Good morning,

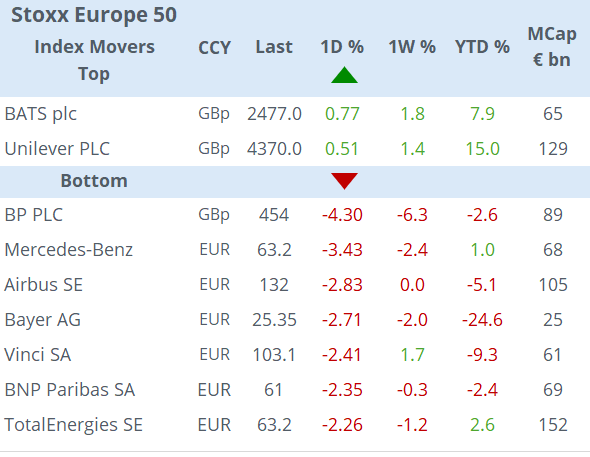

Stock indices in Wall Street ended flat with a mixed performance for mega-caps and Tesla (+3.7%) and Nvidia (+2.5%) as the notable gainers. European equities fell sharply on Tuesday with a widespread weakness driven mostly by the political uncertainty in France. The Dax, Cac 40, Ibex and Austria’s ATX all dropped between 1 and 1.5%. The broad Stoxx 600 index is underperforming the S&P 500 index this year by 10 percentage points.

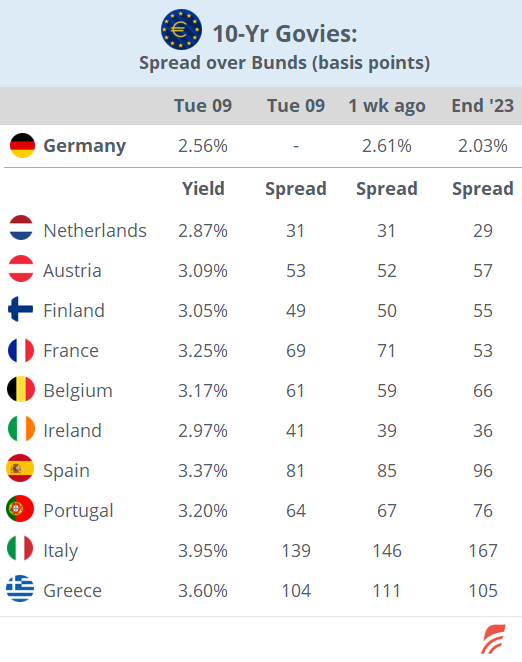

Bonds fell marginally yesterday with interest rates increasing between 1 - 5bp across tenors for benchmark curves ahead of tomorrow's inflation updates in the US and Germany.

Today, European stock futures are modestly firmer while Asian markets are mixed and little changed. Brent oil is weaker at $84.50 and Bitcoin is firmer at $59,000.

Jerome Powell’s first-day testimony before Congress focused on describing the state of the US economy but stopped short of signalling the timing for an interest rate cut. The Fed Chair said that the US is no longer an overheated economy, that the labour market is fully back in balance and that the central bank can no longer solely focus on inflation.

New Zealand’s central bank left interest rates unchanged at 5.50% as expected, for the eighth consecutive meeting, and projects inflation to reach its target (1-3%) by year-end. The Kiwi dollar fell sharply (-0.6%) following the announcement.

China’s CPI inflation eased 0.2% MoM and rose 0.2% YoY in June, missing expectations while producer prices continue to decline (-0.8% YoY), rising deflationary concerns ahead of the Communist party’s policy summit next week.

Headlines,

-Biden hosts the NATO Summit in Washington as it offers Ukraine additional air defence to battle the increased offensive from Moscow. Trump demands that Europe injects $100bn to match the US support.

-India and Russia have pledged to increase their bilateral trade of energy and fertilizers against agricultural and industrial products after Putin and Modi met in Russia.

-Samsung Electronics (Korea, mcap $420bn, P/E 30x) faces an indefinite union workers strike, demanding better pay and benefits.

In M&A, French cyber security company Exclusive Networks SAS (mcap €2.1bn) said it received a non-binding takeover approach from private equity firms for €2.2bn. Shares jumped 8% to an all-time high.

Aramco (Saudi Arabia, oil, mcap $1.8tn) invested $740mn to acquire 10% in Horse Powertrain Solutions, the internal combustion engine joint venture created by Renault and China’s Geely in a bet that petrol engines will co-exist with electric vehicles.

On the IPO front, Chinese-owned Cirrus Aircraft, the US-based small aeroplane manufacturer, raised $192mn in its listing on the Hong Kong Exchange at HKD 27.5/share for a $1.2bn valuation and will begin trading on Friday.

In credit ratings, Telecom Italia Spa (mcap €5bn) was upgraded to BB by S&P.

In new sovereign bond issues, Turkey placed $1.75bn of 8-yr bonds rated B3/B+ at UST +305bp or a 7.3% yield. In corporates, Iberdrola (10-yr, Baa1, @ Bunds +108bp) and John Deere (8-yr, A1, @ B+102bp) placed € benchmark size senior bonds.

In other data updates today, we’ll get inflation in Portugal, Denmark and Norway and industrial output in Italy. Fed Chair Powell continues his testimony on monetary policy before Congress. The 2024 NATO Summit is taking place in Washington.

That’s all for today.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.