Podcast script: Estimated reading time ⏲ ~5 mins

Good morning,

Risk assets rallied yesterday as strong corporate earnings proved a better catalyst for investors’ sentiment than weak manufacturing PMIs. Eurozone stock indices gained between 1.5% and 2% while the FTSE 100 ended modestly firmer at a fresh record high. Wall Street also ended around 1.5% higher last night driven by earnings reports.

Let’s quickly review the contrasting readings of PMIs before jumping into the earnings reports. The preliminary manufacturing PMIs for April showed a steep deceleration in factory activity, mainly in Germany (42.2) and France (44.9) although the UK (48.7) and US (49.9) also suggest that activity levels are cooling. Every manufacturing PMI came in below estimates and almost all of them are weaker than a month earlier. On the other hand, the Services PMI readings for the UK, Germany and France reflected a significant improvement in April which led to the €-zone’s Composite PMI to expand the most in almost a year.

Back to equities, the biggest movers among reporting stocks are Spotify which gained 11% to a total market cap of $60bn, after posting record profits of €197mn on €3.6bn sales in Q1. It reached 239mn paying subscribers.

Tesla reported after market close and missed revenue ($21.3bn) and profit estimates ($1.1bn), with a 9% YoY drop in sales, its worst quarter in 12 years. However, it announced plans to begin production of an affordable new vehicle next year which helped the stock rally 13% in after-hours trading.

General Electric advanced 8% after beating revenue ($15.2bn) and profit estimates ($1.54bn) on strong guidance from its aerospace division. GE shares have rallied 60% this year.

Swiss pharma giant Novartis also beat consensus and raised its full-year guidance leading to a 2% stock gain yesterday.

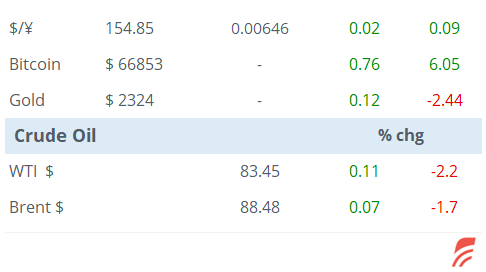

In currency markets, a hawkish comment by Huw Pill, the Bank of England’s Chief Economist, sent cable higher by 0.8% to 1.2448. He warned that the recent inflation fall was not enough to cut policy rates. The yen remains at its weakest level in more than three decades ahead of the Bank of Japan’s meeting on Friday. The central bank gave a strong signal yesterday of a potential market intervention to support the value of the yen.

Headlines,

-The US Senate approved the aid bill destined for Ukraine, Israel and Taiwan for a total of $95bn.

-The Senate also passed the bill that bans TikTok in the US if its Chinese parent Bytedance remains the ultimate owner.

In corporate deals, British apparel retailer JD Sports tabled a $1bn cash bid for smaller US rival Hibbett. The consideration represents a 20% premium to Hibbett’s previous close and shares rose 19% to a 3-year high. JD’s market cap stands at £6.4bn after shares added 4% yesterday.

In the coffee sector, Italian privately owned Lavazza Group is acquiring a 28% stake in IVS, an Italian coffee machine retailer, taking its control to 48% and valuing IVS at €647mn. IVS shares rallied 11% to a 4-year high.

In the music hardware sector, private equity firm PAI Partners acquired British audio console maker Audiotonix for around £2bn from French fund manager Ardian.

On the data front today, we’ll get the Ifo surveys in Germany, durable goods and mortgage data in the US, unemployment in Sweden and retail sales in Canada.

Finally, today will be another active day for earnings reports with Meta, AT&T, Boeing, IBM, Ford, Iberdrola, Atlas and Eni among others reporting results.

That’s all for today, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. It is prohibited to copy and paste, forward, or set up auto email forwarding rules to give access to others. Please share the publication using the button below, as access is free to all.