Podcast script: Estimated reading time ⏲ ~5 mins

Good morning,

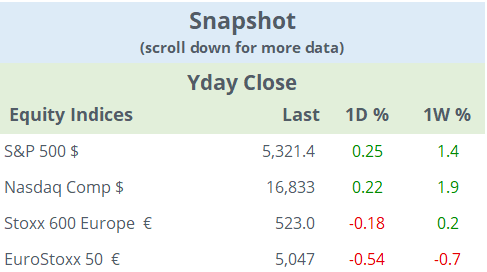

Wall Street ended firmer last night following Europe’s weak trading session for equities that saw the Eurostoxx 50 drop by 0.54%. US indices maintain their positive momentum despite some hawkish remarks by central bankers. The S&P 500 and the Nasdaq Composite added 0.25% yesterday while the Russell 2000 fell by the same amount. B

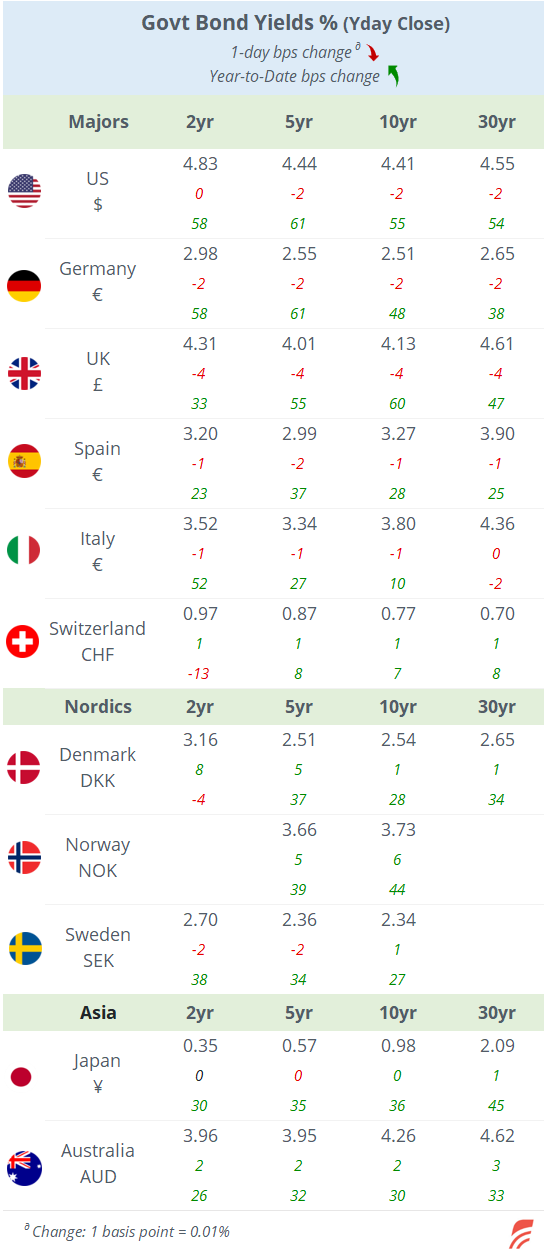

ond yields continue to move sideways and most benchmark yield curves shifted a few basis points lower yesterday with Bunds ending at 2.51%, Gilts at 4.13% and UST at 4.41%. Major currencies barely moved against the $.

Tesla was the notable mover in US markets with a 6.7% jump after providing a detailed update on its project to develop electric semi-trucks, called Tesla Semi, which is on track for deliveries in 2026. Tesla’s stock is down 25% YTD.

In Europe, giant pharma Novo Nordisk was the best performer among large caps with a 2.6% gain while BNP went ex-dividend and the price adjusted by 6%.

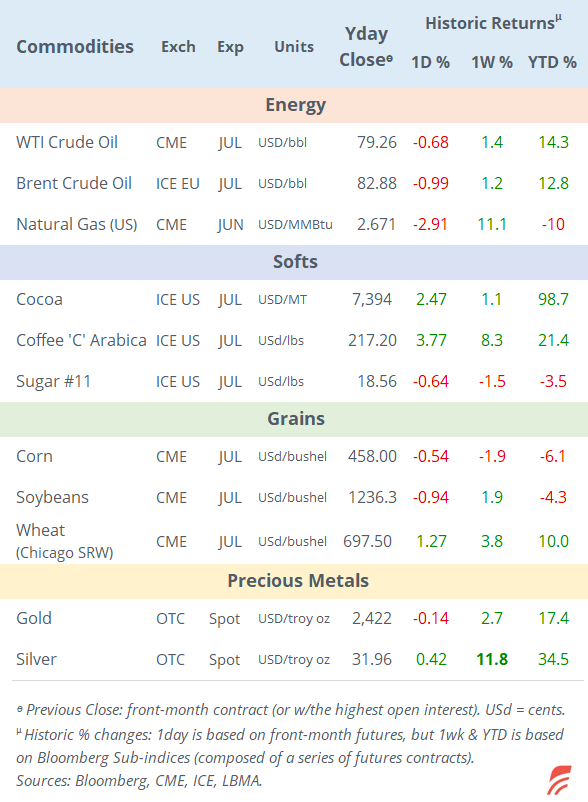

Asian markets are trading mixed today, with Japanese stocks lower by 0.6% and Taiwan up by 1.5%, while others are marginally higher. The ¥ is above 156 against the $, Brent oil is weaker at $82.20 and European equity futures are a touch firmer in early morning trading.

In central bank talks, we heard from ECB President Lagarde who said she was “really confident” that inflation in the €-block was under control and that policymakers’ forecasts for next year and the following are getting very close to target. She also warned that Europe should prepare for a possible win by Trump and the potential impact of trade tariffs. The ECB meets on June 6th and markets are pricing in a 25bp rate cut and the focus moves to where rates go next.

Remarks by Fed officials were not as encouraging as Waller stated that he needs several more months of good inflation data before supporting a rate cut. His view was shared by Cleveland and Boston Fed Presidents in a series of cautious comments regarding monetary policy. The Fed meets on June 12th and no rate change is expected.

Today, the Reserve Bank of New Zealand maintained its policy rate unchanged at 5.5% as anticipated. The NZD dollar is firmer by 0.43% at 0.6115. Indonesia’s central bank is expected to meet later today.

The main data released yesterday was Canadian inflation which eased to +0.5% MoM and 2.7% YoY. Denmark’s GDP shrank by 1.8% QoQ in Q1, its first negative quarter in three years.

In the Eurobond market, Romania’s government issued 8 (at ms+255bp) and 13-year (at +290) bonds for €3.2bn, rated Baa3/BBB-. On the corporate side, Portugal’s utility EDP placed 30-year subordinated bonds, rated Ba1/BB+, at 241bp over Bunds.

In the crypto space, Ethereum rallied nearly 30% in the past seven days to $3,775 this morning, after the SEC requested asset managers to refile their applications for Ether ETFs, in a similar move that Bitcoin had recently. Ethereum’s market cap stands at $454bn compared to Bitcoin’s $1.3tn.

Today’s key data release will be inflation in the UK at 7 AM London time, with headline CPI expected to drop to 2.1% YoY and core to 3.6%. We’ll also get existing home sales in the US.

On the earnings front, a market-moving event for tomorrow will be Nvidia’s results after today’s market close. Also reporting today, Marks & Spencer, Swiss Life and Target.

That’s all for today, see you tomorrow.

*Please add a like and share this post if you find it useful* 🙏

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Please share using the button below, as access is free to all.