Morning,

A series of positive bank earnings reports including Morgan Stanley and Bank of America, helped US value stocks outperform their growth peers, with the Dow Jones Industrials rallying nearly 2% while Nasdaq indices closed almost flat.

The sudden funds’ rotation out of technology names and into mid and small-cap stocks led to a 3.5% jump in the Russell 2000 index which accumulated a 12% gain this year to a 2.5-yr high. European stocks continue to lag those in the US, mainly on weaker commodity-linked and luxury companies.

Germany’s Hugo Boss (mcap €2.9bn) plunged 7.5% to the lowest level in three years after cutting full-year sales guidance ahead of its earnings release in two weeks. European luxury stocks, Kering (-3%), Hermes (-2.3%), LVMH (-2%) and L’Oreal (-1.5%) were among the weakest large-caps for a second straight session.

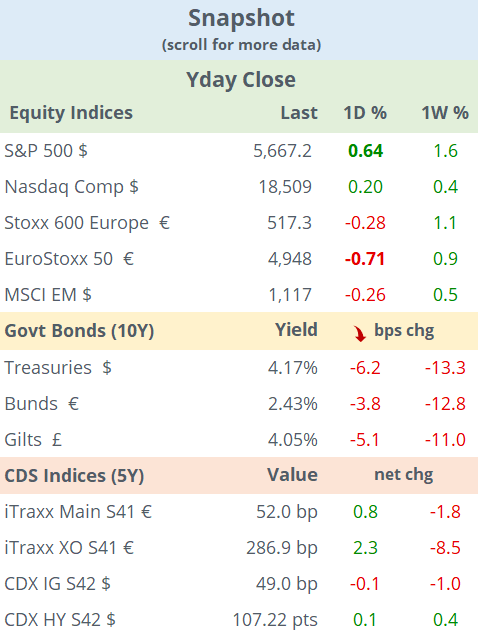

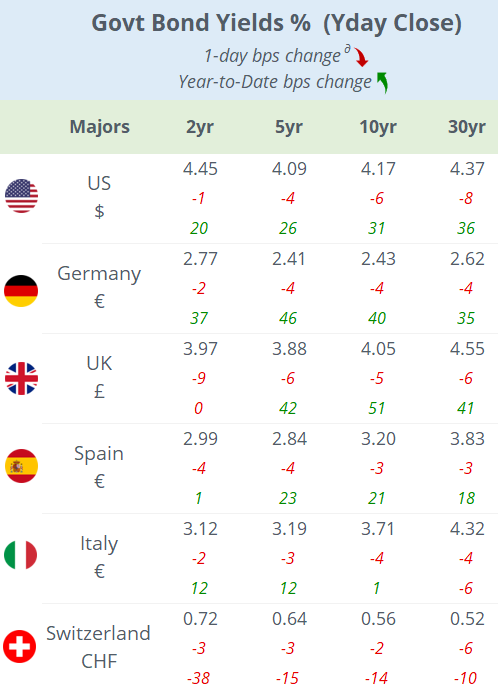

Bonds traded firmer across regions with yields dropping up to 9bp across tenors following dovish remarks by Fed Governor Adriana Kugler. 10-yr Treasuries closed at 4.17%, Bunds at 2.43% and Gilts at 4.05%.

Headlines:

-Trump is gaining support from former rivals within the Republican party and high-profile figures including Elon Musk.

-Trump questioned US defence commitments with Taiwan. TSMC shares are down more than 2% today. Also, the Biden administration is considering tougher trade rules on semiconductors made in China or with Chinese components.

Asian markets are trading mostly higher today except for Taiwan. FTSE futures are firmer while the €Stoxx 50 is flat this morning and US stock futures are pointing lower overnight. Currencies are little changed but gold is at a record high and Brent oil is flat at $83.65.

Retail sales in the US for June delivered a positive reading with a flat print, better than expectations and May’s figure was revised upwards, a signal of consumers’ resilience that improves the growth prospects in Q2.

Canada’s CPI inflation in June decelerated to 2.7% YoY, below estimates and the monthly reading declined (-0.10% MoM) for the first time in six months.

In M&A deals, Spanish train maker Talgo SA (mcap €500mn) received a merger proposal from Czech rival Skoda without providing details of the offer. Hungarian consortium Ganz-Mavag launched a public tender offer to acquire Talgo for €619mn in cash in March.

On the IPO front, the world’s largest cold storage REIT, Lineage of the US, said it is considering an IPO in a US exchange and is aiming to raise $3.85bn at a $19bn valuation. Lineage has 482 warehouses for a total of 3 billion cubic feet of capacity across North America, Europe and APAC.

In bond deals, American Honda Finance Corp placed 7-yr senior bonds in €, rated A-, at Bunds +135bp or a 3.67% yield.

In corporate credit ratings, Delta Airlines (BBB-) and General Dynamics (A) of the US, were u/g one notch.

The Fed issues its beige book of economic condition today while Governors Barkin and Waller attend conferences.

Indonesia’s central bank meets today with its 7-day repo rate expected to remain unchanged at 6.25%.

In data today: inflation (CPI, RPI and PPI) in the UK and the final inflation reading for June in the €-zone; housing figures and industrial production in the US.

Earnings today: ASML, J&J, US Bancorp, Prologis.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.