Morning,

The latest in geopolitics is an agreed ceasefire between Israel and Hezbollah brokered by Washington and Paris. Israel has 60 days to withdraw from Lebanon while Hezbollah must abandon the south of the country in a deal that Biden described as a ‘permanent ceasefire’.

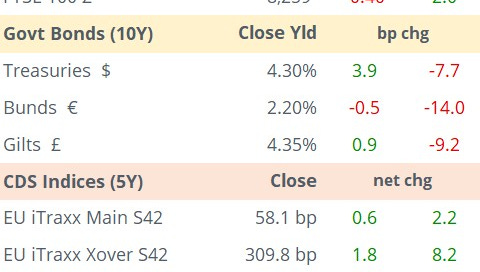

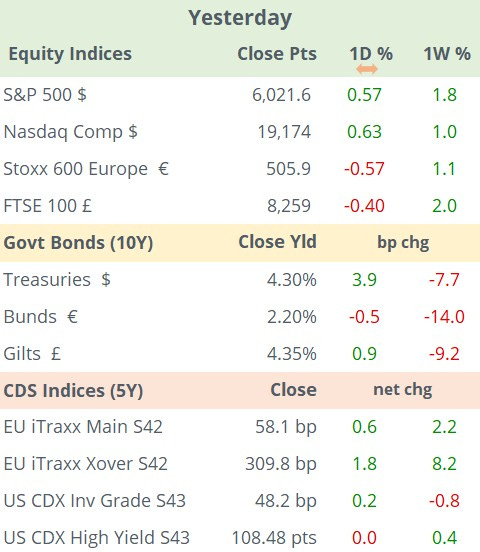

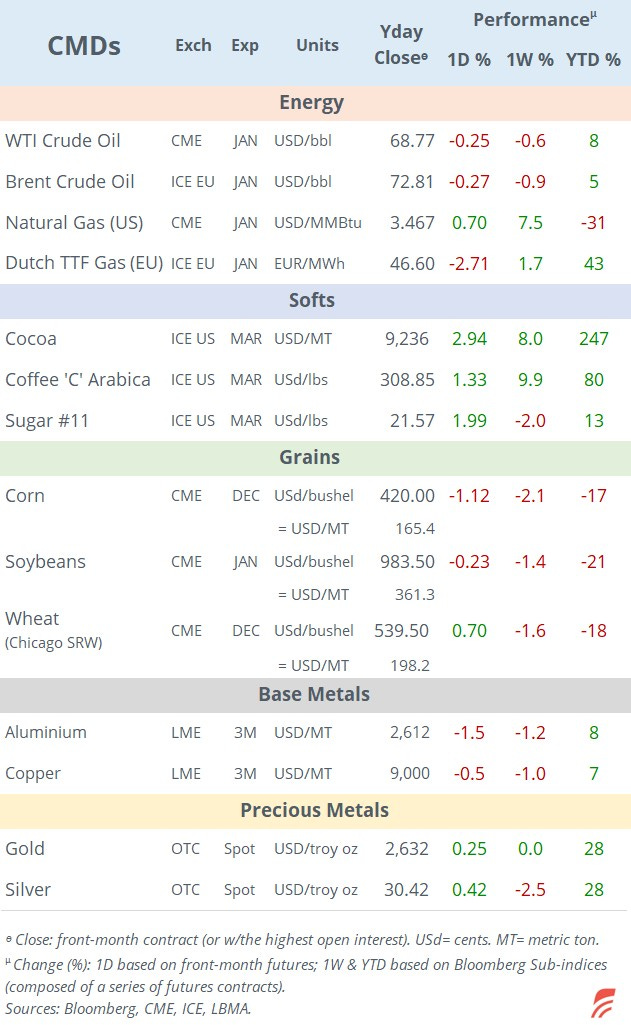

Stocks on Wall Street closed at an all-time high last night as markets digested the latest updates on Trump’s tariff plans, the release of the Fed’s last meeting minutes and ahead of today’s inflation update. The S&P 500 and Nasdaq indices advanced 0.6% while the small-cap Russell 2000 index ended 0.7% lower.

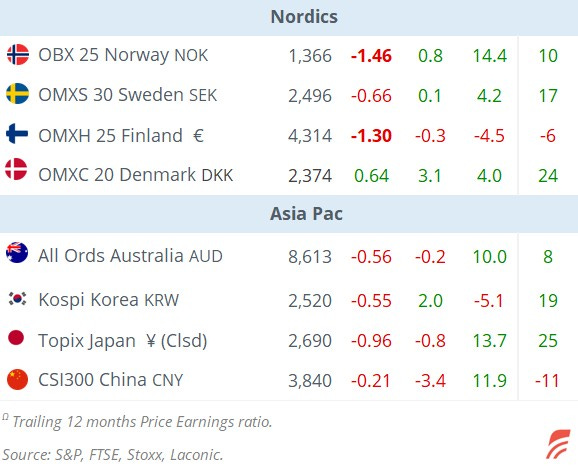

European benchmarks fell across the continent as a new global trade war is expected next year. The broad Stoxx 600 finished 0.6% lower mainly on weakness for auto-related stocks and is ~6% higher this year compared to a 26% gain by the S&P 500. One notable mover among single names in Europe was Bayer AG (mcap €18bn) which accelerated its downfall to a fresh all-time low, down 5% to accumulate a 44% YTD loss to become the Dax’s worst performer this year.

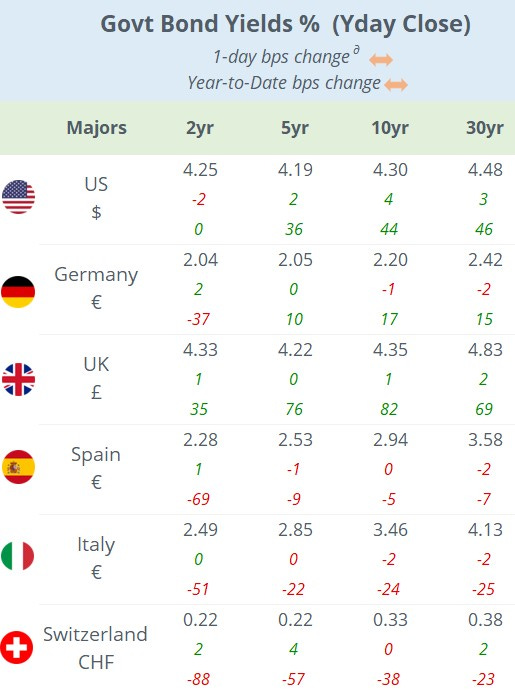

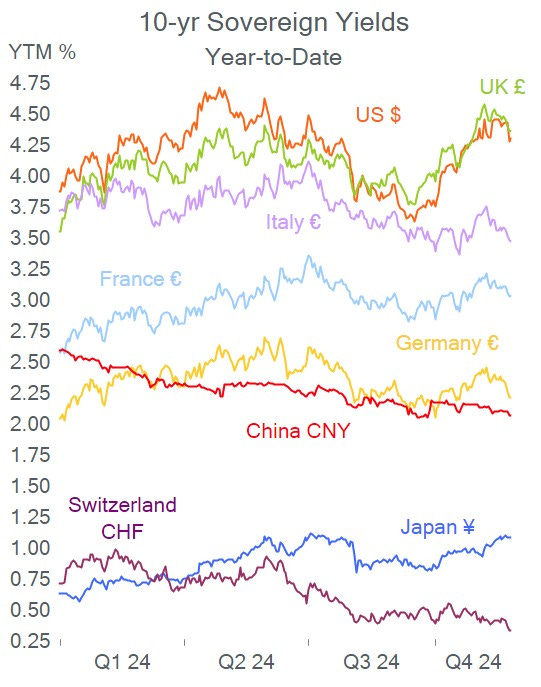

The Fed’s Minutes showed officials seemed divided on how much further the central bank should ease policy rates and, in a cautious sign, agreed that it should provide less specific guidance to the market. Trump’s policies have made the Fed’s outlook less predictable. Futures are implying a 37% chance for the Fed’s target rate to remain unchanged at the Dec 18 meeting.

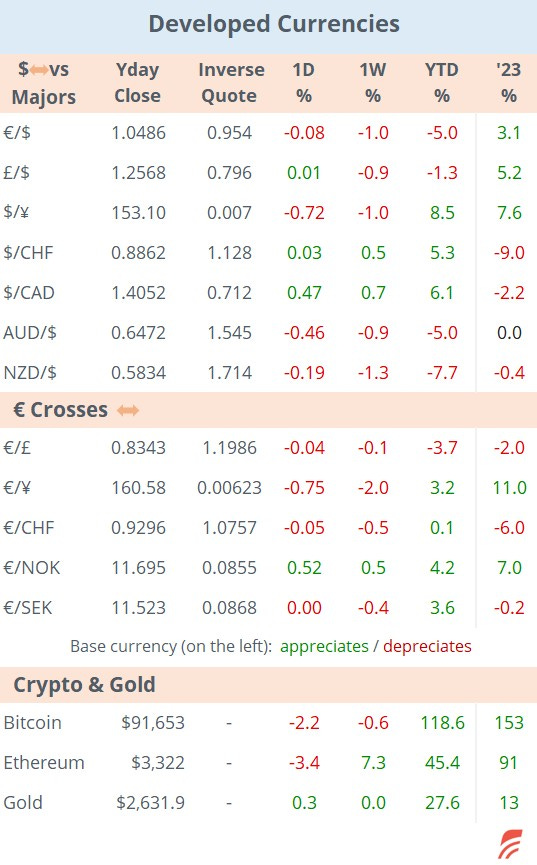

A quick update on Mexican markets, as Trump’s tariff will directly hit its biggest trade partner. The main equity index is down 29% in $ terms this year, the Mexican peso has depreciated 18% YTD and the 10-yr $ bond (BBB rated) fell 5 points during October, before the US election, and now yields 6.10% or 190bp over UST.

In central bank action today, the Reserve Bank of NZ cut its cash rate by 50bp to 4.25%, its third cut in four months and signalled further easing, anticipating another large reduction in February. Yet, the Kiwi dollar appreciated 0.5% today as some analysts expected a wider rate cut.

In corporate deals, Roche Holding AG (mcap $231bn) will buy US biotech Poseida Therapeutics (mcap $914mn) for $1.5bn to expand on complex immune cell therapies. Poseida shares jumped 228% yday.

In the Italian pharma sector, Recordati’s (mcap €11bn) main shareholder, CVC Capital Partners, is exploring a sale of its 52% stake. Stock is up 6% YTD.

In sovereign credit ratings in EM, Panama was d/g to BBB- and El Salvador was u/g to B3. In the US corporate space, United Airlines was u/g to BB, American Express was u/g to A- and Marathon Oil was u/g to A.

Companies reporting today include EasyJet, Gazprom, Rosneft and Lukoil.

Economic data today: US PCE inflation (2.3% exp, at 3pm Ldn), durable goods, personal consumption, jobless claims and a GDP update.

This morning, Australia’s CPI inflation for October came in below estimates at 2.1% YoY. The Aussie dollar is unch.

Thanks for your time, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.