Morning,

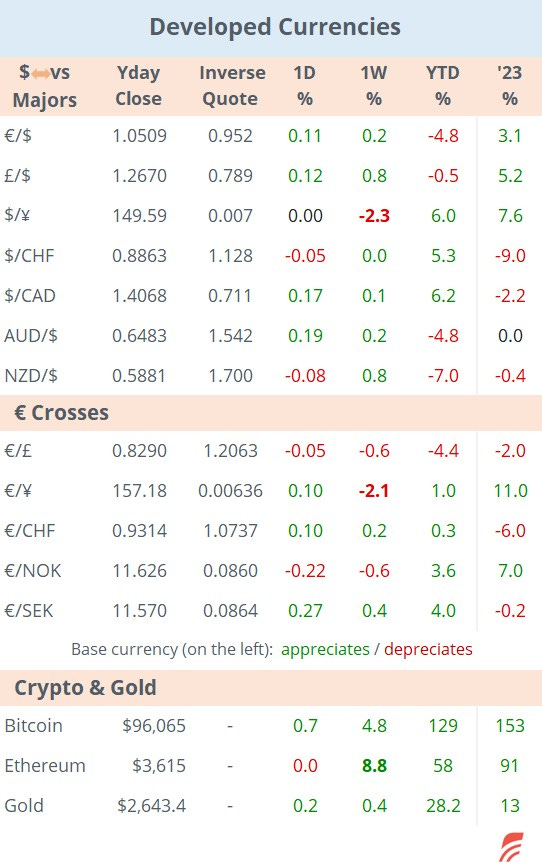

South Korea faces its deepest political crisis in decades after lawmakers called for the impeachment of President Yoon Suk Yeol following his chaotic martial law declaration. The country’s finance minister said he was ready to deploy unlimited liquidity into markets following yesterday’s highly volatile conditions for the Korean won which is trading at a two-year low (1,412 per $). Korea’s Kospi index is down 1.5% today while most other Asian stock markets are trading firmer.

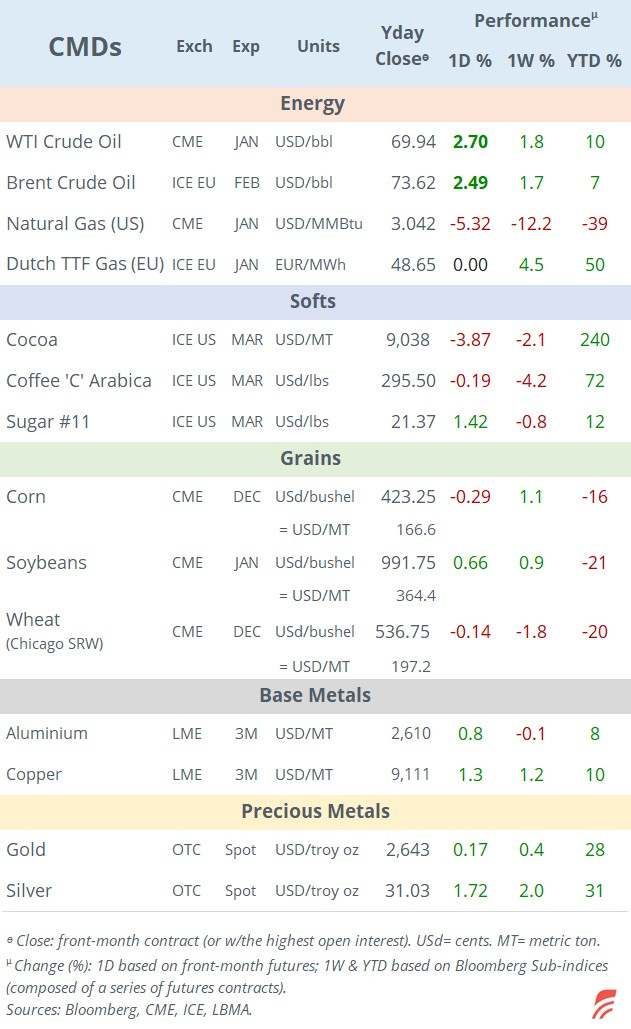

Crude oil prices climbed 2.5% on Tuesday following new sanctions on Iran by Washington. Traders’ focus is on OPEC’s next move regarding its supply cuts amid a weaker demand outlook, mainly from China. Brent is a touch higher this morning at $73.82.

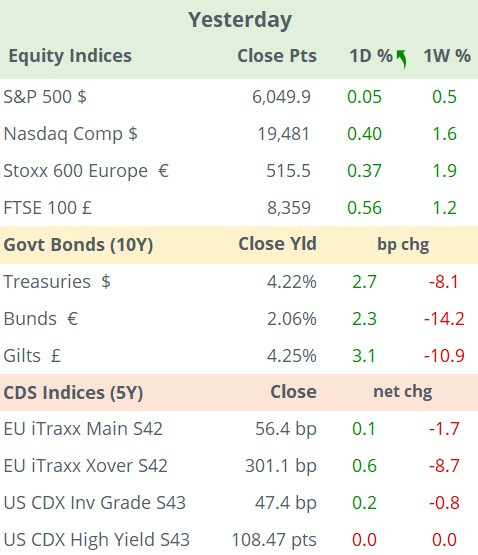

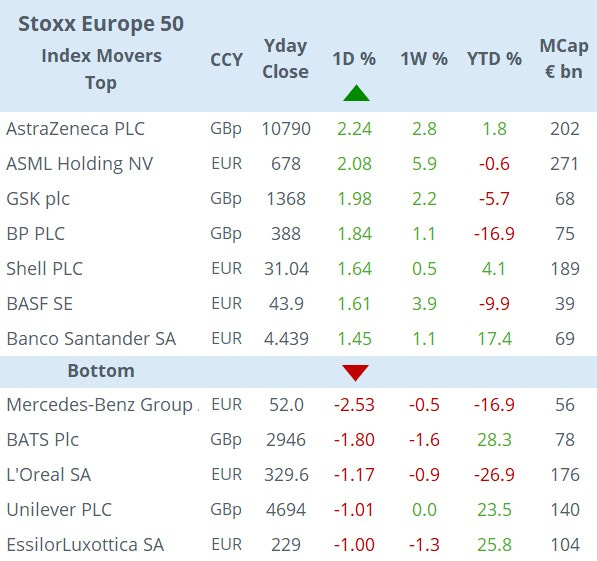

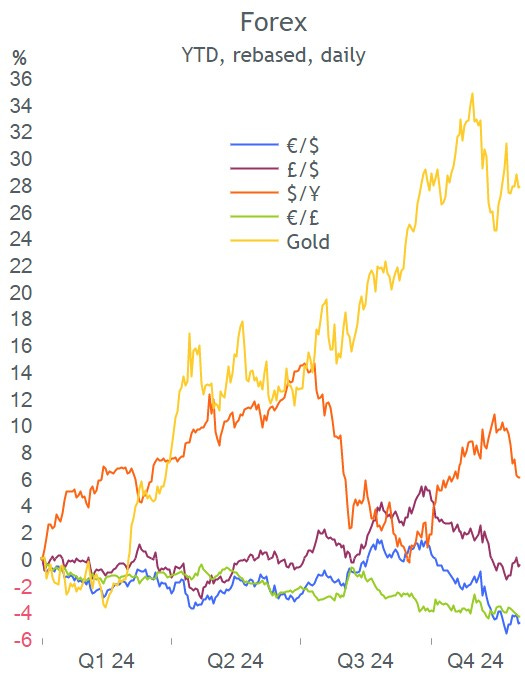

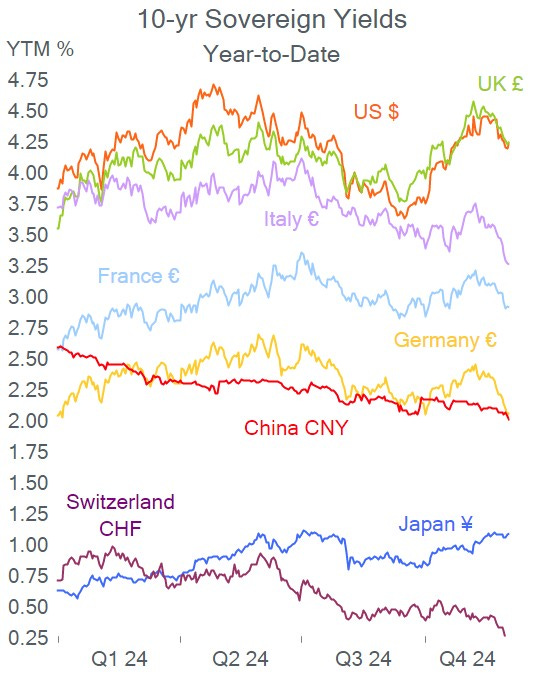

Currency and bond markets were little changed yesterday while equities ended firmer on both sides of the Atlantic with Spanish and Italian indices as the outperformers. There were no significant moves among large caps to highlight.

In the US, enterprise software giant Salesforce (mcap $316bn) shares rallied 10% in extended hours after beating revenue ($9.4bn) and profit ($1.5bn, +25% YoY) estimates and provided strong sales guidance.

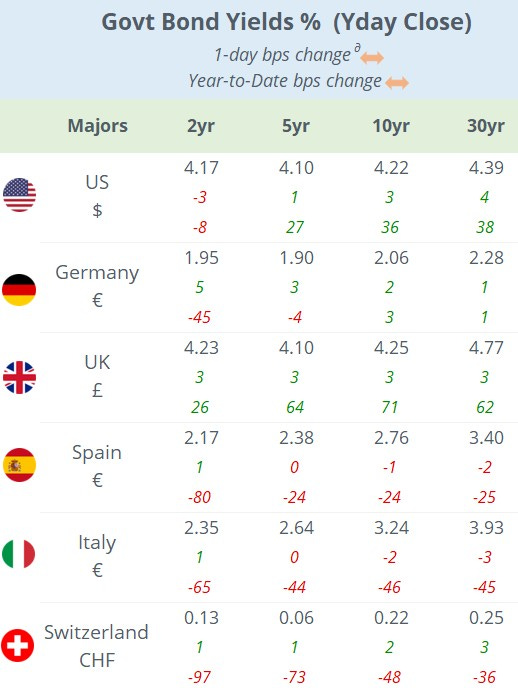

In economics yesterday, Swiss headline inflation in November ticked marginally higher to +0.7% YoY from a three-year low. The SNB meets on Dec 12 and futures are pricing in a 71% chance for a 50bp rate cut to 0.5%.

In deals, Blackrock is acquiring private credit fund manager HPS Investment Partners (a 2016 JP Morgan spin-off) for $12bn in stock. Also, TotalEnergies is in talks to buy renewable energy developer VSB Group (unlisted) for €2bn from Swiss PE firm Partners Group.

In the primary € debt markets, Veolia placed 6-yr senior bonds rated BBB at a 2.97% yield (+106bp) and Flos B&B Italia sold 5-yr FRN senior secured high yield bonds (rated B) at +387bp.

Day ahead:

Focus will be in Paris with the expected no-confidence vote that will determine the continuity of Michel Barnier as Prime Minister.

Data: Services PMIs in the €-zone, US, UK, China; €-zone producer prices; US factory orders.

Monetary policy meetings, the central bank of Poland meets today with rates expected to remain steady at 5.75%. Also, the Fed issues its Beige Book and the Governor of the BoE participates at an FT conference.

Earnings reports: Canadian banks RBC and NBC; and Synopsys.

See you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.