Morning,

The conflict in the Middle East escalated sharply on Tuesday when Iran launched a missile attack on Israel as a response to Tel Aviv’s ground offensive in Lebanon to fight Hizbollah. This is Tehran’s retaliation for the killing of Hamas and Hizbollah leaders in Tehran and Beirut. Israel's air defence managed to intercept most missiles but a few hit in the centre and south of the country with no casualties reported. However, eight people were killed by terrorists in Israeli territory.

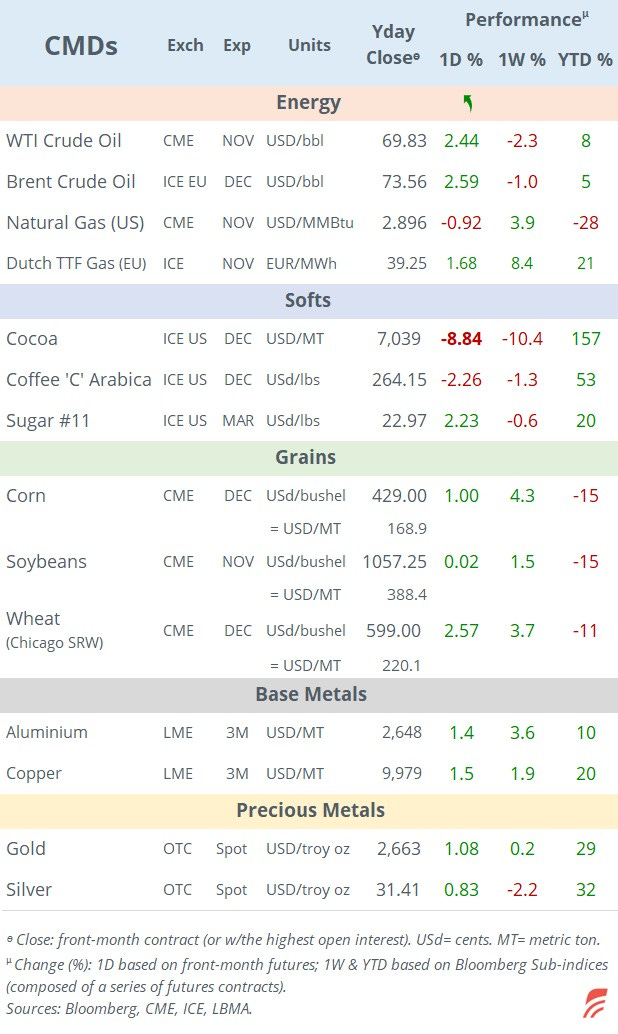

Crude oil jumped more than 5% last night to $75.50 and is now trading at $74.60 ahead of today’s OPEC+ meeting to review its oil policy.

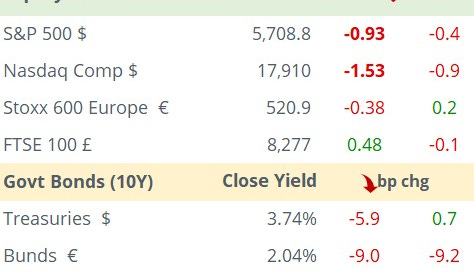

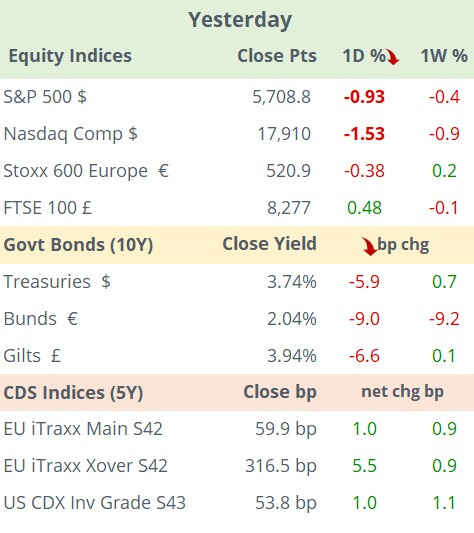

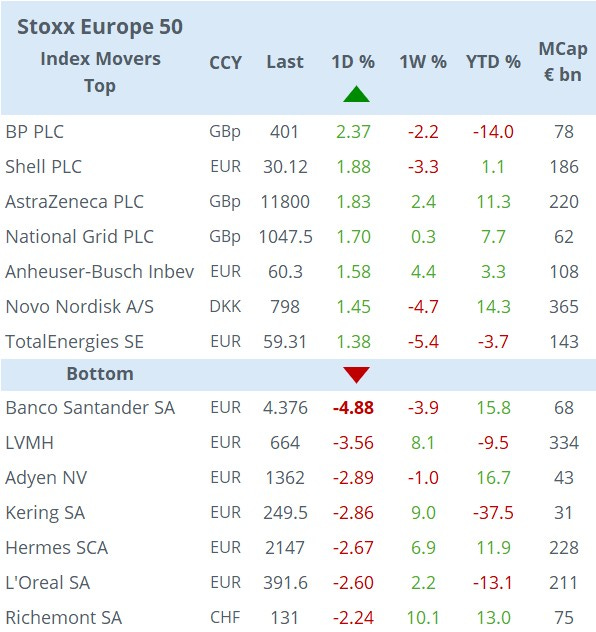

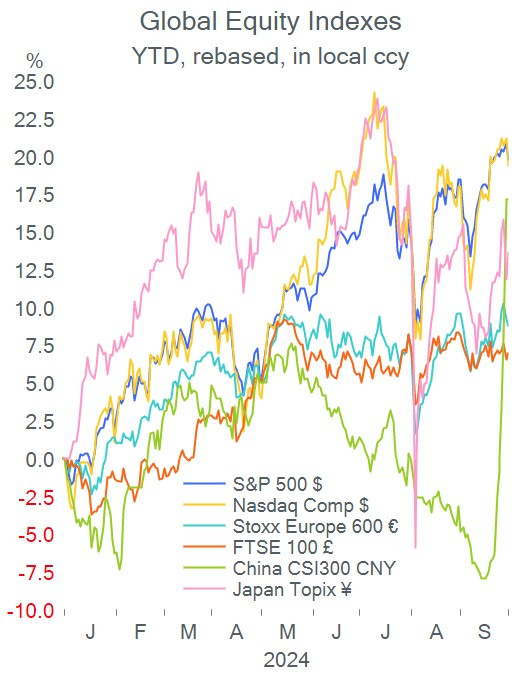

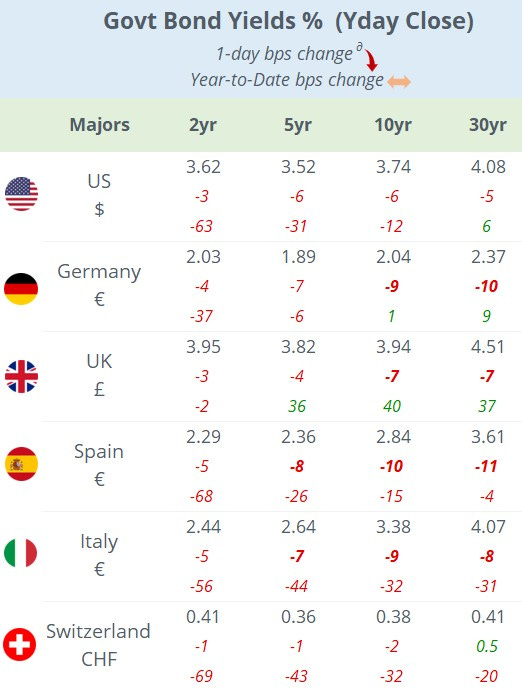

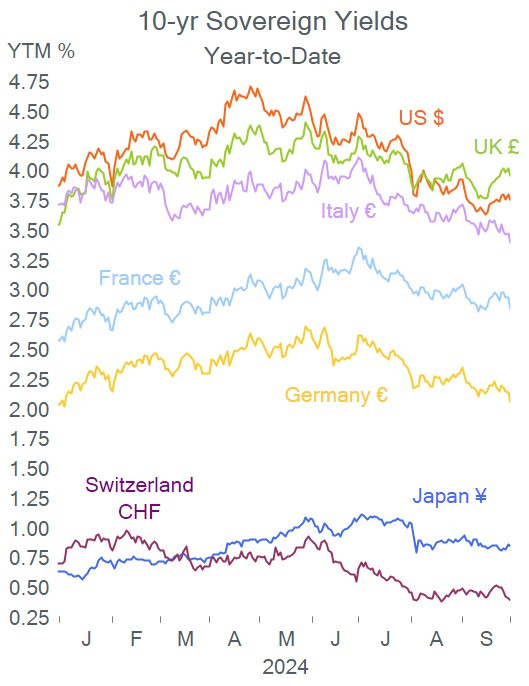

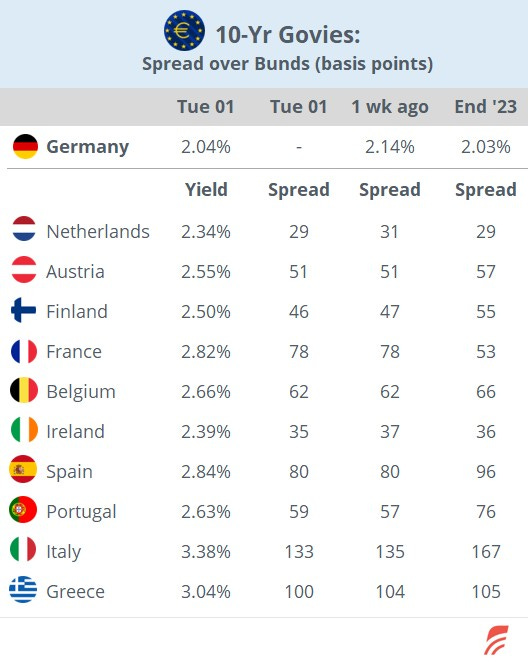

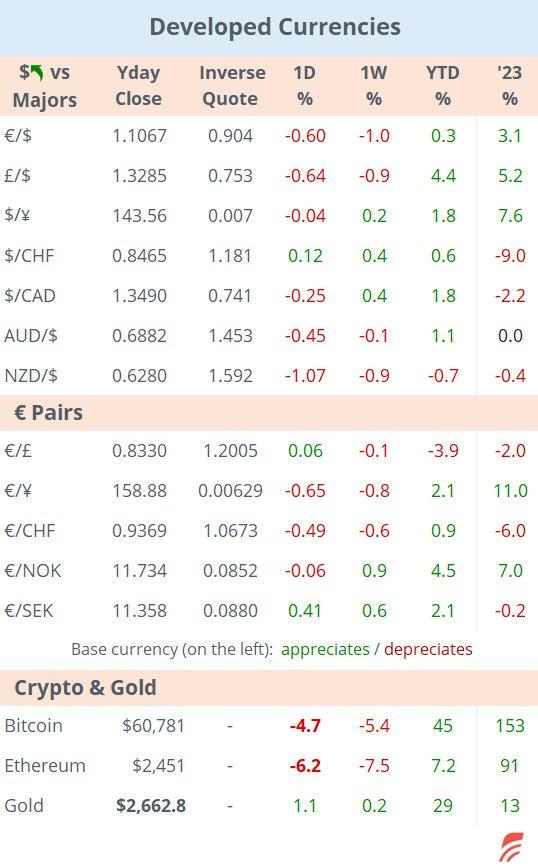

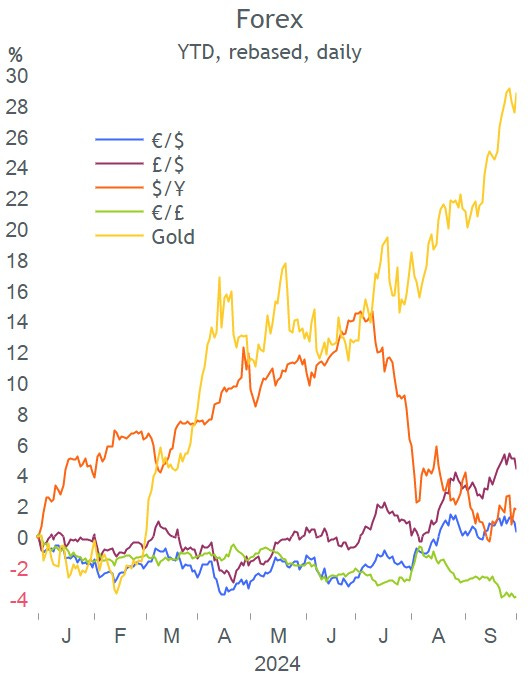

Wall Street ended lower following the geopolitical news with the S&P 500 down by 1% and the Nasdaq Composite losing 1.5% with defence stocks as the only winners. Bonds rallied as investors sought safe havens with €-zone long-end yields falling sharply after the inflation update. The $ appreciated and gold advanced 1% and continues to trade near its record high.

In economic data, inflation in the €-zone in September fell to 1.8%, in line with consensus, below August’s 2.2%, and the lowest since April 2021, mainly on falling energy costs. The core reading came in at 2.7%, marginally lower than a month ago. The update strengthens the case for another ECB rate cut according to policymaker Olli Rehn who made dovish comments yesterday. Traders are pricing in two more 25bp-rate cuts by year-end.

In earnings reports after the U.S. market close, Nike (mcap $133bn) missed revenue ($11.6bn, -10% YoY) and beat profit ($1.05bn, -27% YoY) quarterly estimates. It also withdrew its full-year guidance and said it was postponing its investor day as it prepares for a CEO change. Shares fell 6% in after-hours and are now 24% lower YTD.

In corporate deals, Abu Dhabi's energy giant ADNOC (mcap $12bn, state-controlled) is acquiring German chemicals Covestro (mcap €11bn), in a €14.7bn enterprise value deal in cash, its biggest takeover ever. Covestro shares gained 3.8%.

Also, Italian brake manufacturer Brembo (mcap €3.1bn) is divesting its 5.6% stake in tyre maker Pirelli (mcap €5.4bn) worth ~ €300mn, through an accelerated book-building process.

In private markets, UK-based fintech SumUp is said to be planning a new share sale with a valuation target of £6.7bn as it seeks investors for a ~4% stake. Also, Swiss private equity firm Partners Group is selling Techem, the German metering company to TPG’s Rise Climate Fund for €6.7bn. Partners had acquired Techem in 2018 for €4.6bn.

It will be a light day on the data front with €-zone unemployment and inflation in Korea. In monetary policy, Poland's central bank meets today with its benchmark rate expected to remain steady at 5.75%. There are no blue-chip earnings reports scheduled for today.

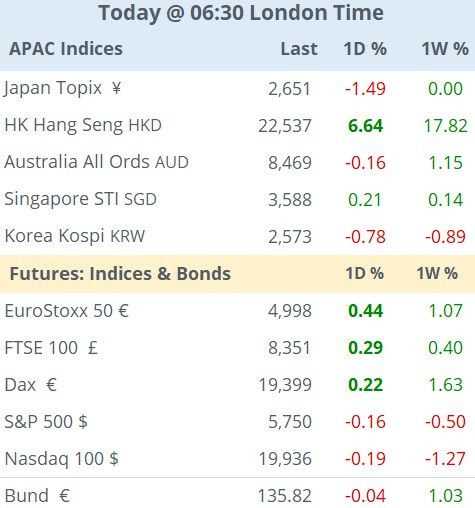

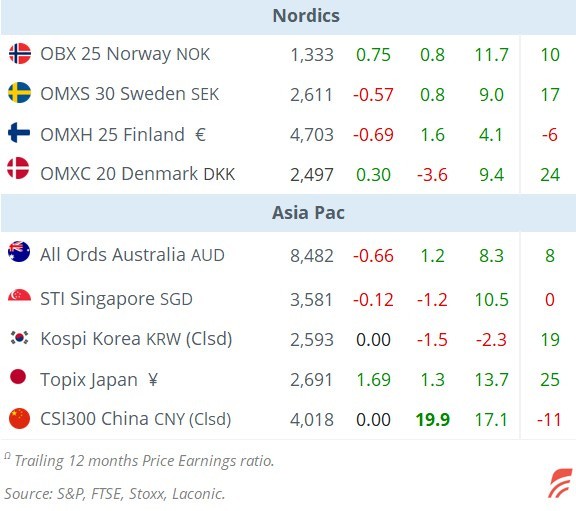

In Asia, shares in Hong Kong are rallying 6% following Monday’s holiday with property and mining stocks gaining the most. European stock futures are a touch firmer in early morning trading.

It’s a holiday in China, India, Taiwan and Israel.

Thanks for your time, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.