Morning,

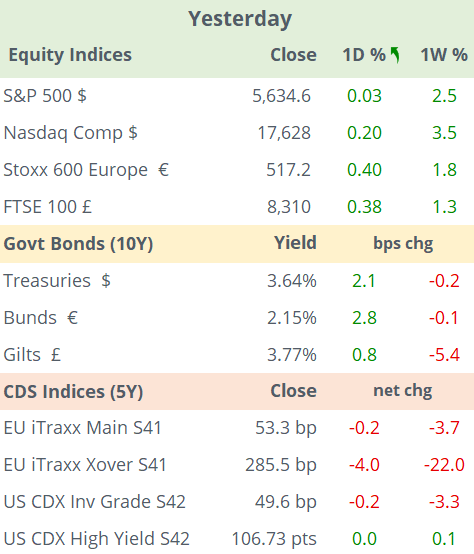

The S&P 500 index traded at a fresh record high on Tuesday before finishing the session unchanged and accumulating an 18% YTD return. The main drivers were a better-than-expected retail sales print (+0.1% MoM) and a solid update for industrial production (+0.8% MoM), also above estimates.

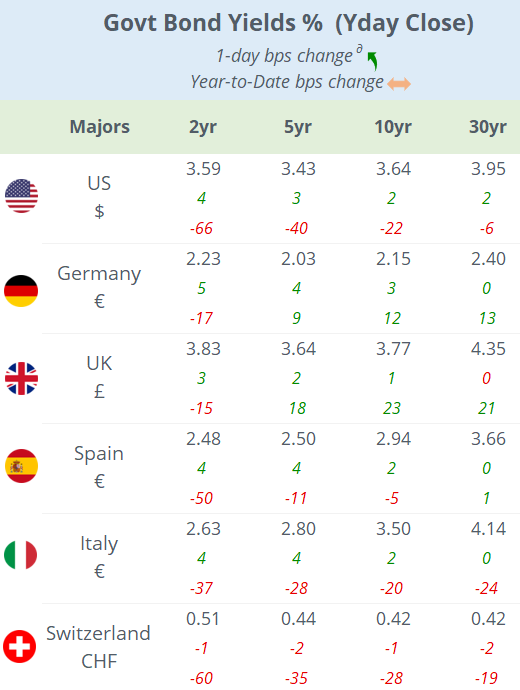

Traders’ focus continues to be today’s Fed decision as investors prepare for the first interest rate cut in 4.5 years. The question is by how much, 25 or 50 basis points, from the actual 5.375% mid rate.

Stocks in Europe finished a touch firmer yesterday with Madrid’s Ibex as the notable mover advancing 1% to a 9-yr high and becoming this year’s best-performing €-zone country benchmark with a 16% gain. The Ibex 35 index is trading at a price-earnings ratio of 11 times, below the broad Stoxx 600’s 15.5 times.

Currency and bond markets ended little changed yesterday with the ¥ as the main mover with a >1% fall against the $ and the €, following two straight months of appreciation.

At 7 PM London time today, the Fed will announce its monetary policy decision. Most banks forecast a 25bp rate cut (including Morgan Stanley, Deutsche Bank, UBS), while JP Morgan, Citigroup and MUFG anticipate a 50bp cut. However, futures markets are pricing in a 65% chance of a 50bp cut versus 35% for a 25bp. The last time the Fed made a change to its policy rate was in July of last year and the last time it lowered its target rate by 50bp was in March 2020, during the early days of the pandemic.

In credit ratings, Fitch upgraded Turkish banks by one or two notches but all remain sub-investment grade.

U.S. consumer products company Tupperware Brands Corp (mcap $24mn) filed for Chapter 11 bankruptcy. Shares are down 75% YTD.

In data releases, we’ll get €-zone and U.K. consumer inflation for August with analysts expecting both at 2.2% YoY. Besides the Fed, we’ll hear from the central banks of Brazil (+25bp to 10.75% exp) and Indonesia (unch at 6.25% exp). U.S. food processor General Mills (mcap $41bn) reports earnings today.

It’s a holiday in China, Hong Kong, Korea and Chile.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.