Morning,

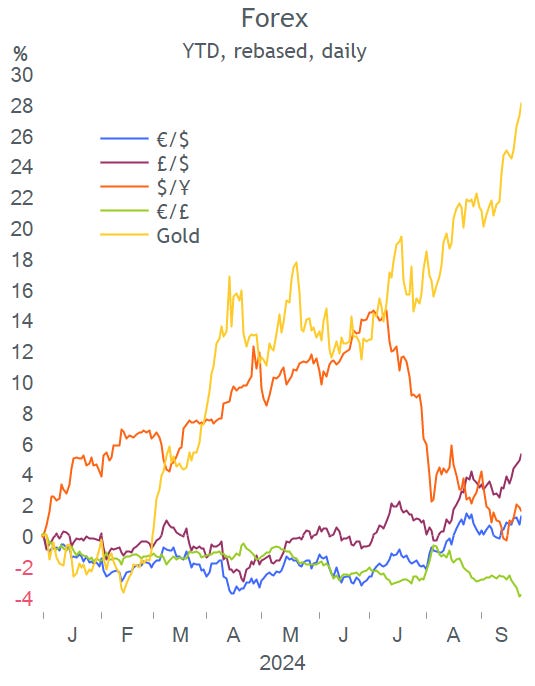

Yesterday’s key development in global markets was Beijing’s aggressive stimulus announcement to revive China’s economy, including an interest rate cut, support for the property sector and state funding to invest in equities. The CSI300 index rallied more than 4% on Tuesday, its best day in four years, and is advancing more than 2% today but continues to underperform stock benchmarks in the U.S. and Europe in 2024.

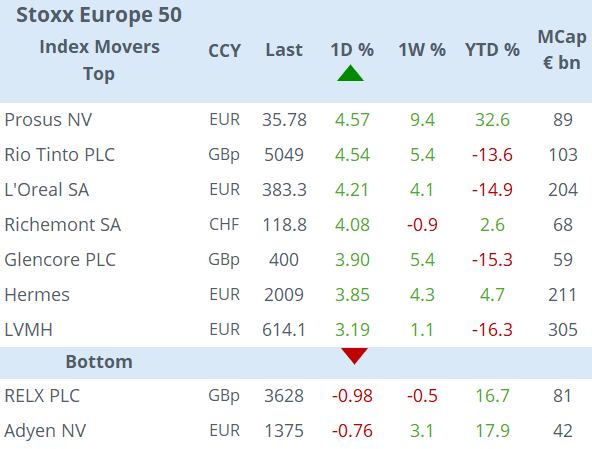

The news triggered a recovery in European luxury and mining stocks with LVMH, Hermes, Richemont, Rio Tinto and Glencore as the top performers among large caps. The €-Stoxx 50 index added 1.1%, the French CAC40 outperformed its €-block peers with a 1.3% gain and indices on Wall Street also finished firmer last night, with the S&P 500 and Dow Jones Industrials trading at all-time highs.

Headlines:

-Vice-president Harris widens her lead over Trump by 6 ppt in the race for the White House according to a Reuters/Ipsos poll.

-Trump pledged to a ‘new American industrialism’ era with a protectionist plan to cut taxes for production in the U.S. and tariffs on foreign manufactured products. (NYT)

-France is considering raising taxes even further on the wealthy and large businesses to reduce its widening deficit that is forecast to reach 5.6% of GDP this year. (RFI)

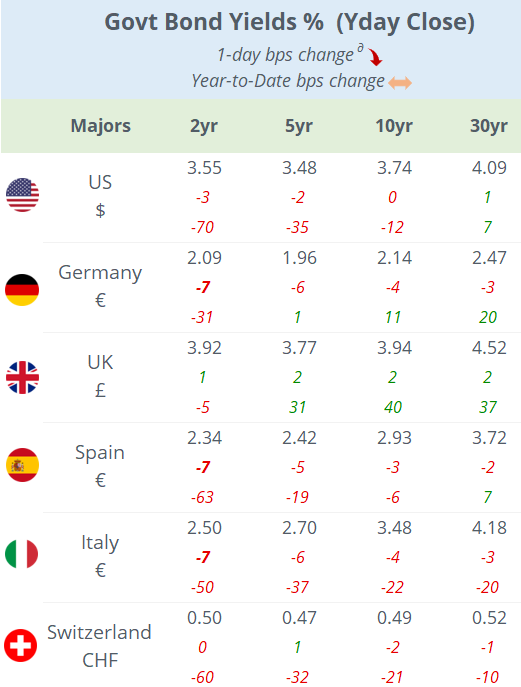

-The Bank of England governor Bailey said that interest rates are gradually heading downwards as inflation pressures ease, following the 2.2% CPI update in August.

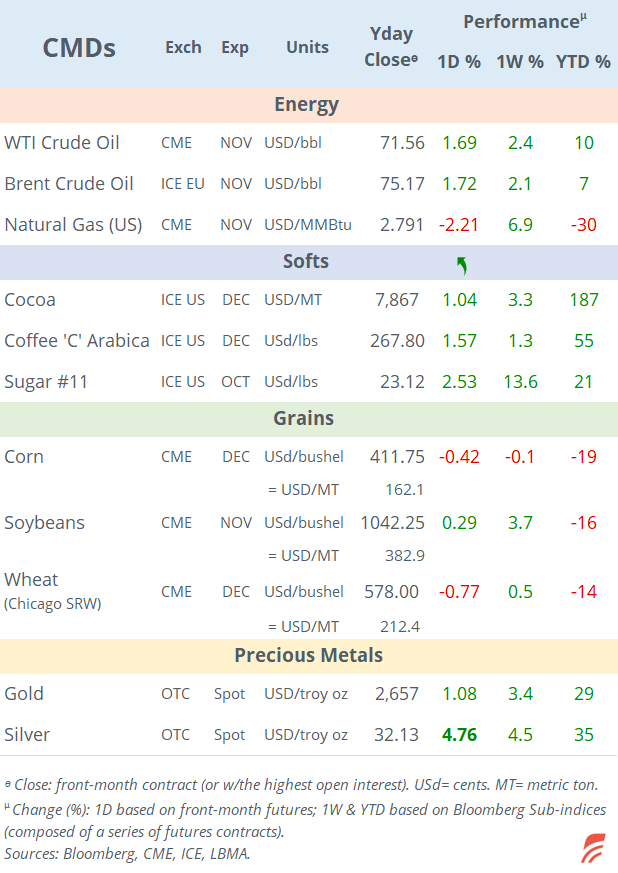

- Crude oil climbed to a three-week high yesterday, driven by China’s stimulus plan and the escalating conflict in the Middle East. Brent is trading at $75 this morning.

In economic updates, U.S. consumer confidence in September came in well below consensus, dropping the most in 3-yrs on the back of rising concerns over the labour market (98.7 pts). The three German IFO indicators were also below estimates, reflecting a deterioration in activity expectations.

On Tuesday, Hungary’s central bank cut interest rates by 25bp to 6.5% as expected, still the highest policy rate in the E.U.

Corporate deals: the London Stock Exchange Group (mcap £54bn) is considering divesting its stake in clearing firm Euroclear, according to media reports.

French pharma giant Sanofi (mcap €130bn) is in talks with two private equity firms interested in acquiring its consumer health unit for an estimated €15bn.

The asset management unit of Australian infrastructure group Macquarie (mcap $58bn) is buying a minority stake in D.E. Shaw’s renewable energy division for $1.7bn.

Corporate debt issuance: German auto parts Continental (at a 3.51% yield) and Austrian metals company Voestalpine (at a 3.81% yield) placed 5-year senior bonds in €.

Central bank action today: Sweden’s Riksbank holds a policy meeting with analysts and futures markets anticipating a 25bp interest rate cut to 3.25%. The Czech Republic is also expected to ease rates by 25bp to 4.25%.

Economic data: we’ll get US new home sales and 30-year mortgage rates; Australia’s consumer inflation; Sweden’s wholesale inflation and France’s consumer confidence.

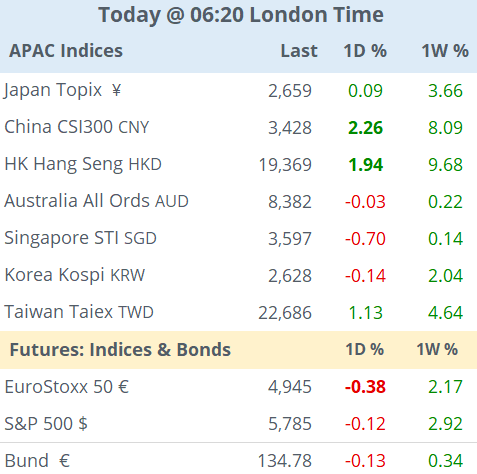

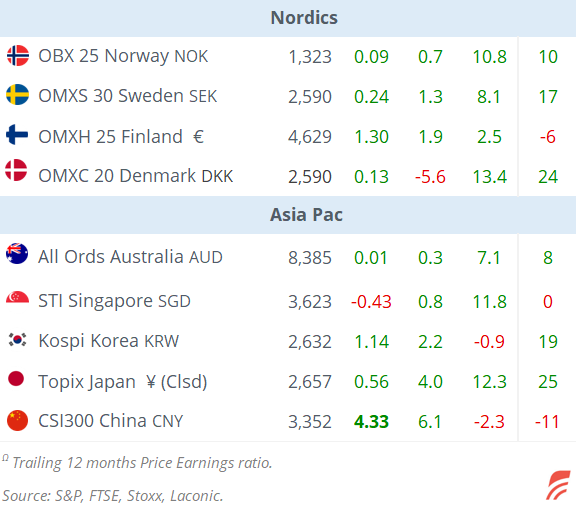

Asian equity markets are mixed today, while China, Hong Kong and Taiwan continue to move higher, those in Singapore and Korea are a touch weaker. European index futures are pointing to a lower opening in early trading.

That’s all for today, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.