Morning,

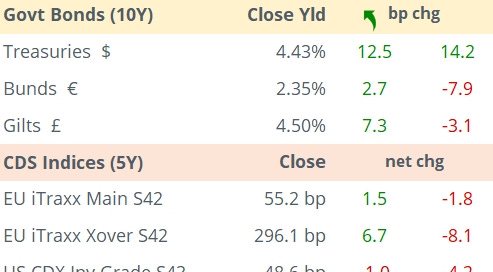

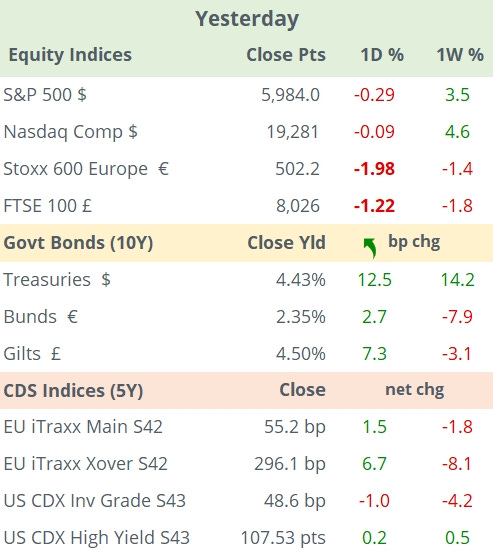

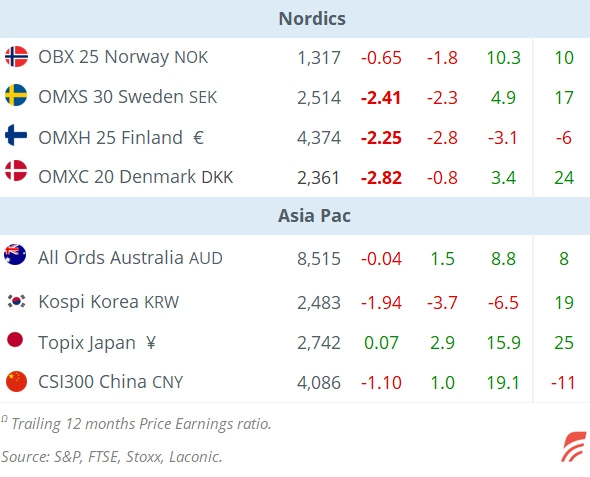

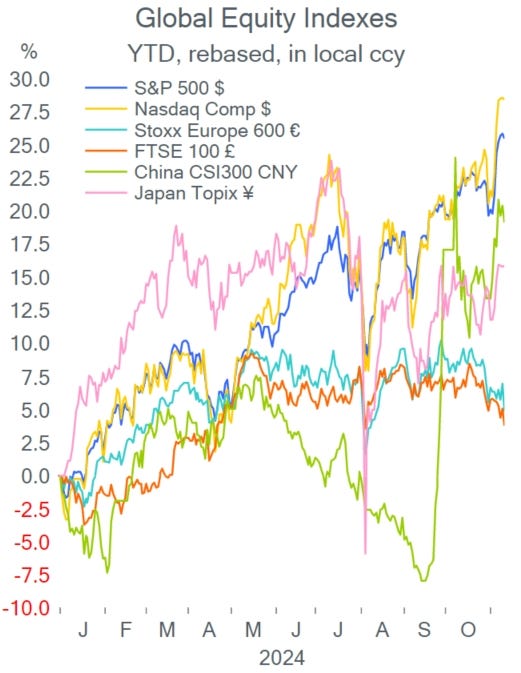

European stocks fell sharply on Tuesday as Trump began to reveal his Cabinet with hawkish stances on China that could trigger a new trade war. €-zone indices lost >2% following a positive start of the week and the FTSE 100 ended 1.2% lower, widening the divergence in returns with the US stock market.

ECB officials warned that the Trump administration´s protectionist policies will impact global growth and lead to a rise in US inflation. Some of Trump´s campaign promises included a 60% tariff increase on Chinese imports and at least a 10% universal levy on imports from elsewhere to reduce the US trade deficit.

Trump´s first announcements include Marco Rubio as Secretary of State and Elon Musk as co-head of a new Department of Government Efficiency, aimed at reducing bureaucracy, reshaping Federal Agencies and cutting expenses.

French luxury names declined ~5% with LVMH accumulating a 22% YTD drop while rival Kering is 47% lower this year on weaker demand in China. Yesterday´s notable single stock mover was Bayer AG (mcap €20bn) which plunged 14.5% to a two decade low after missing earnings estimates, lowering its full-year outlook and anticipating a further drop in profits for next year.

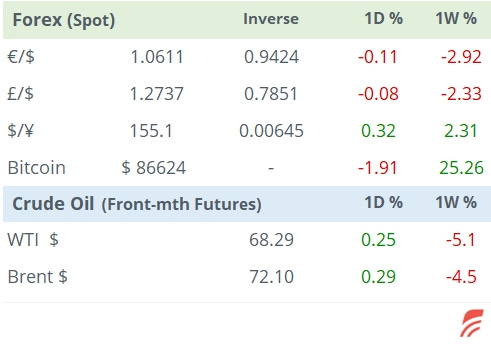

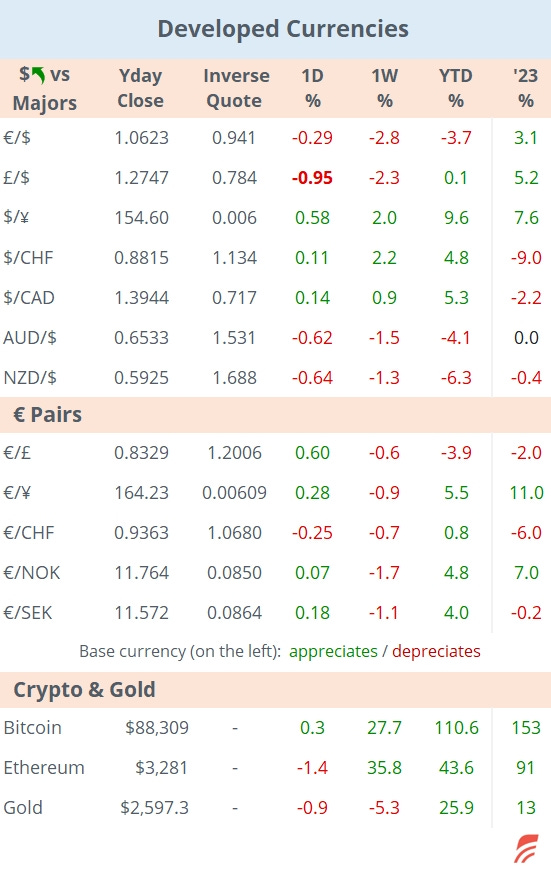

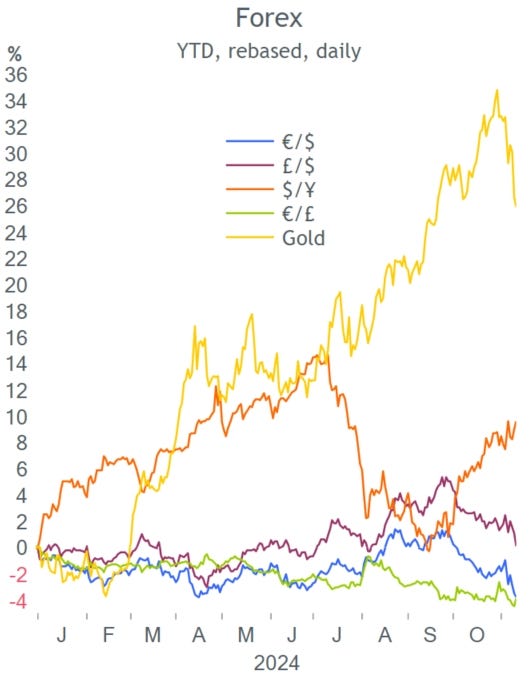

Wall Street finished marginally lower last night ahead of today´s key inflation update. The $ continues to appreciate with £ losing 1% yesterday and the € briefly trading at a 1-yr low <1.06.

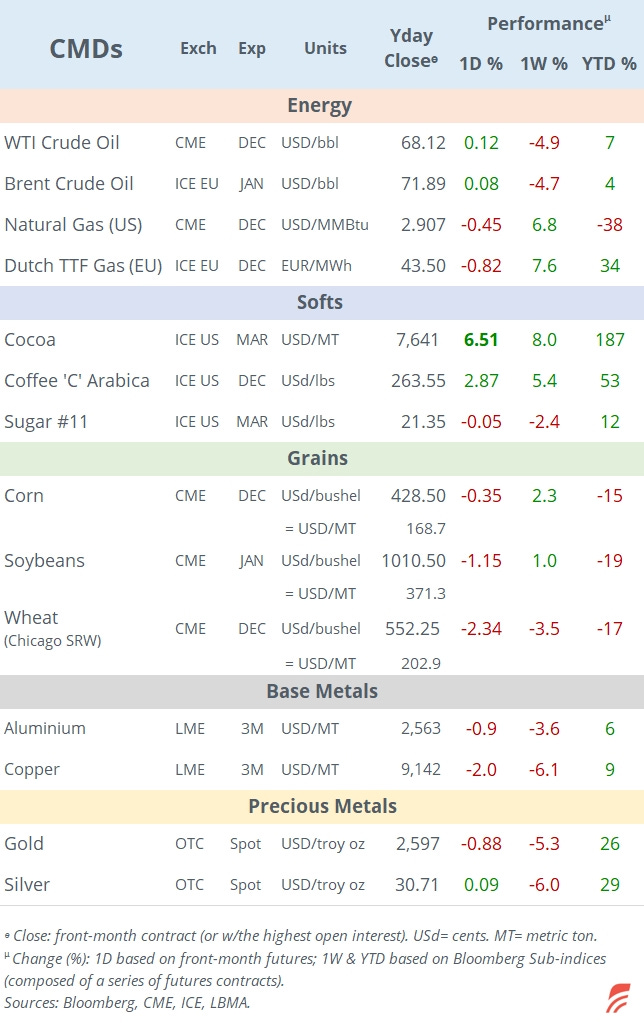

Asian stock markets are mostly weaker today with Korea falling 2.5% and Japan 1.4%. US futures are a touch weaker overnight and the €-Stoxx 50 futures are down 0.4% in early morning trading. Brent is little changed at $72 and Bitcoin remains near its record at $86.8k.

In M&A, Japanese food retail giant Seven & I holdings (mcap $37bn), which received a takeover approach by Canadian Alimentation Couche-Tard a few months ago, is considering a management buyout to take the company private for ~$58bn, according to Bloomberg.

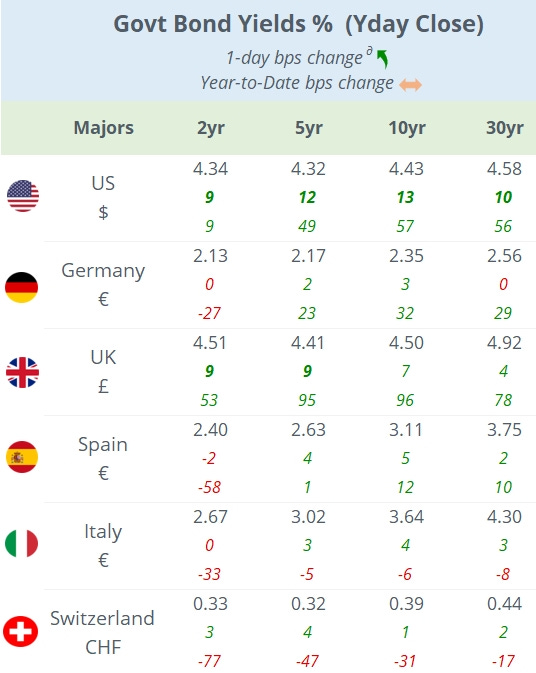

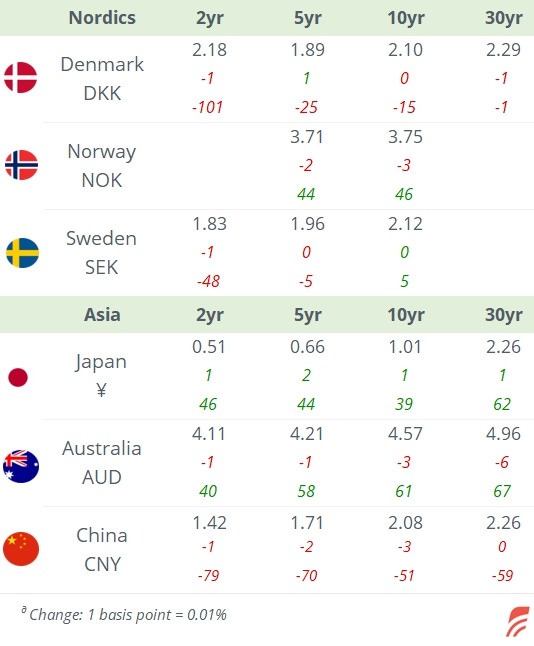

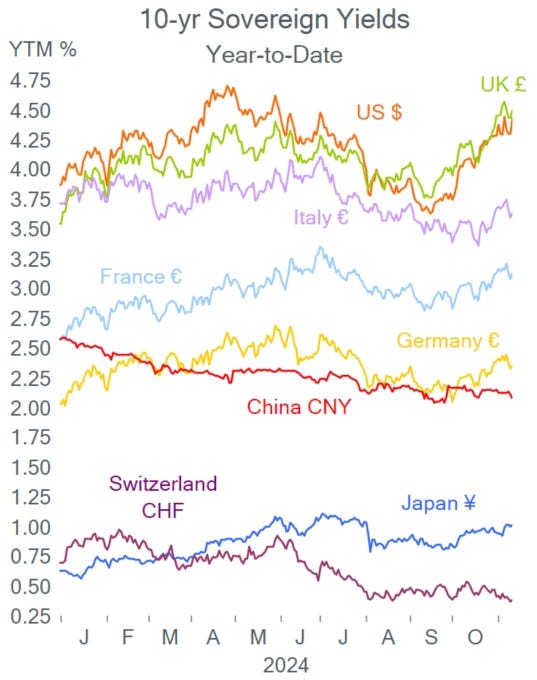

In debt capital markets, South Africa raised $3.5bn in 12 and 30-yr bonds rated Ba2/BB- at 7.1% and 7.95% with strong investor demand. On the € investment-grade space, Volkswagen placed 7-yr senior bonds at 176 over Bunds (3.95% yield) and US real estate company WP Carey sold 10-yr bonds at 150 basis over or 3.84%.

In data releases today, at 13:30 London time, we´ll get US CPI inflation with consensus expecting an uptick to 2.6% YoY. Portugal will also update on consumer inflation.

Earnings reports scheduled for today include Allianz, Siemens Energy, RWE, Alstom, Cisco and Tencent.

Thanks for your time, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.