Podcast script: Estimated reading time ⏲ ~6 mins

Good morning and happy labour day, it’s Wednesday 1st of May.

Euronext exchanges will be closed today. The London Stock Exchange and US equity markets will be open for business.

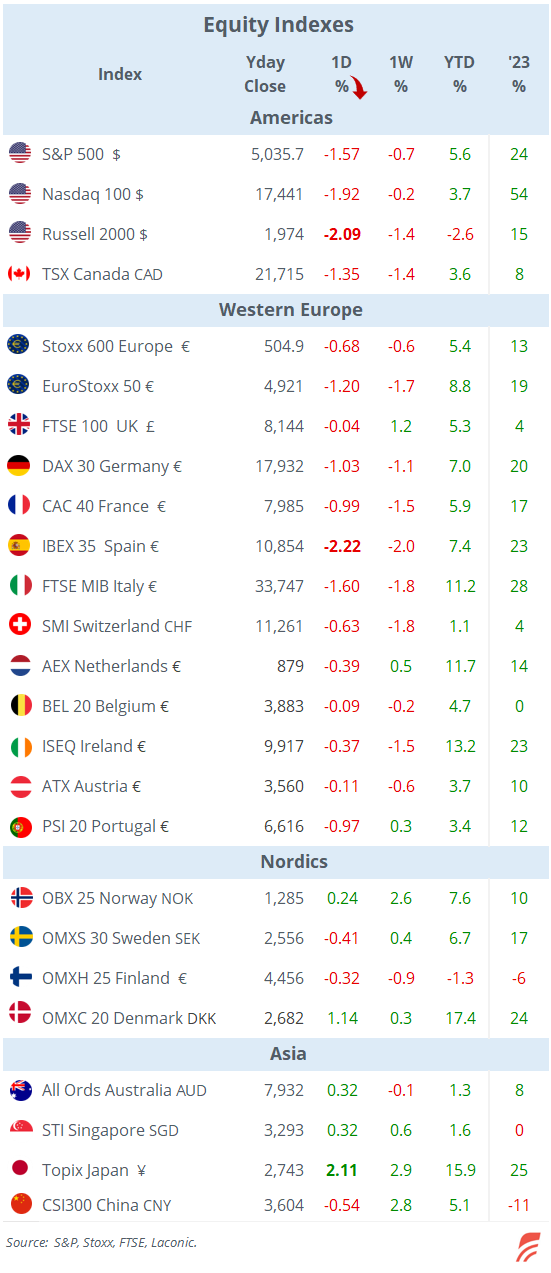

In Asia today the only two open markets are Australia which is falling 1% and Japan, slightly weaker, following the steep sell-off in the US last night. Equities fell sharply on both sides of the Atlantic yesterday with Nasdaq benchmarks posting one of their worst days this year, down by 2%. The Dow Jones, S&P 500 and Eurostoxx 50 all ended around 1.5% lower.

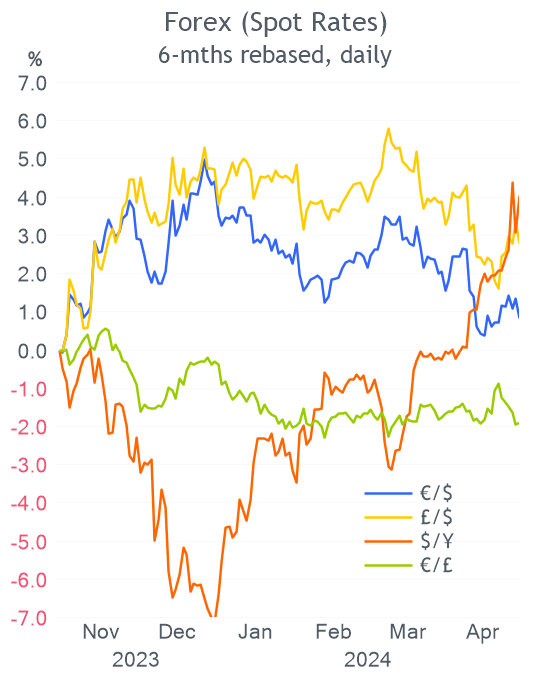

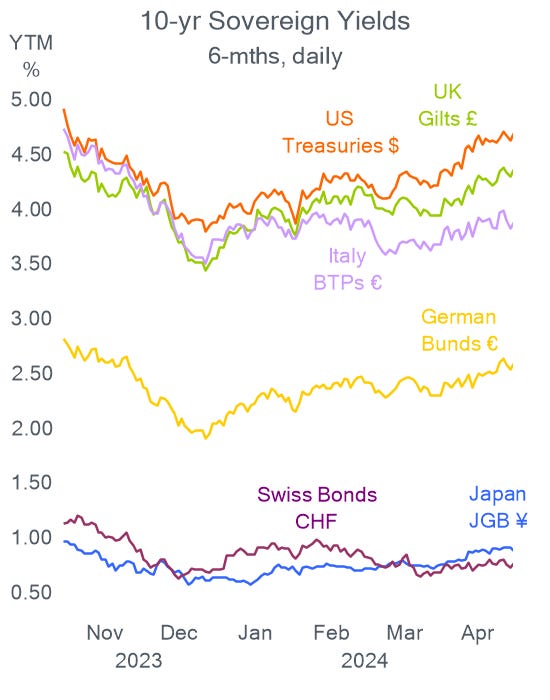

The driver of weakness was the higher US labour cost data a day ahead of today’s FOMC meeting. Labour costs rose in Q1 fueled by increasing wages and benefits which were reflected in the latest inflation updates. Trader’s sharp swing in rate cut expectations in recent weeks means that just 30 bp of rate cuts are priced in for 2024. Bond yields shifted higher in all markets and the dollar appreciated.

On corporate results, around 80% of the 265 companies in the S&P 500 that reported Q1 results, beat analyst forecasts, above the historic average. In a nutshell, yesterday’s market impact of the announcements was positive for PayPal, Elly Lilly and 3M and was negative for Amazon, McDonald’s, Starbucks and GE Healthcare.

Amazon shares fell 3% but recovered in after-hours trading when it released results that beat estimates but missed on revenue forecast. As with most other big techs, Amazon’s focus is on its strong AWS unit and artificial intelligence investments.

GDP in the €-zone expanded twice as much as expected, +0.4% YoY despite Q4 being revised lower to reflect a marginal contraction of 0.1% QoQ. Figures show that the economy rebounded from a mild recession in late 2023. France grew by 1.1% YoY, Spain by 2.4%, Italy by 0.6%, Portugal by 1.4% and Germany was the main drag as it expanded during Q1 but remained weak on an annual basis, -0.9%.

Headline inflation in the €-zone remained unchanged at 2.4% and in line with estimates while core inflation managed to ease lower to 2.8%. This led to dovish comments by ECB official Francois Villeroy who stated that these figures increase confidence that the central bank will be able to cut rates in early June. Futures markets are pricing in a 67% probability of a 25 bp cut at the next ECB meeting.

In corporate deals, Spain’s second-largest lender BBVA and fourth-largest Sabadell, confirmed that they are exploring a merger. The combined market value is €69bn, compared to Santander’s market cap of €72bn. BBVA shares fell 7% while Sabadell gained 8%.

Also, French satellite operator SES has agreed to acquire Intelsat Holdings for $3.1bn to create a European communications rival to Space-X’s Starlink and Amazon’s Kuiper. SES shares declined 8%.

Finally, retail skincare and fragrance company L’Occitane International, which is listed in Hong Kong, will be taken over by its largest shareholder in a deal that values L’Occitane at €6bn.

In IPOs, Spain’s largest offering in a decade, beauty group Puig, was priced at €24.5, the top of its guidance range in an oversubscribed book, for a valuation of 14bn and will begin trading on the Madrid exchange on Friday.

The Fed’s policy meeting will be today’s focus with analysts and traders anticipating the funds' target rate to remain steady at 5.375% mid-range.

Today’s earnings reports will come from Pfizer, Mastercard, AIG and Qualcomm among others.

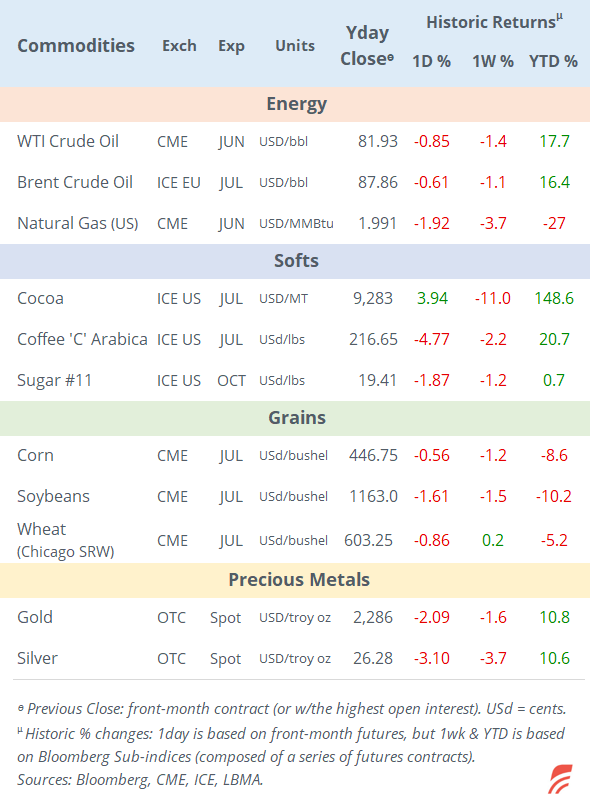

Right now, Brent oil is trading below 85.60, Bitcoin is around 60,000 and FTSE and S&P futures are unchanged on light volume.

See you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. It is prohibited to copy and paste, forward, or set up auto email forwarding rules to give access to others. Please share the publication using the button below, as access is free to all.