Morning,

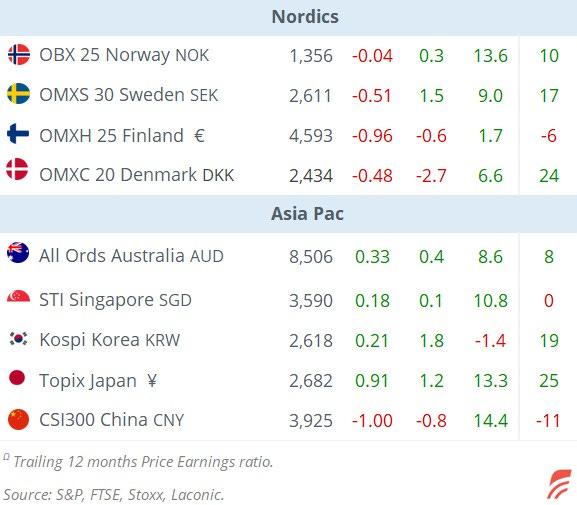

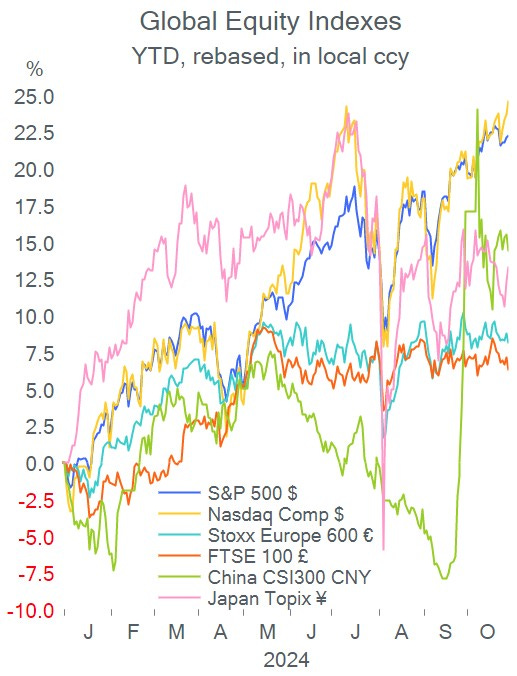

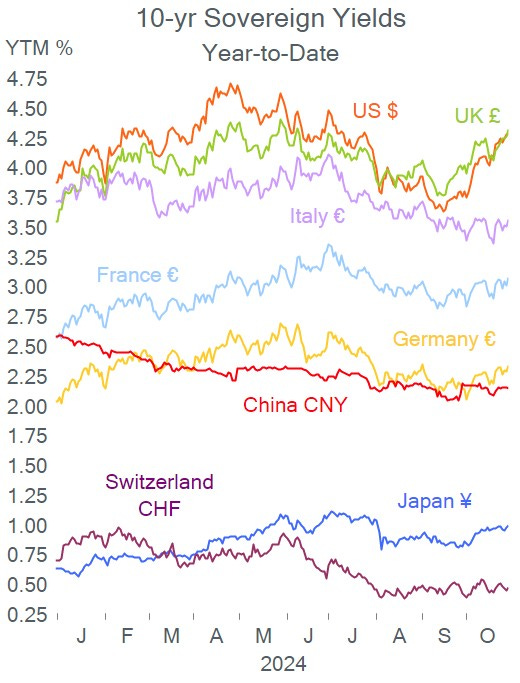

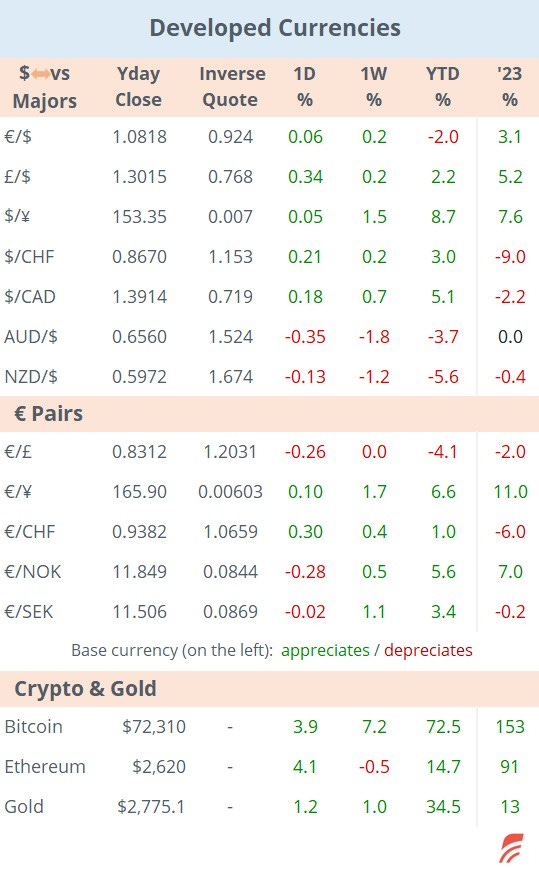

Asian equities are selling off today driven by weakness in Hong Kong, mainland China and Korea as Trump’s odds of winning the election showed improvements in the latest polls which anticipate a tight contest. A Republican government is expected to bring higher tariffs and bond yields with increased Treasury issuance. Interest rate options markets are anticipating sharp moves in yields following the election next week. Stocks in Tokyo are advancing 1% while the ¥ is flat this morning. Europe’s stock futures are pointing to a weaker open while US futures are flat overnight.

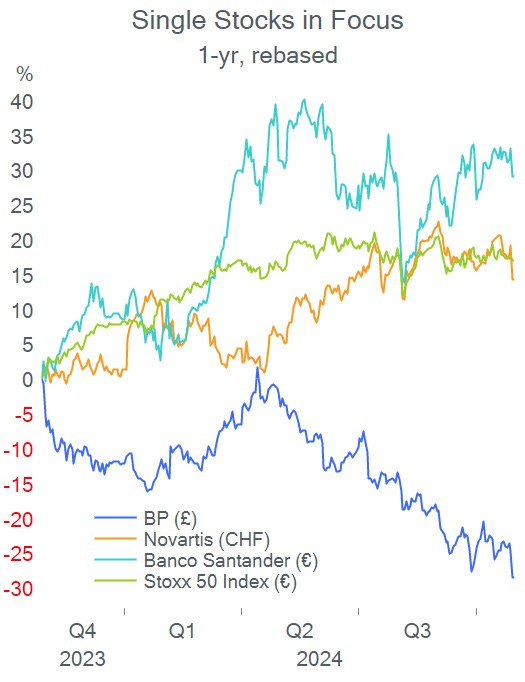

European stocks finished lower yesterday driven by weak or unconvincing earnings reports by Novartis (-4%), BP (-5%) and Santander (-3%) which fell the most among Stoxx 50 members. The broader Stoxx 600 benchmark traded sideways during October. Before today’s market open, UBS delivered a large profit beat ($1.4bn), reporting more than twice the earnings expected.

Wall Street finished firmer on Tuesday with Nasdaq benchmarks hitting a fresh record and Alphabet (mcap $2.1tn) reported solid results after the close, beating estimates on the back of a strong Cloud services unit and shares rallied 6% in after hours. Revenues ($88bn) at Google’s parent grew by 15% YoY and net income ($26bn) expanded by 33% YoY.

On the A.I. world, chip maker AMD (mcap $270bn), fell 7% after the close on the back of a disappointing growth outlook.

Reddit (mcap $13bn), the US social media platform, saw shares rally 25% in after-hours trading following its first profit announcement ($30mn in Q3). Shares have gained 117% since its IPO last March.

In new corporate bond issues, L’Oreal placed 7-yr senior notes in €, rated AA at 2.88% and Sweden’s real estate developer Heimstaden sold 5-yr BBB- senior bonds at 4.04%.

Regarding credit ratings, French luxury co Kering (mcap €29bn) was d/g one notch by S&P to BBB+, outlook stable.

It will be an active day on the data front, with Q3 GDP updates in the €-zone, its members and in the US; inflation in Germany, Spain and Belgium as well as €-zone’s sentiment indicators.

Earnings today: UBS, Airbus, VW and BASF in Europe. Microsoft and Meta after the US close and Eli Lilly, Caterpillar and AbbVie before the open.

The British government announces its Autumn Budget at midday London time.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.