The Bank of Japan raised its benchmark interest rate to 0.25% from a 0% to 0.10% range and reduced its bond-buying programme in a change to its monetary policy. The ¥ and bond prices fell following the news while banking stocks rallied. The BoJ cut GDP (+0.6% YoY) and core inflation (+2.5% YoY) forecasts for this year.

All Asian stock benchmarks are firmer today with China and Hong Kong rallying 2%, Australia gaining 1.3% and others around 0.5% higher.

Equities in New York ended lower last night as the technology sector continues to retreat from its recent record high ahead of this week’s mega-cap earnings reports. The Nasdaq 100 index dropped 1.4% with Nvidia (mcap $2.55tn) as the leading loser, down 7% to its lowest level since May.

Except for Procter & Gamble (shares -5%), all US companies that released results yesterday, beat sales and profit estimates. Microsoft reported after the market close, beating revenue ($64.7bn, +15% YoY) and earnings ($22bn, +10% YoY) estimates. However, the company’s sales guidance for the next quarter ($64.3bn) was below expectations and it also disappointed in its Azure cloud unit as growth slows. Shares fell 7% in after-market hours.

Chipmaker AMD (mcap $224bn) also beat estimates and shares rallied in extended trading, helping stock futures recover overnight (Nasdaq +0.9%).

The picture for risk assets in Europe was more positive as economic data helped sentiment. €-zone GDP for Q2 rose slightly more than expected, +0.3% QoQ despite Germany’s contraction by 0.1%, its third quarterly GDP fall in the past year.

Also, the preliminary readings for German (HICP) inflation in July came in at 2.6%, a touch higher than a month earlier while Spanish inflation (HICP) eased sharply to 2.9% after a monthly deflation of 0.7%, the steepest fall in 2.5 years.

Bond prices continue to rise ahead of this week’s busy central bank calendar. German Schatz were the notable movers with yields down 9bp to 2.56%, their lowest level since early February, reducing the Bunds curve inversion.

In forex markets, yesterday’s key mover was the ¥ which appreciated nearly 1% ahead of today’s Bank of Japan meeting.

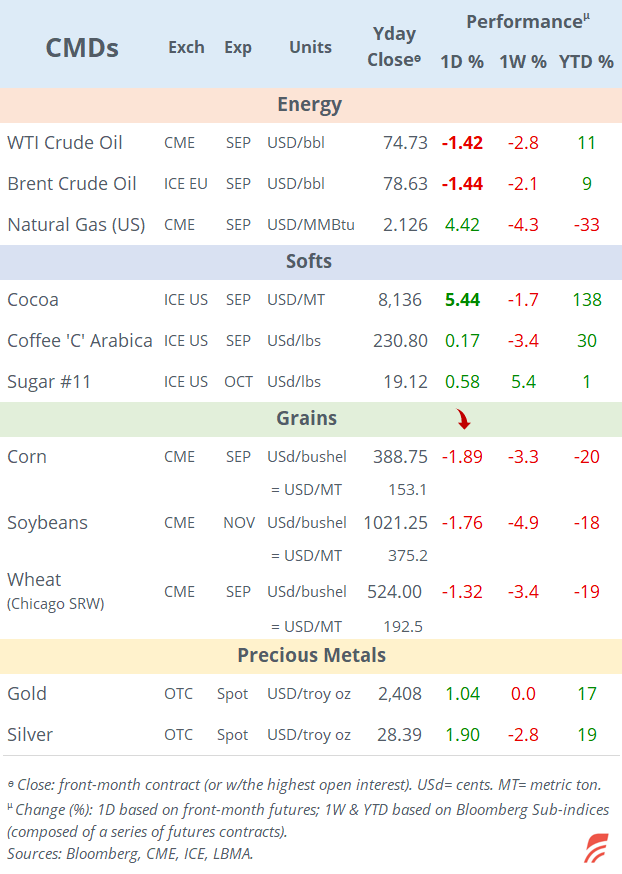

Crude oil declined to a 7-week low but is recovering somewhat today following Israel’s strike in Lebanon. Brent is up 1.5% this morning at $79.90 ahead of OPEC’s meeting tomorrow.

Headlines:

-Israel Defense Forces targeted a Hezbollah commander based in southern Beirut with an air strike as a retaliation against the recent attack on Golan Heights.

-Meta Platforms agreed to a $1.4bn settlement with the State of Texas on claims that it compiled facial recognition data from millions of citizens without their consent. Shares barely moved.

In corporate deals, US regional bank Renasant Corp (mcap $2bn) has agreed to acquire smaller rival The First Bancshares (mcap $1bn) in an all-stock deal valued at $1.2bn. TFB shares rallied 9%.

In credit rating updates, Telecom Italia was u/g one notch to BB by Fitch. In new bond issues, Netflix (mcap $267bn) sold 10-yr (at +80bp) and 30-yr (at+100bp) senior notes in $, rated Baa1/A, for a total of $1.8bn.

It will be an active day for economic data and central bank action. Data include CPI inflation in the €-zone, France, Italy and Austria; PPI inflation in France and Italy. The Fed meets at 7 PM London time followed by Powell’s press conference. Analysts and traders expect the Fed Funds target rate to remain steady at a 5.25 to 5.5% range.

In EM, Brazil (unch at 10.5% exp) and Colombia (-50bp to 10.75% exp) will also hold monetary policy meetings.

It will also be a busy day for earnings reports. Large caps include HSBC, Rio Tinto, Arm Holdings, Safran, BBVA and Adidas in Europe. Meta, Mastercard, Qualcomm and Boeing in the US.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.