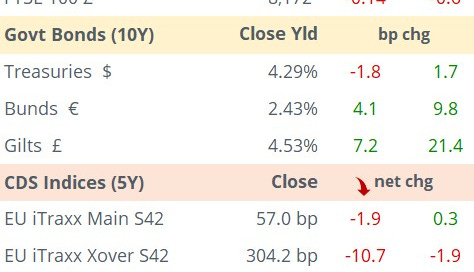

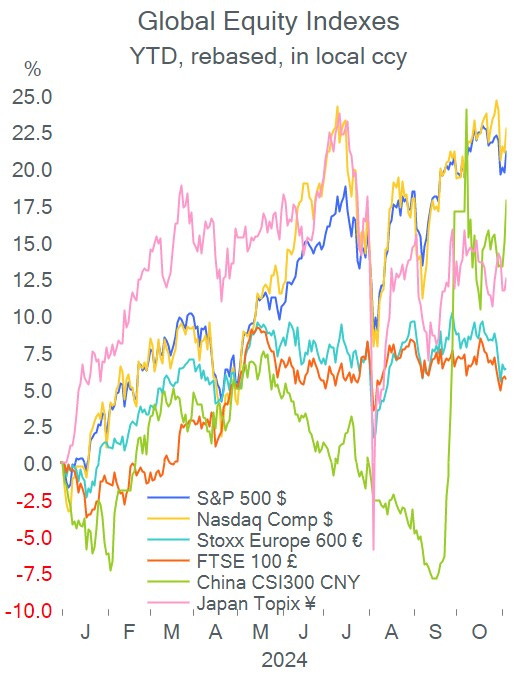

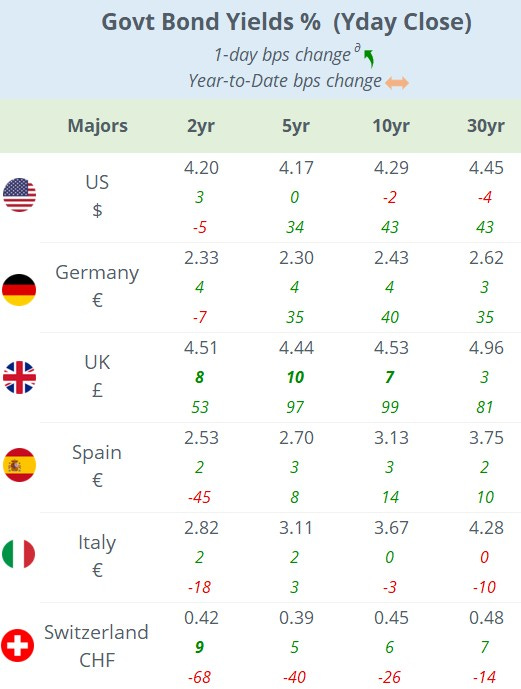

Wall Street finished on a positive tone last night with the S&P 500 and Nasdaq indices advancing 1.2% and the $ appreciated against all majors. In interest rate markets, UK Gilts remain in focus with an upward curve shift of ~8bp.

In earnings reports yesterday, Ferrari NV (mcap €73bn) met quarterly revenue (€1.6bn), beat net profit (€375mn) estimates and confirmed full-year guidance but shares posted their worst day in >3 yrs with a 7% drop driven by a large fall in deliveries in China. Shares remain 33% higher this year.

Data software maker Palantir Technologies (mcap $115bn) rallied 23% on Tuesday to accumulate a 200% jump this year after beating forecasts and increasing its revenue outlook on the back of strong demand for artificial intelligence. The stock is trading at a trailing price-earnings of 300 times and a forward PE of 100 times.

In business news, AstraZeneca (mcap £156bn) saw shares plunge 8% following a report that dozens of the company’s executives in China could be implicated in a large insurance fraud.

Data releases today: €-zone PPI and Services PMIs in Europe.

Central bank action: Brazil (+50bp to 11.25% exp) and Poland (unch at 5.75% exp).

Earnings reports today: Novo Nordisk (BMO), Toyota, BMW, Enel, Unicredit, Credit Agricole, Siemens Health and Qualcomm.

Thanks for your time, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.