Est reading time: 4 min

Morning,

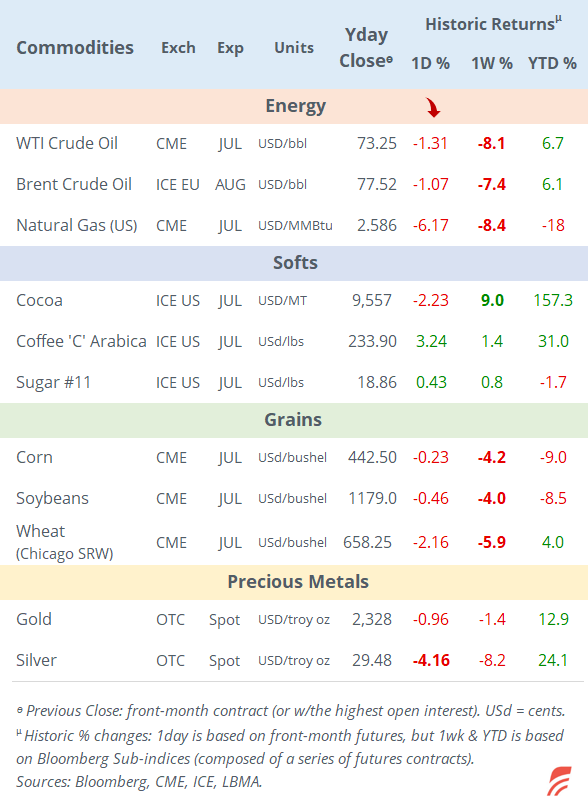

A risk-off sentiment hit European stock markets yesterday with significant declines for the oil & gas, basic resources and bank sectors, sending the blue-chip Eurostoxx 50 index down by 1%. A sell-off in commodities also weighted on weaker stock prices, as Bloomberg broad BCOM index fell for five straight days. Crude oil has accumulated a more than 7% loss in the past week, Copper fell 5.3% in the same period while the grains complex is down by more than 4%.

Wall Street finished a touch firmer last night driven by weaker JOLTS employment figures (8.06mn lowest in more than three years) that support a Fed rate cut scenario. The Nasdaq 100 added 0.3% while the small-cap Russell 2000 lost 1.2%.

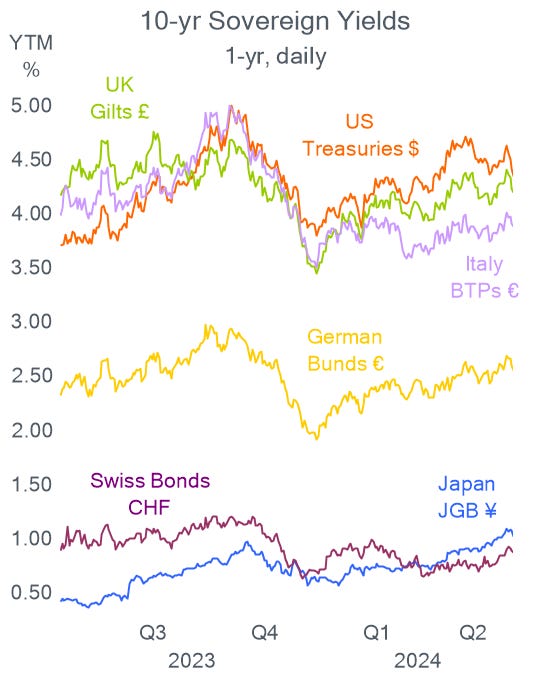

Traders' focus was once again on the bond market with prices rallying on renewed bets for more Fed cuts this year and ahead of tomorrow’s ECB meeting, which is widely expected to reduce rates by 25bp.

10-year Treasury yields fell another 7bp to 4.34%, a three-week low, Bunds fell 5bp to 2.54% and Gilts 4bp to 4.18%.

Onto markets in Asia today, except for Japanese stocks which are falling 1.5%, all other markets are trading firmer, including India. European equity futures are pointing a to partial recovery from yesterday’s falls, up more than 0.5% this morning. Brent oil is flat at $77.50 while Bitcoin is testing its all-time high, now at $71,000.

Headlines,

-India’s election results surprised markets with Prime Minister Modi needing to rely on his coalition allies to secure a third term as his BJP party failed to win a majority. The Nifty 50 stock index plunged 6% yday from a record high, its worst day in four years. The rupee (INR) had its most volatile day since August and depreciated 0.5% to 83.52. Emerging market investors are also keeping an eye on politics for developments in Mexico and South Africa.

-Washington accused Netanyahu of taking a political advantage by extending the war against Hamas.

Data released today include China’s Services PMI showing a robust expansion to a 10-month high (54 pts) confirming an improvement in business activity in the country. Korea’s GDP for Q1 expanded at a 3.3% annual pace, slightly below official estimates. Australia’s real GDP for Q1 came in below expectations at 1.1% YoY, a deceleration from the 1.6% in Q4’23.

In corporate deals, BBVA of Spain has requested the ECB authorization to take its €12bn bid for Banco de Sabadell (mcap €10bn) straight to shareholders. Both stocks dropped more than 3% yday.

In debt capital markets, the notable new bond issue was Becton Dickinson (US, medical equipment, mcap $69bn) which raised €1.8bn in senior notes rated BBB, of 8 (at Bunds +135bp) and 12 years (at +142bp), to finance the acquisition of Edwards Lifesciences critical care division (see yday).

The day ahead brings Services PMIs for developed countries; producer prices in the €-zone; and monetary policy meetings by the central banks of Canada (25bp cut to 4.75% expected) and Poland (unch at 5.75% expected). Inditex (mcap €137bn), the Spanish fashion giant, reports earnings today.

Remember that on Friday we’ll get US non-farm payrolls. Denmark’s stock market will be closed today.

That’s all for today, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Please share using the button below, as access is free to all.