Morning,

The focus on global markets shifts to geopolitics and Nvidia’s earnings report. The Ukraine-Russia war escalated on its 1,000th day anniversary when Kyiv used the US-made long-range missiles (Atacms) into Russian territory for the first time since Washington’s approval a few days ago. Ukraine hit a Russian weapons arsenal 115km from the border. Putin responded with a decree that lowered the threshold for the use of nuclear weapons.

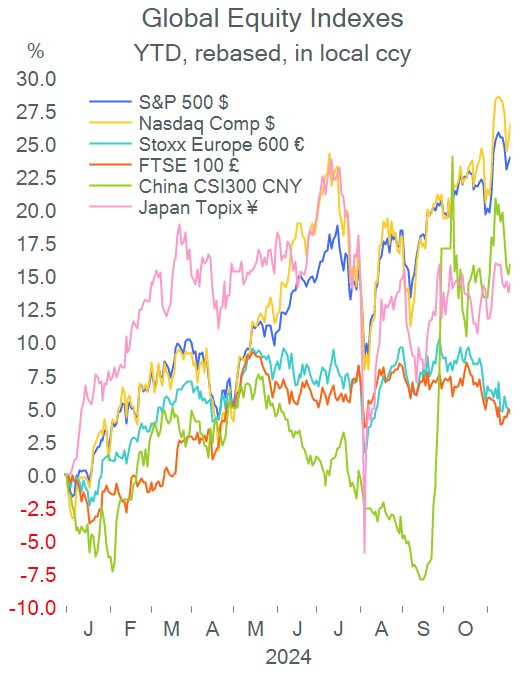

Nvidia, the world’s largest company with a market value of $3.6tn, rallied 5% yday ahead of today’s highly awaited earnings release after the US close. The AI-focused chip maker has gained nearly 200% this year.

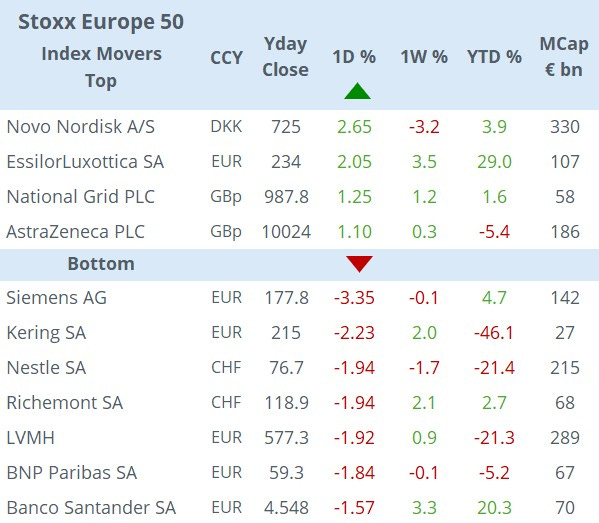

Tuesday was a volatile day for European equities with the Stoxx 600 down by 1.5% at one point before ending 0.5% lower driven by the escalation in the Ukraine conflict. Wall Street finished firmer driven by Walmart’s earnings release and Nvidia’s rally. Walmart (mcap $696bn) reported quarterly results that beat revenue ($169bn) and profit ($4.6bn) estimates and raised its full-yr sales guidance (+5% YoY) as consumer spending improved. Shares gained 3% to an all-time high.

China maintained its benchmark lending (loan prime LPR) unchanged at 3.10% for 1-yr loans and 3.60% for 5-yr as anticipated. Beijing is expected to wait until Trump assumes power in January to announce further stimulus measures.

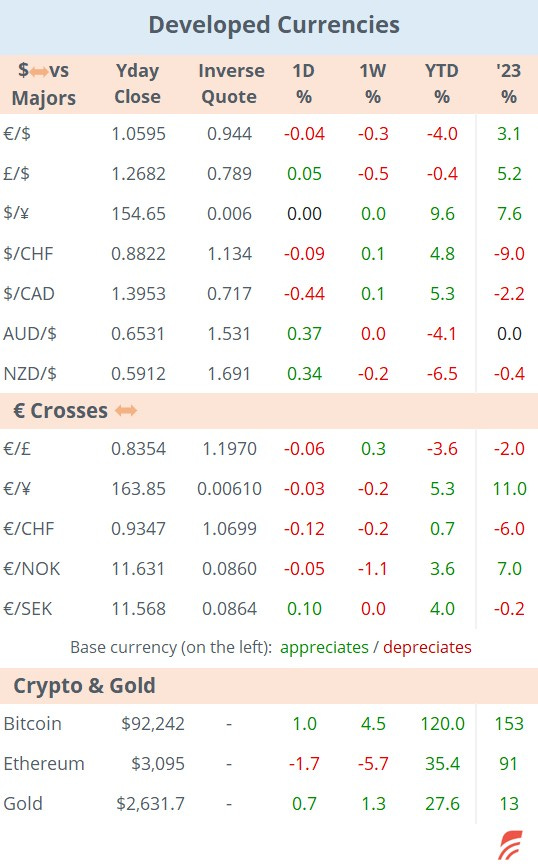

Asian stock markets are mixed today with China and HK advancing while others are a touch weaker without significant moves. The ¥ is trading above 155, Brent is steady at $73.20, and Bitcoin remains at its record high shy of $93k. €Stoxx 50 futures are firmer in early trading.

Trump nominated Howard Lutnick, a supporter of high tariffs and CEO of brokerage Cantor Fitzgerald, as Commerce Secretary.

A notable corporate deal announced yday was in the US packaging sector where Amcor Plc (mcap $14bn) will acquire Berry Global Group (mcap $7.6bn) for $8.4bn in an all-stock deal to create a container packaging giant.

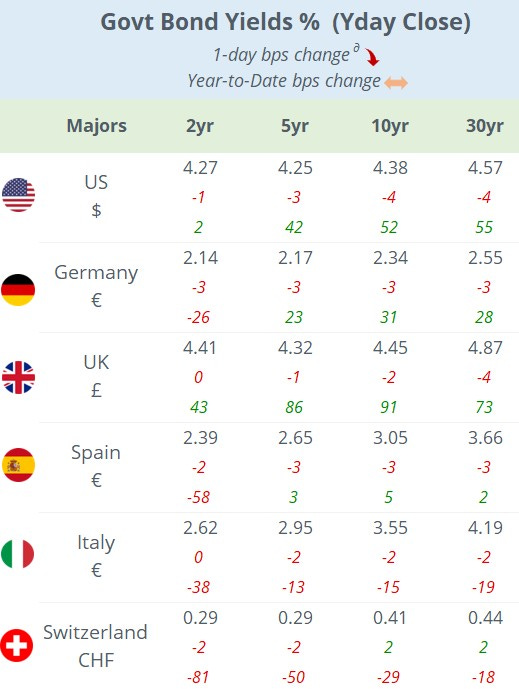

In DCM, Italian gas distributor Snam Spa (mcap €14.5bn) issued 12-yr senior bonds in sterling, rated BBB+ at a 5.8% yield. French telecom Iliad issued 5-yr high yield (BB-) € bonds at 5.38%.

In credit ratings, Banco BPI of Portugal was u/g two notches by Moody’s to A2 and Teva Pharma of Israel was u/g one notch by S&P to BB.

Data to be released today: UK inflation (CPI, RPI and PPI); Germany PPI; Japan trade; Denmark GDP. Indonesia’s central bank meets today with rates expected to remain unchanged at 6.0%.

Blue-chips reporting today: Nvidia (AMC) and TJX Companies. It’s a holiday in Brazil and India.

Thanks for your time.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.