Wall Street stocks fell sharply last night after risk assets had fully recovered from the August sell-off. IT was the weakest sector with the semiconductor’s space dropping the most in 4-yrs as investors doubt the A.I. rally can maintain the momentum. The Nasdaq 100 lost 3.1%, the S&P 500 fell 2.1% and the €-Stoxx50 ended 1.2% lower on Tuesday.

Nvidia (mcap $265tn) sank nearly 10%, losing $280bn in market value, the biggest-ever loss for a company in a single session. After the close, Nvidia got a subpoena from the Department of Justice relating to an anti-trust investigation and shares dropped another 3% in extended trading. Other nations have also requested information from Nvidia regarding its partnerships, including China, the UK and the EU. Other chip makers falling sharply include Broadcom, AMD, Micron, Qualcomm and Intel.

Intel (mcap $86bn) is the Dow Jones Industrial’s worst performer this year with a 60% fall, has the lowest share price ($20) and could lose its membership to the price-weighted index.

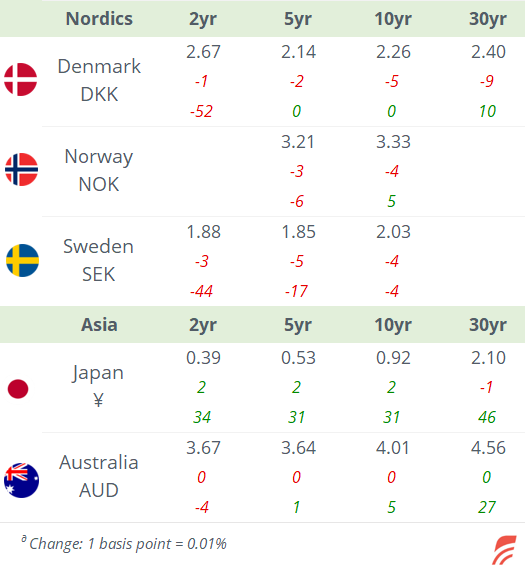

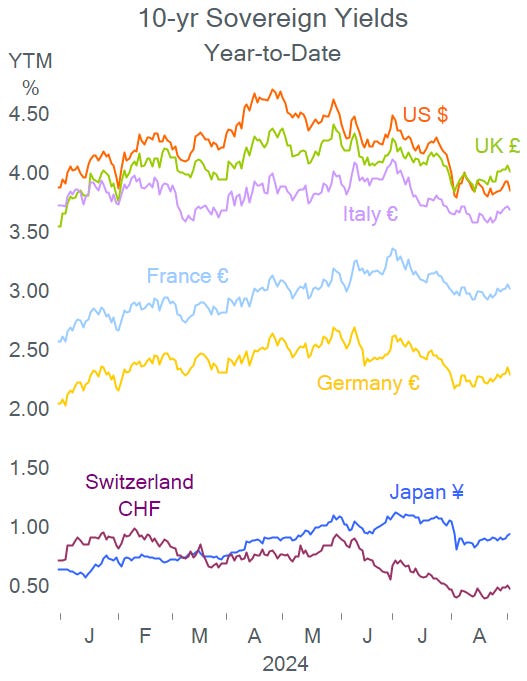

A marginally weaker-than-expected manufacturing PMI (47.2 pts) in the U.S. also weighed on sentiment despite showing a modest recovery from a month ago. Risk-free bond prices rose sending yields 5 to 7bp higher across tenors in the U.S., Germany and the UK. In forex markets, the $ traded mixed, gaining against the € and £ but falling 1% versus the ¥.

In commodities, crude oil prices dropped more than 4% yesterday to their lowest level in ~9 months. Libya could soon resume its oil exports following a political dispute. Brent oil is 0.5% lower this morning at $73.40, its lowest level since mid-December.

Asian markets are sinking today with Taiwanese stocks plunging 4%, Japan and Korea down nearly 3%, and Singapore and Australia dropping 2%. Equity futures in Europe are pointing to a weak open with the €Stoxx 50 down 1% and U.S. indices losing 0.5% overnight.

In central bank meetings yesterday, Chile cut its policy rate by 25bp to 5.5% as expected.

It was an active day for new corporate bond issues in $ with TotalEnergies (10, 30, 40-yr), Roche (5, 7, 10, 30), Mastercard (7, 10) and Autos GM (5, 10), Ford (5) and Honda U.S. (5-yr) placing debt.

In data today, we’ll get €-zone PPI or wholesale inflation; Services PMIs in European countries; International trade, durable goods and factory orders in the U.S.

In monetary policy, the Bank of Canada meets today with analysts anticipating a 25bp rate cut to 4.25%. Poland also meets and is expected to keep rates unch at 5.75%. Also, the Fed issues its Beige Book. HP Entreprise reports earnings today.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.