Est reading time: 5 min

Good morning,

Tuesday was another weak session for European assets with equities dropping 1% on average and significantly more in Milan, Madrid and Paris. Investors continue to digest the latest political updates and the rising uncertainty in France after Macron’s surprise move to call for a snap legislative election in only two weeks. He is taking the risk of a divided leadership, by sharing the government with Marine Le Pen’s RN party, which promotes significant increases in public spending.

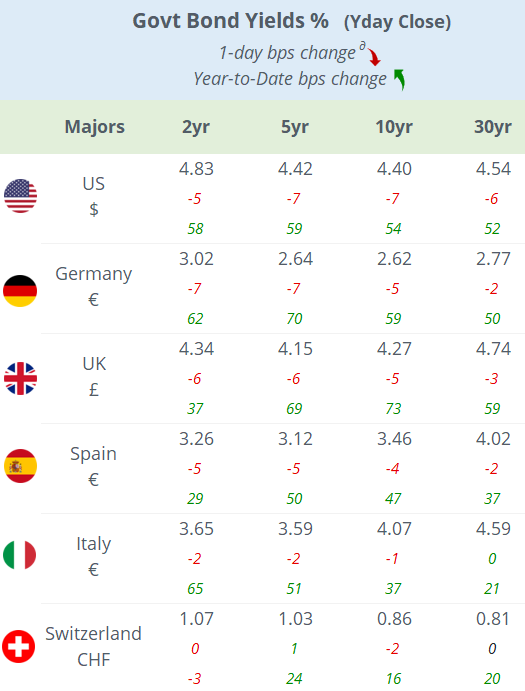

French banking stocks fell the most with SocGen down by 5%, BNP and Credit Agricole losing 4% again. 10-yr OATs widened marginally to Bunds and closed at 62bp over, for a 3.24% yield. Moody’s issued a warning on France’s sovereign rating saying that the snap legislative election is credit-negative for the country’s finances. Moody’s still rates France at Aa2, a notch above Fitch and S&P.

Wall Street closed firmer last night ahead of today’s crucial inflation update at 13:30 London time and the Fed’s press conference this evening. Benchmark equity indices closed at another record high as the S&P 500 and Nasdaq Composite accumulated 13 and 14% gains this year. Oracle reported after the close and although it missed revenue and earnings estimates, shares rallied 9% in after-market hours as it announced a multicloud A.I. deal with Alphabet and OpenAI.

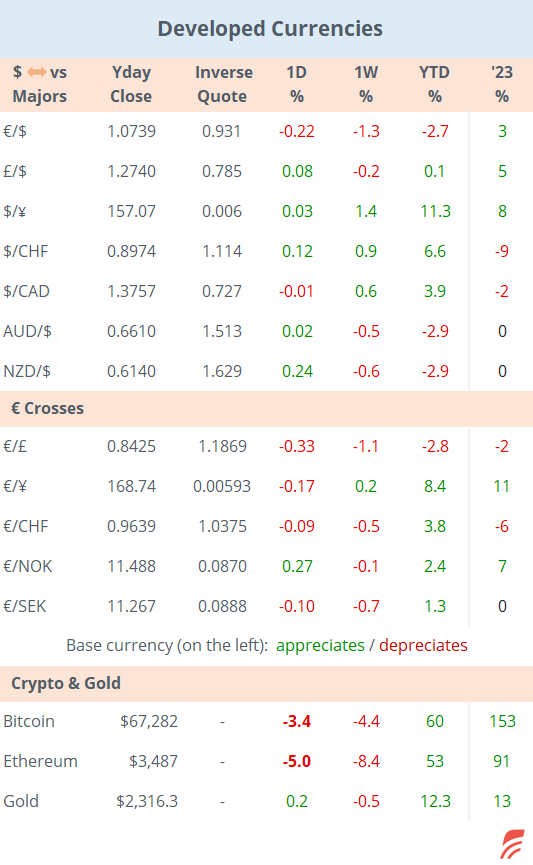

Bond markets traded firmer with yields declining 5-7bp across tenors on both sides of the Atlantic. The Fed is widely expected to leave policy rates unch at 5.25-5.50% but markets will react to any signals from Jerome Powell.

In data today, China’s CPI inflation rose by 0.3% YoY, marginally less than consensus while producer price inflation fell 1.4% YoY, less than a month ago.

Asian markets are mixed with the Hang Seng dropping 1.5% after the EU announced tariffs on electric vehicle exports from China. Stocks in Taiwan are gaining more than 1% while Japan and Australia are weaker. European futures are trading a touch firmer this morning, Bund futures are little changed, Brent oil is higher at $82.30.

In IPOs, Cambridge-based computer maker Raspberry Pi Ltd (RPI) rallied 37% to a total market cap of £740mn on its debut as an LSE-listed company. It raised £167mn by selling 30% of its outstanding shares at GBp 280. The co is a designer and developer of high-performance, low-cost computers for markets worldwide

ENI (Italy, oil & gas, mcap €44bn) is selling a third of its holding equal to 10% of the shares of Saipem (Italy, oil services, mcap €4.1bn) via an accelerated bookbuilding procedure to strengthen its balance sheet. S&P cut ENI’s rating outlook to negative (A-) last Tuesday.

Spanish holding co Criteria, the controlling shareholder of Caixabank, sold 2.64% of Cellnex Telecom shares (mcap €23bn) for €613mn or €32.9/share in a private placement. Cellnex shares fell 3% yday to €32.54.

Mistral, the one-year-old French artificial intelligence start-up raised €600mn at a €5.8bn valuation, mostly from existing investors which include Microsoft, Nvidia, Salesforce and IBM.

French utility EDF raised €3bn in senior notes with 7 (at ms+125bp), 12 (+155bp) and 20-yr (+200bp) maturities, rated Baa1/BBB+.

In credit ratings, Germany’s Daimler Truck Holding (mcap €30bn) was upgraded one notch by S&P to A-.

Additional economic data to be released today includes the UK’s latest GDP estimates as well as industrial and manufacturing output, and Germany’s final inflation reading for May. In EM, besides inflation in China already mentioned, we’ll get inflation data in India.

Broadcom, the US semiconductor giant, which is trading at a record high (mcap $667bn), reports earnings today. Exchanges in Russia and Israel will be closed on holiday.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Please share using the button below, as access is free to all.