Podcast script: Estimated reading time ⏲ ~5 mins

Good morning,

Wall Street ended mixed yesterday with the Dow Jones Industrials down by 0.5% while the Nasdaq Composite added 0.6% to close above 17,000 for the first time, as the tech sector continues to rally. Nvidia gained 7% to a fresh record, reaching a market of $2.8tn and closing the gap with Apple, which ended flat despite data showing a 52% year-on-year increase in iPhone sales in China.

European markets underperformed yesterday with the broad Stoxx 600 losing 0.6% and the Cac 40 and Swiss SMI as the weakest indices, down nearly 1%.

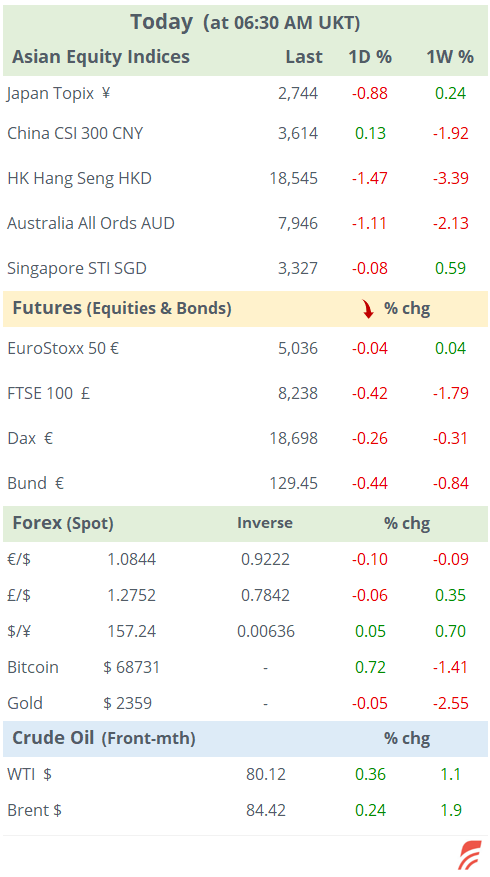

It is a risk-off day for Asian markets with stocks in Hong Kong and Korea leading the fall with a 1.5% decline. European equity futures and the S&P 500 are around 0.3% weaker this morning.

On this side of the Atlantic, fixed income markets were little changed and are waiting for this week’s inflation data which kicks off today with Germany’s update. Dutch central bank chief Knot made dovish comments as he expects slow and gradual interest rate cuts by the ECB.

The US Treasury market sold off with 10-yr yields adding 7bp to 4.54%, a three week high. There were hawkish remarks by Minneapolis Fed President Kashkari yesterday who stated he wanted to see significant progress on inflation data before a rate cut and did not rule out a rate hike if price pressures persisted.

Headlines,

-Israel escalated its attack on Rafah by launching a ground offensive with a tank invasion that the White House did not disapprove of, following its deadly air strike.

-South Africans head to the polls today in one of the most unpredictable elections in three decades. The governing ANC party is facing increasing pressure from leading opposition parties as well as emerging alternatives that may lead to a coalition scenario.

-In Dutch politics, Dick Schoof, the former head of the country’s intelligence agency, was chosen as prime minister by the populist coalition led by the far-right Freedom Party (PVV).

-Australia’s consumer prices moved higher, up 3.6% in April, higher than expected and above the March update, driven mostly by rising rents and transport costs. Sydney’s All Ordinaries stock index is falling 1.2% today.

In corporate deals, Hess Corp (US, oil & gas exploration, mcap $47bn) shareholders have approved the $53bn merger with Chevron (mcap $293bn). The deal was announced in October and grants Chevron access to the oil-rich offshore fields of Guyana in South America. Hess shareholders will own 15% of the combined entity once it’s completed.

*T-Mobile US (wireless telco, mcap $194bn) is acquiring most of the wireless operations of small regional carrier United States Cellular (mcap $3.6bn) for $4.4bn. US Cellular will retain 70% of its spectrum assets and thousands of telecom towers. Shares rallied 10%.

*Vista Outdoors (US, recreational products, mcap $2bn) is selling its sporting products unit which includes brands such as Remington, for $1.9bn in cash to a Czech defence company.

*Atlantica Sustainable Infrastructure (US, electric utility, mcap $2.7bn) will be acquired by P.E. firm Energy Capital Partners for $2.5bn in cash. Shares dropped 5%.

*ABN Amro (Netherlands, mcap €8bn) is buying German private bank Hauck Aufhäuser Lampe for €672mn from China’s Fosun International.

*Newlat Food Spa (Italy, agroindustrial, mcap €350mn) agreed to acquire food group Princes of the UK for £700mn from Mitsubishi Corporation. Newlat shares gained 11%. The merged group will be known as New Princes.

In bond issues, Linde Plc (Chemicals, mcap $210bn) raised more than €2bn in three senior tranches rated A2, of 6 yr (Bunds+90bp), 10 yr (ms+75) and 20 yr (ms+108). Also, AXA (Insurer, mcap €76bn) issued a 10 yr senior bond rated A+ (at Bunds+88bp, 3.43% yield).

Today’s key economic data will be Germany’s inflation (prelim) for May, and retail sales in Spain and Sweden.

Companies reporting earnings today include Salesforce and HP, both after market close.

That’s all for today, see you tomorrow.

** Correction: US »

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Please share using the button below, as access is free to all.