Morning,

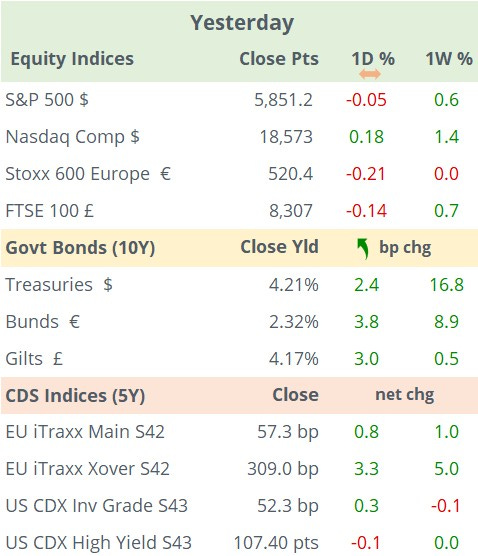

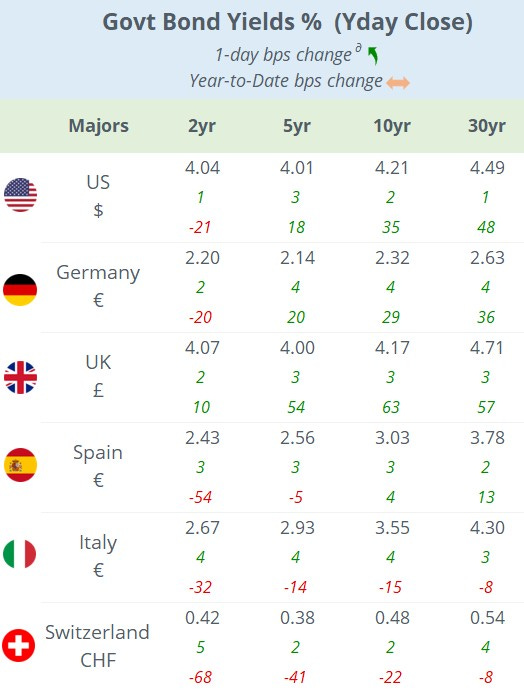

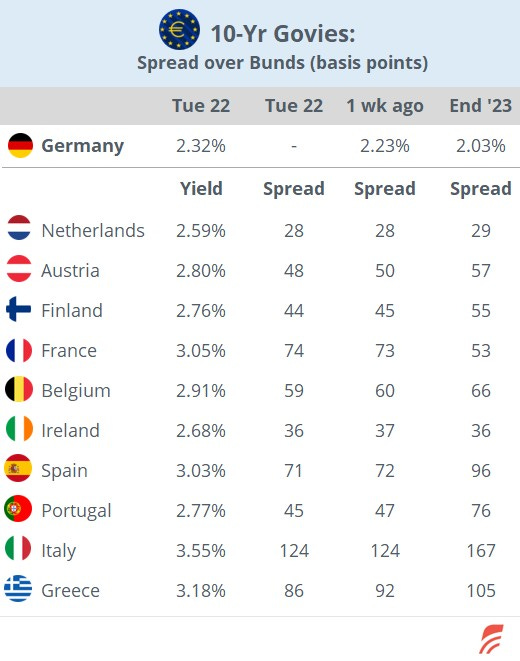

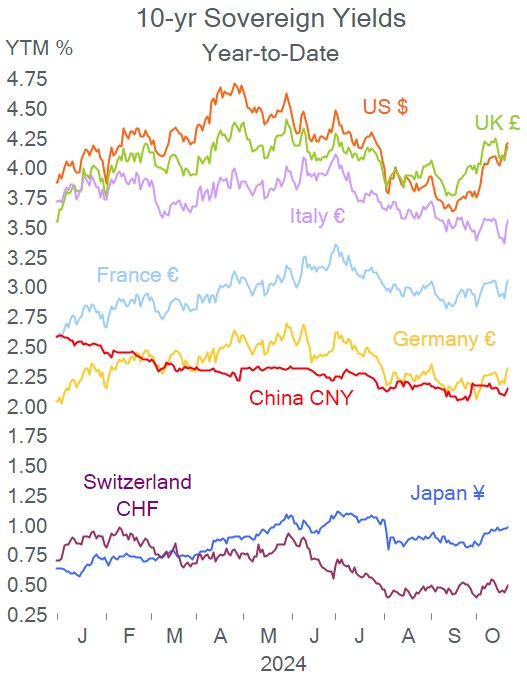

Bond markets remain this week’s focus as the correction in prices during October continues to push yields higher with 10-yr Treasuries hitting a 3-month high at 4.21%, as traders price in a soft landing for the US economy. The catalysts for this bond sell-off are a less dovish Fed after the recent employment data and investors’ hedging ahead of the election with Trump’s odds improving. Bond yields in the UK, Germany and other €-zone countries also shifted higher with Gilts yielding 4.17%, Bunds 2.32% and BTPs 3.55%.

At the IMF and World Bank annual meeting in the US yesterday, the IMF cut its growth forecast for Germany and now expects a 0.2% contraction for this year, as Germany becomes the weakest economy in the €-zone and other G7 member countries. The IMF also reduced Germany’s expansion estimate for 2025 to +0.8%. The €-zone is expected to grow by 0.8% in 2024. (IMF)

Also, ECB policymakers, in particular the heads of the central banks of France, Portugal and Finland expressed concerns over too low inflation in the €-block triggered by weak economic conditions and a still restrictive level of interest rates. €-zone inflation surprised last month with a low 1.7% reading. Traders are pricing in 135bp of ECB rate cuts by the end of next year.

Stocks ended little changed on Wall Street ahead of today’s earnings announcement and with the rise in bond yields on the focus. General Electric (mcap $191bn) shares fell 9% on Tuesday (worst day in 2.5 yrs) despite beating quarterly sales and earnings estimates and raising this year's profit forecast, hit by persistent supply constraints that impacted operations at its jet engine unit. GE is still 73% higher YTD.

In IPOs today, government-owned Tokyo Metro, one of the capital’s two major underground operators carrying 6.5mn passengers every day, raised $2.3bn, making it the biggest listing in Japan in six years. Shares were priced at ¥1,200, the top of the guidance range and rallied 45% on their debut for a $6.2bn market cap. (WSJ)

In deals, French investment firm Wendel SE (mcap €4bn) is taking control of US middle market private lender Monroe Capital for $1.1bn. (Reuters)

In business news, HSBC (mcap £124bn) is launching a significant global restructuring that will involve splitting the group into east (HK) and west (UK) operations and simplifying its structure into four main divisions. Shares are up 10% YTD. (FT)

In new bond issues, Italy placed €10bn of 7-yr BTPs rated BBB at a 3.2% yield or 103bp over Bunds. It also tapped a 30-yr bond for a total of €3bn, attracting strong investor demand. Italy’s 10-yr sovereign yield spread to Bunds has narrowed by 43bp this year.

The Bank of Canada holds a policy meeting with analysts expecting a 50bp cut to 3.75% and traders pricing in a 91% chance for a similar cut. Also, the Fed issues its Beige book.

Russia is hosting this year’s BRICS summit in the city of Kazan with more than 20 heads of state attending.

Today’s the most active day of the week regarding earnings announcements with Tesla (AMC), Coca-Cola, Roche (sales update), IBM, Boeing, AT&T, Deutsche Bank, Iberdrola and Heineken reporting results.

Finally, it’s a light day on the data front with €-zone consumer confidence and US existing home and mortgage figures.

Thanks for your time, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.