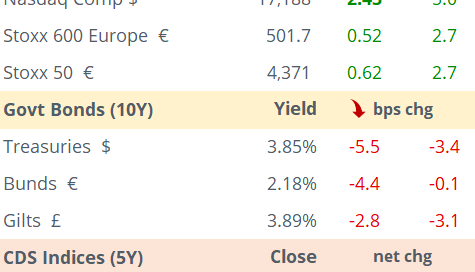

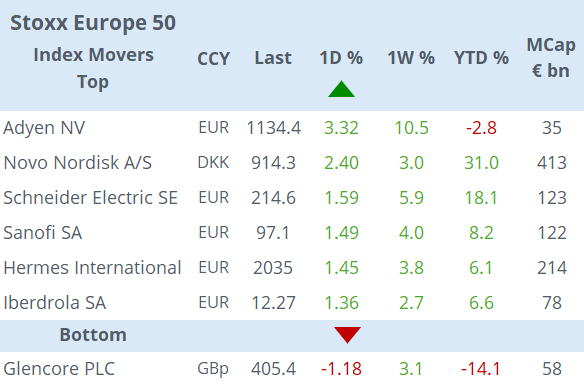

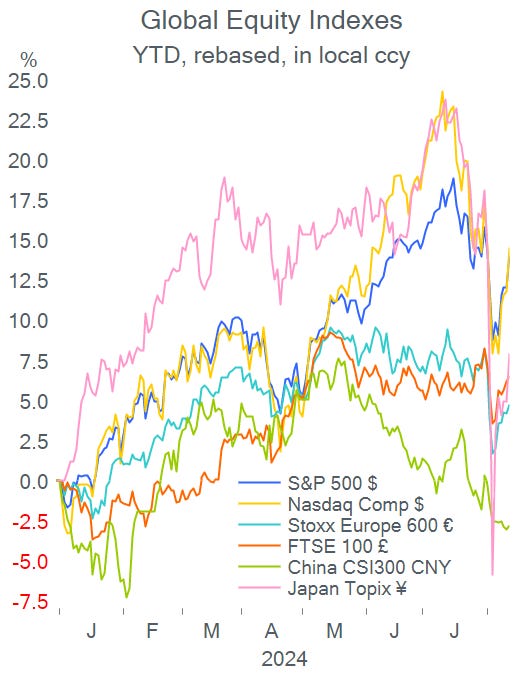

Wall Street rallied yesterday driven by softer U.S. producer price inflation and all leading indices gained between 1 and 2.5%, with tech stocks as the outperformers, ahead of today’s CPI update. Nvidia, Broadcom and Tesla advanced more than 5% while Apple, Amazon and Microsoft added 2%. In Europe, equities ended 0.5% higher on average despite weak German investor morale as reflected by the ZEW indicators.

Pharma giant AstraZeneca became Britain’s largest listed co with a £200bn valuation as its cancer and diabetes treatments paid off. Shares are trading at an all-time high following this year’s 22% rally.

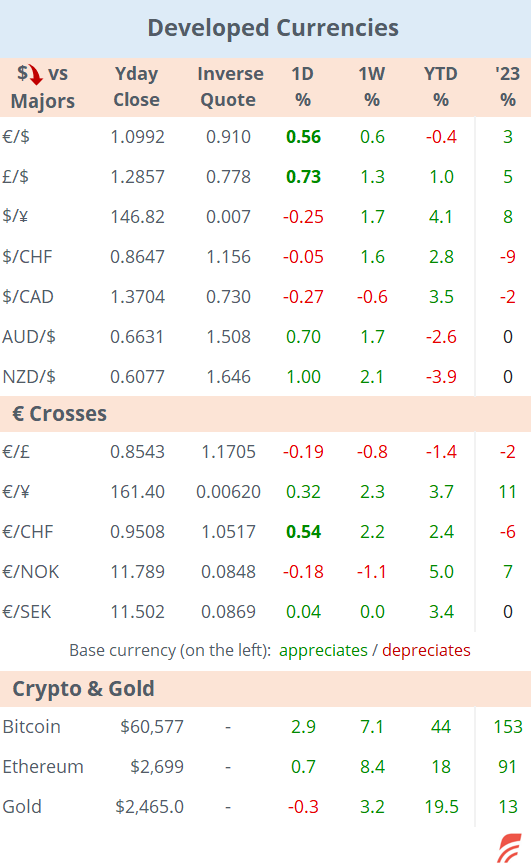

In data yesterday: US PPI inflation cooled to +2.2% YoY in July, below estimates and significantly lower than the revised 2.7% print in June, a sign that price pressure is easing. In Britain, the unemployment rate fell to 4.2% while average earnings rose by 5.4%, the lowest pace in two years. These labour market figures led traders to trim bets for a Bank of England rate cut in September and £ had its best day in three months to close at 1.2857.

The DXY $ index fell on Tuesday and the € appreciated to a 7-month high at 1.10. Benchmark interest rates resumed their downward trend with the short-end of the Treasuries curve rallying 7bp to 3.94% as data reinforces a Fed rate cut scenario.

In commodities, soybean futures in Chicago fell 2.4% to a four-year low and are 23% lower YTD, on the back of a record U.S. harvest forecast and weaker demand from top importer China.

The Reserve Bank of New Zealand surprised analysts today with a 25bp rate cut to 5.25%, its first cut in four years as inflation is declining (3.3% YoY), the economy is slowing down and signalled further easing ahead. The Kiwi dollar is reversing yesterday’s 1% gain.

Asia today: except for Chinese and Hong Kong stocks, which are marginally weaker on the back of slower loan growth in mainland China, all other equity markets are trading firmer with Taiwan and Korea gaining around 1%. European stock futures and Brent oil are a touch firmer overnight.

Headlines:

-Japanese Prime Minister Kishida announced he will step down in September and will not seek re-election as the party leader.

-Starbucks (mcap $108bn) fired its CEO and replaced him with the head of Chipotle Mexican Grill (mcap $71bn). Starbucks shares rallied 25% yesterday, its best day ever to a 6-month high and Chipotle’s fell 7.5%.

-Media reports suggest that the US DoJ is considering forcing Alphabet to break up Google for its online search dominance.

-Norway’s sovereign wealth fund NBIM (AUM $1.7tn) reduced its equity holdings in Meta Platforms, Novo Nordisk and ASML while maintaining its three largest positions, Apple, Nvidia and Microsoft.

In M&A: Germany’s Rheinmetall AG (mcap €24bn) is in the process of acquiring U.S.-based military vehicle parts manufacturer Loc Performance (unlisted) for $950mn.

Carlyle Group agreed to buy Baxter International’s (mcap $18bn) kidney-care unit Vantive for $3.8bn.

WSP Global (mcap $20bn), Canada’s engineering service co, announced it would take over U.S.-based Power Engineers (unlisted) for $1.8bn.

UK pension fund, The Universities Superannuation Scheme (AUM £77bn), acquired 3,000 affordable homes from Blackstone for £405mn.

In the high-yield bond market, JetBlue Airways of the U.S. (mcap $1.6bn) raised $2bn in 7-yr senior-secured notes, rated B-, at 624bp over UST or a 10% yield.

In credit ratings: Ukraine was d/g to Restricted Default by Fitch, citing the expiry of the grace period for its €-bond ’26 payment.

It is an active day for inflation data. At 7A.M. Ldn time we’ll get the latest on British inflation with analysts expecting an annual headline CPI print of 2.3%, above June’s 2.0%. At 1:30P.M, U.S. CPI monthly update with consensus anticipating no change at 3.0%. Also, inflation in Sweden & France; and GDP and industrial production in the €-zone.

Large-caps reporting earnings today include UBS Group, Cisco, Tencent, Foxconn, RWE and E.ON.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.