Morning,

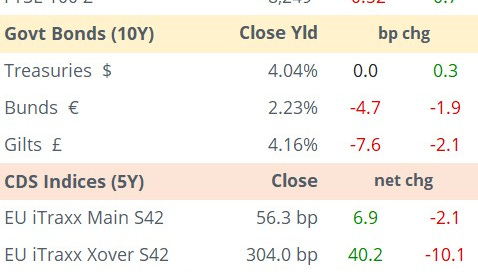

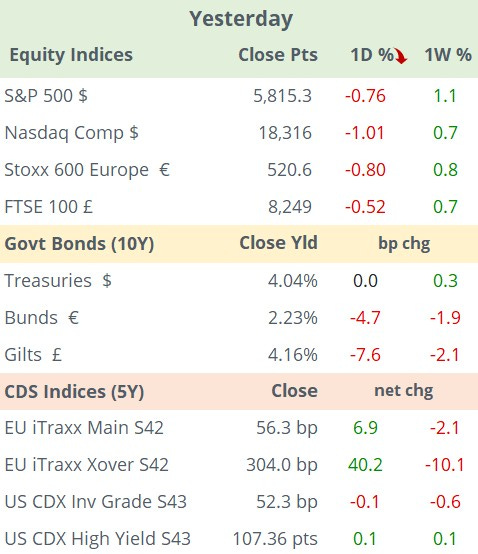

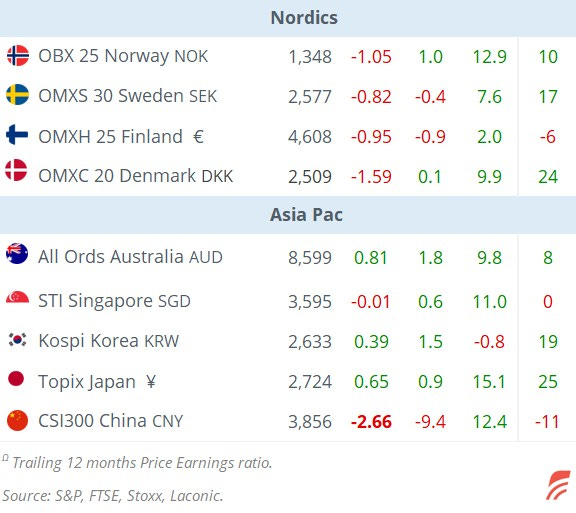

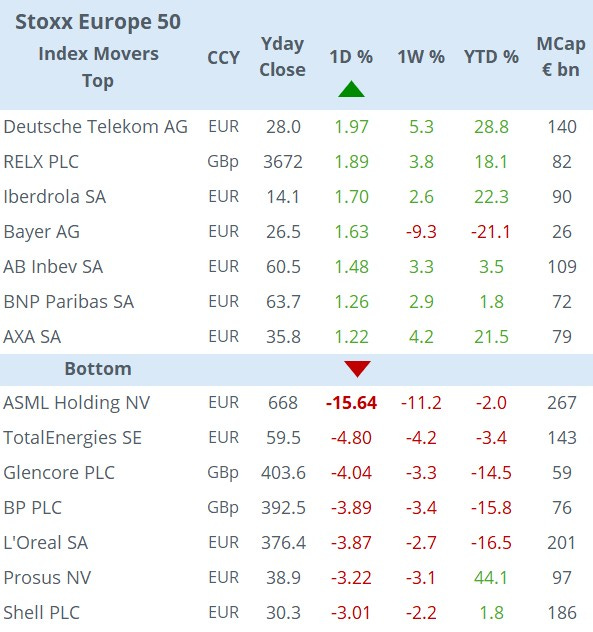

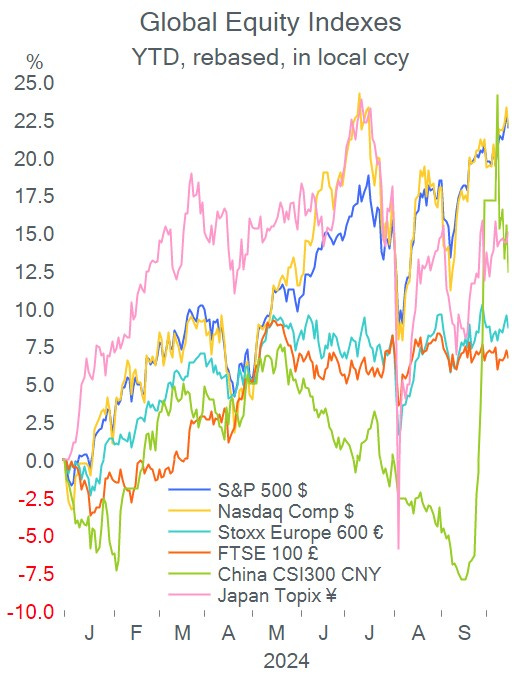

Risk assets retreated from their record highs on both sides of the Atlantic driven by an outlook downgrade by Dutch semiconductor equipment ASML (mcap €267bn) whose shares plunged 15% yesterday (worst day in >20-yrs, see chart) and pulled the whole chip sector lower. Nasdaq benchmarks declined by 1.4% while the EuroStoxx 50 lost nearly 2%. ASML’s earnings report was published earlier than scheduled due to an apparent technical error that leaked the figures. The company reported quarterly sales of €7.5bn and a net income of €2.1bn beating estimates but its demand outlook from chip makers fell short of expectations. The sector was also hit by reports that the White House was considering capping sales of advanced A.I. processors to some countries. The Philadelphia Semiconductor index lost 5.3%.

On the banking front, reports by Goldman, Citigroup and Bank of America beat profit estimates on strong investment banking and trading results but were lower than a year ago. Citi shares were the only notable mover with a 5% drop. In Europe, LVMH (mcap €313bn) missed revenue forecasts driven by weaker demand for luxury goods by Chinese and Japanese consumers. Shares ended a touch lower (-2%).

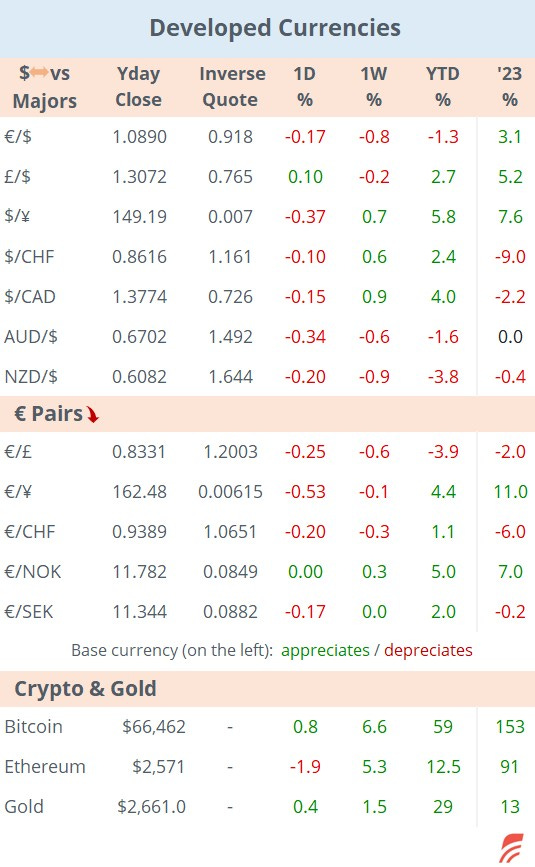

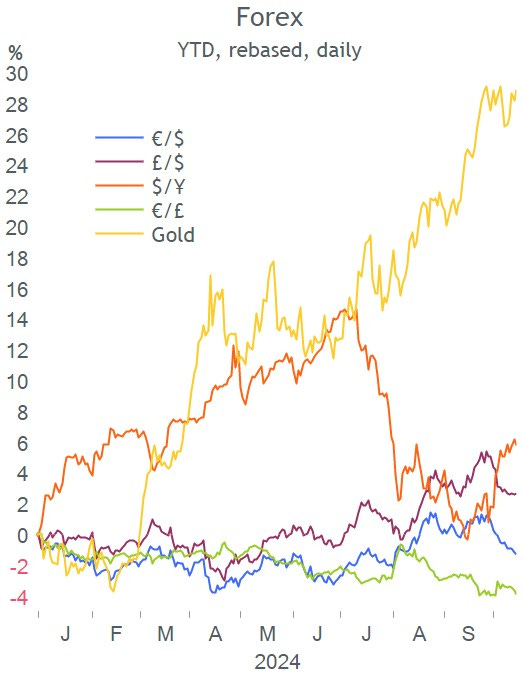

In forex markets, the € reached a two-month low while £ continues to trade range bound around the 1.30 level.

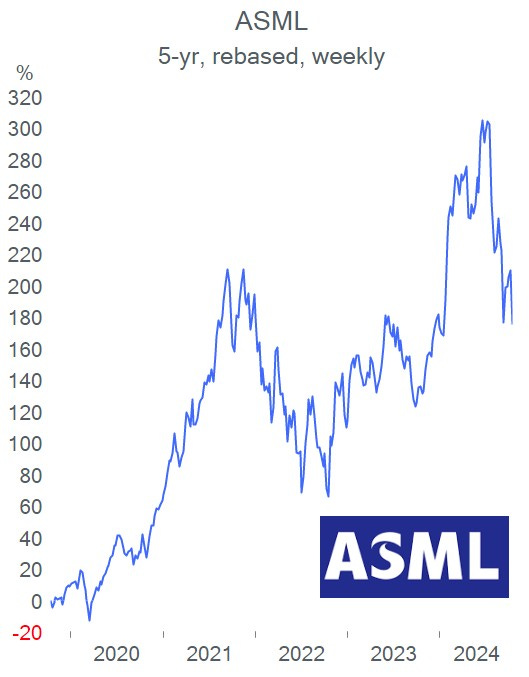

In Asia today, stocks in Tokyo are falling 1% after a poor surprise for machinery orders (-3.4% YoY), and BoJ dovish comments regarding policy rates. Taiwan’s benchmark is also down by 1% weighed by chip leader TSMC. Eurostoxx futures are trading lower by 0.6% in early morning trading while US indices are flat.

Headlines:

-The IMF issued a warning regarding the high level of global public debt which is expected to reach $100tn and represent 100% of worldwide GDP. The US and China are the main drivers of sovereign bond issuance while the UK, France and Italy’s public finances are expected to keep deteriorating as plans to reduce debt levels are insufficient.

-Boeing (mcap $94bn) plans to raise $25bn in debt and equity after agreeing to a $10bn credit line to improve its balance sheet as it faces liquidity issues following workers’ strike that reduced factory output. Shares are 41% lower YTD.

In credit ratings, Canada’s Toronto Dominion Bank (mcap $98bn) was d/g one notch by S&P to A+ (outlook stable). On the sovereign space, Barbados (B+) and Belize (Caa1) were u/g one notch.

In economics today: inflation in the UK and Italy; import prices and mortgage data in the US.

Blue chips reporting today: Morgan Stanley, US Bancorp, BHP, Abbot Labs, Antofagasta.

Monetary policy meetings: Indonesia (unch at 6% exp) and Thailand (unch at 2.5% exp).

Thanks for your time, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.