Morning,

Tuesday was another positive day for global equities with every country benchmark trading higher and US indices breaking their 30th record high in the past six months. The S&P 500 added 0.25% and the Stoxx 600 advanced 0.7%.

The risk-on sentiment helped chip maker Nvidia Corp add 3.5% yesterday to $135.6, accumulate a 174% YTD rally and claim the spot as the world’s most valuable company at $3.33tn, marginally above Microsoft, which has advanced 19% YTD. Apple, now the world’s third largest company, added 11%. Nvidia is trading at a 12-month trailing P/E ratio of 80 times compared to 27 for the S&P 500.

Investors’ frenzy for artificial intelligence stocks is this year’s main catalyst for the outperformance of the information technology sector in the US which has gained 31% in 2024. The fever for A.I. hardware made Nvidia the best-performing stock of the past 25 years. Markets will be able to breathe today during the US holiday.

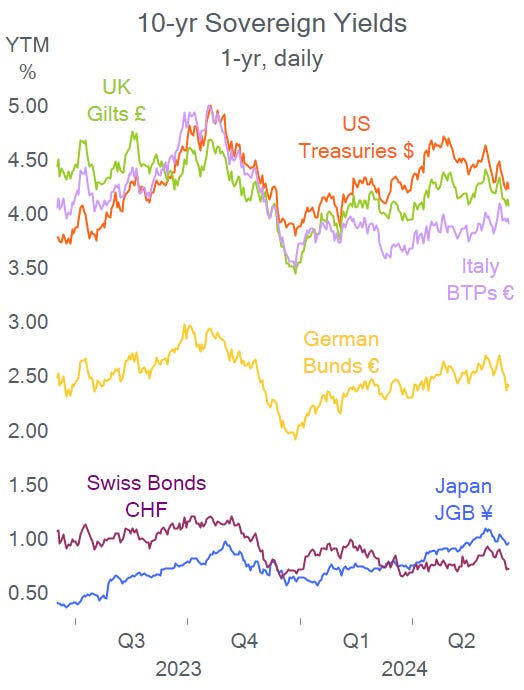

On to yesterday’s drivers of performance, the US retail sales reading for May came in below estimates (+0.1% MoM) and April was revised lower, mainly on lower petrol prices, a sign of an economic slowdown that traders interpret as positive for a lower interest rate environment. Bond markets traded firmer on the news with the US government curve shifting lower by 6bp across tenors as the 10-yr yield closes at 4.22%. Other markets traded in a similar direction with UK Gilt yields also dropping ahead of today’s inflation update.

In forex markets, although the DXY $ index ended flat on Tuesday, the Swiss franc and Aussie dollar appreciated sharply, around 0.6%. The Swiss National Bank meets tomorrow while the Reserve Bank of Australia met yesterday.

Asian markets are rallying today with equities in Hong Kong and Taiwan gaining 1.5-2%, Korea is up by 1%, while other markets (China, Australia) are modestly weaker. European stock futures are flat and Brent oil is unchanged at $85.36 following two strong days and is now trading at its highest since early May.

In deals, British wealth management firm Hargreaves Lansdown (mcap £5.3bn) received a bid approach from a consortium led by private equity CVC for £5.4bn in cash. Shares gained 5%.

Blackstone tabled a $1.7bn bid to acquire Japanese digital comic platform Infocom Corp (mcap $2bn) in the largest private equity deal in Japan this year.

Boston Scientific Corp (US, medical equipment, mcap $112bn) is taking over smaller rival Silk Road Medical (US, heart prevention devices, mcap $855mn) for $1.16bn. Silk shares rallied 24%.

In bond issuance, Enel placed 5-yr (@ UST +115bp) and 10-yr (+150) senior notes in $, rated Baa1/BBB+. In equity capital markets, Nextera, the US utility (mcap $148bn), raised $2bn by selling equity units to Wells Fargo and BofA. Shares dropped 2.5%.

Italian luxury sneaker maker, Golden Goose, postponed its planned IPO in Milan due to the recent weakness in investors’ interest in luxury goods stocks.

In special situations, electric vehicle co Fisker filed for Chapter 11 bankruptcy protection following several attempts to rescue the firm after a potential cash injection deal failed. Fisker is now trading as an OTC pink-sheet stock and fell 55% yday to a market value of just $24mn.

Besides UK inflation which will be released this morning, Brazil’s central bank holds a policy meeting with rates expected to remain steady at 10.5%.

When sharing, use the button below. Access is free to all. Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use.