Wall Street closed on a positive note last night ahead of the Presidential Debate but S&P 500 futures gave up Tuesday’s gain of 0.5% towards the end of the event. ‘Fierce’ and ‘combative’ were the most used adjectives in media headlines to describe Kamala Harris and Trump’s first debate on the economy, foreign policy, immigration and abortion. Pop star Taylor Swift endorsed Harris via Instagram to her 283mn followers.

The financial and energy sectors were the worst performers driven by JP Morgan’s weakness and a plunge in crude oil. JP Morgan’s (mcap $585bn) president said that analysts were over-optimistic about the bank’s interest income for next year, which was interpreted as an earnings warning and shares lost 5.2% to a one-month low. Goldman Sachs’ (mcap $147bn) CEO also warned that trading revenues could drop by 10% this quarter. Shares fell 4.4%.

In Europe, the weakness in the German Auto sector drove the Frankfurt and Milan benchmarks down by 1%. BMW (mcap €43bn) sank 11%, its worst session since the early pandemic days to a nearly 2-yr low after cutting this year’s profit margin outlook due to poor demand in China and issues linked to a braking system produced by Continental (-10.5%).

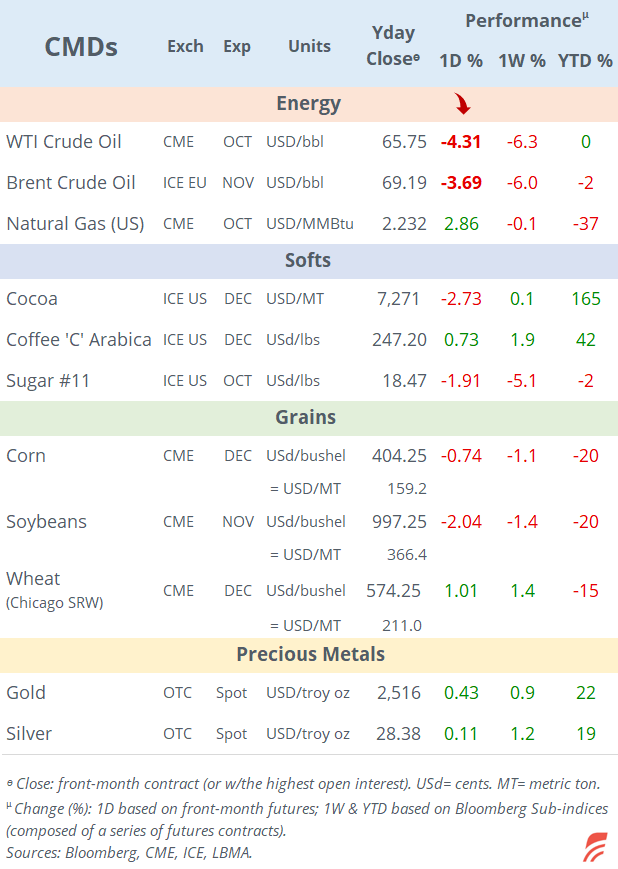

Crude oil lost 4% yesterday following OPEC’s announcement to cut its forecast for global oil demand growth for this year and next, the second downward revision by the cartel. Front-month Brent futures have lost 10% this year while Bloomberg’s Brent index (based on a series of futures contracts) is down by 2%.

Currency markets had a quiet Tuesday with the ¥ maintaining its appreciation trend beyond the 142 level this morning and accumulating a 14% rally against the $ since mid-July. Gold remains near its all-time high above $2,500, as traders price in a lower interest rate outlook.

Asian markets are trading lower today with Japan’s Topix and Hong Kong’s Hang Seng dropping around 1.5% after the U.S. debate. The ¥ strengthened overnight and nears the 141 support level against the $.

In economic updates yesterday, Germany's inflation for August was confirmed at 2.0% YoY, well below the 2.6% recorded in July. Inflation in The Netherlands came in at 3.6%, in Norway at 2.6%, Denmark at 1.4% and Greece at 3.0%. Unemployment in the U.K. fell marginally to 4.1% as the number of jobs created jumped but worker’s pay cooled.

In M&A deals, British miner AngloGold Ashanti (mcap £11.5bn) acquired smaller rival Centamin Plc (mcap £1.7bn) in a £2bn deal to expand its production to Egypt.

Also, British private equity firm CVC is in talks to acquire Spanish Rovi Pharma’s (mcap €4bn) third-party vaccine manufacturing unit for an estimated €3bn. Rovi shares fell 7% yesterday.

In debt capital markets, French telecom Orange was the notable corporate issuer in €, with a 10-yr senior bond rated BBB-, priced at 104bp over Bunds for a 3.30% yield.

Spanish fashion giant Inditex (mcap €144bn) reports earnings today.

On the data front, U.S. CPI inflation is expected at 2.6% YoY for August, well below the 2.9% recorded in July; U.K. GDP and industrial output; and inflation in Portugal.

See you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.