Morning,

Yesterday’s most important events took place after markets on Wall Street closed with Tesla, Alphabet and Visa releasing results. Leading indices ended marginally lower except for the small-cap Russell 2000 index which added 1%.

Tesla shares were down 8% in extended trading following a weak quarterly report that showed its worst profit margins in five years. Tesla met revenue ($25.5bn, +2% YoY) but missed profit ($1.48bn, -45% YoY) estimates as car sales dropped for a second straight quarter, down 7% YoY.

Alphabet met sales ($84.7bn, +14% YoY) and profit ($23.6bn, +28% YoY) estimates on the back of strong cloud services and web search figures but missed estimates on YouTube’s advertising revenues which expanded 13% YoY. Shares were down 2% in after-hours.

In Europe, LVMH also reported H1 results after stock markets closed. It missed revenue (€41.7bn) and earnings (€7.3bn, -14% YoY) expectations due to lower demand in China. Smaller rivals Burberry and Hugo Boss issued profit warnings a week ago.

€-zone stocks closed mixed with the Dax as the outperformer (+1.6%) on the back of a 7% jump for SAP, Europe’s largest software company, after releasing a solid quarterly update with operational profits up 33%. It beat revenue (€8.3bn) and profit estimates. SAP is trading at an all-time high for a total market value of €244bn.

Asian markets are a touch lower today with Japan as the weakest market mostly driven by the earnings results in the US and Taiwan is closed for holidays. European stock futures are pointing to a lower open with the €-Stoxx 50 down 0.7%. US equity futures are down between 0.7% and 1% in overnight trading.

Brent oil is almost unchanged at $81.10 following a poor day for energy markets in the US. WTI fell 3.5% on ceasefire talks between Israel and Hamas that could ease tensions in the Middle East.

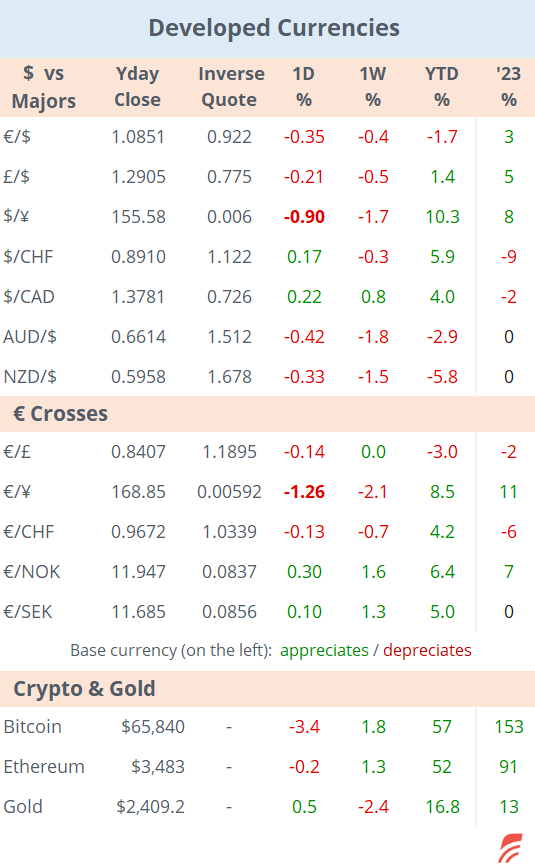

In currency markets, the $ traded mixed on Tuesday as it appreciated against the € and £ but fell versus the ¥ which continues to recover and is now at the strongest level in two months. The ¥ has appreciated 4% against the € in the past two weeks.

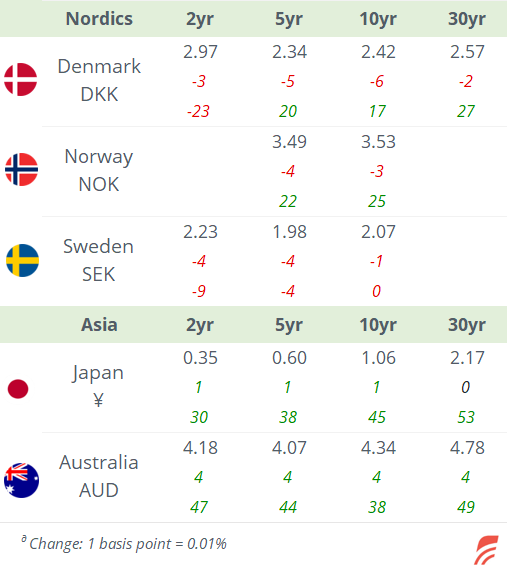

There were no significant moves in interest rate markets with benchmark yields easing a couple of basis points across tenors and in every region. 10-yr Treasuries closed at 4.24%, Bunds at 2.44% and Gilts at 4.13%.

Turkey maintained its monetary policy rate unchanged at 50% without surprises and sees the disinflation process gaining strength (71% YoY). On Friday, Turkey’s sovereign credit rating was u/g two notches to B1 by Moody’s. Also, Hungary cut its policy rate by 25bp to 6.75% as analysts expected.

In corporate deals, British events organiser Ascential Plc (mcap £938mn) is in advanced talks to be acquired by Informa Plc (UK, business support services, mcap £11.6bn) for £1.16bn. Ascential shares rallied 20% to a 3-yr high.

Bosch (Germany, engineering, private co) acquired Johnson Control’s and Hitachi’s residential ventilation divisions for $8bn, the company’s largest takeover ever.

Eni Spa (Italy, oil & gas, mcap €46bn) is in exclusive talks with KKR to sell a 20-25% stake in Enilive, its biofuel division, that could value the business at €12bn.

In debt capital markets, investment-grade issuers UnitedHealth (5 to 40-yr) and Occidental Petroleum (5 to 30-yr) placed a total of $15bn in senior bonds.

Today’s key data releases will be flash PMIs (Mfg and Services) in the US, €-zone, Germany, France and the UK. Also, the Bank of Canada holds its policy meeting at 14:45 UKT with analysts expecting a 25bp rate cut to 4.5%, in line with futures markets which are pricing in an 85% chance for a cut.

Blue-chip names reporting earnings today include Kering, Iberdrola, Santander, BNP, Thermo Fisher Scientific, IBM, AT&T and Ford.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.