Morning,

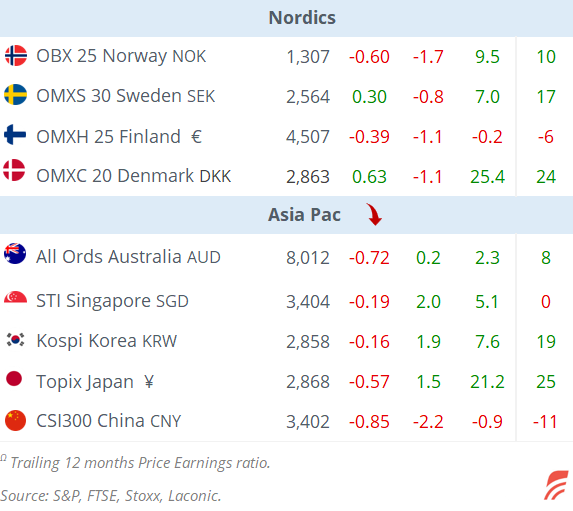

Markets had a relatively calm start to the week with leading stock indicators trading mostly sideways in Europe and marginally firmer in Wall Street where the S&P 500 and Nasdaq continue to break new records. In Europe, France’s CAC 40 was the underperforming index with a 0.63% drop as investors anticipate a complex situation for politicians to form a government given the newly fragmented parliament.

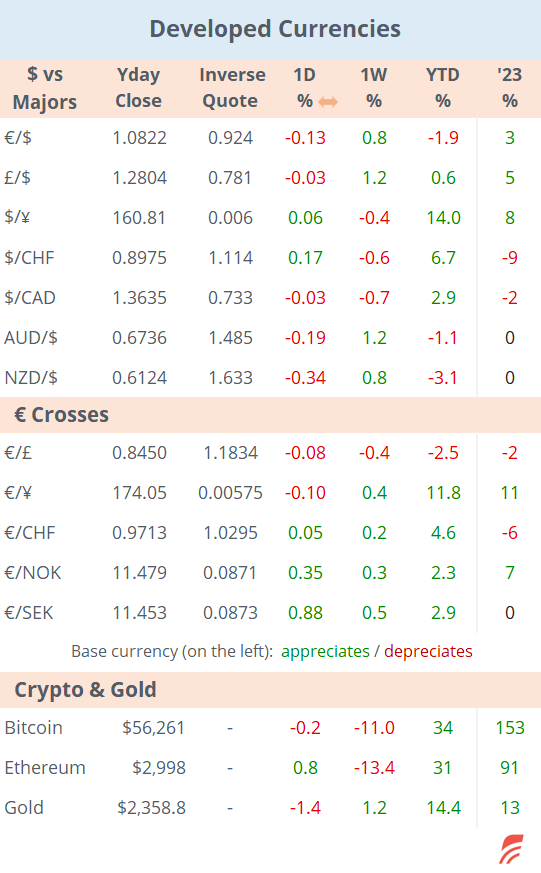

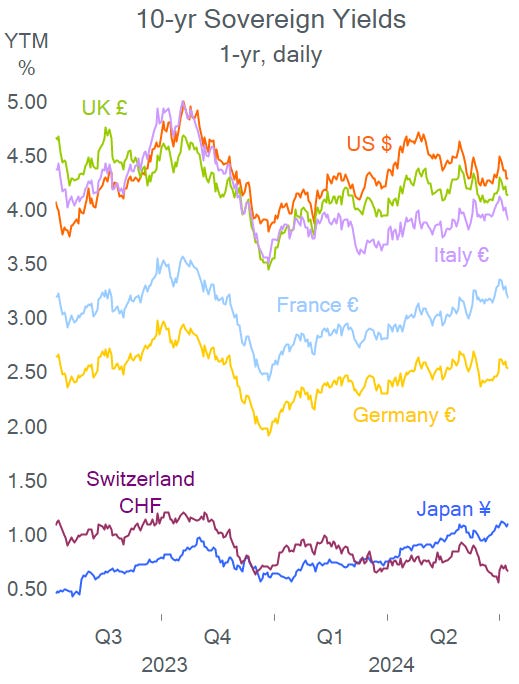

Currency and bond markets were also quiet ahead of this week’s key inflation update in the US and Powell’s speech today. French OAT bonds recovered partially to close at a 3.17% yield or 65bp over Bunds.

In commodities, grain markets were particularly weak but energy also traded lower with Brent dropping below $86.

In single stocks, a notable mover was Delivery Hero SE (Germany, online food delivery, mcap €5.25bn) which fell 7% to the lowest since February after anticipating a potential EU antitrust fine for more than €400mn.

Markets in Asia are mostly firmer today with stocks in Tokyo advancing 1.1% to a record high and Sydney adding 0.8% while China and Taiwan are a touch lower. European stock futures are 0.25% weaker in early morning trading while US indices are somewhat higher overnight.

In data yday, Germany’s international trade surprisingly dropped in May with exports declining by 3.6% MoM and imports by 6.6%, significantly worse than expected, mainly on weaker demand from its largest trading partners China, the US and the EU.

In central bank action, the Bank of Israel left its benchmark rate steady at 4.5% as expected, for a fourth consecutive month on the back of stubborn inflation (2.8% YoY) and the country’s high-risk premia due to the war.

Headlines,

-Moscow intensified its offensive over Ukraine with a missile strike that left >40 dead and included a children’s hospital as a target and the country’s biggest mining company lost 10 workers.

-President Biden insisted that he is not considering stepping down from his re-election race while some Democrats propose vice-president Kamala Harris as an alternative candidate.

-French politicians begin a negotiation process following the deadlock situation from Sunday’s election outcome. Leaders of the New Left Alliance (NFP), winners with 31%, disagreed on who they should propose as prime minister.

-Australia accused a Chinese state-backed cyber hacking organisation of targeting its government and private company networks, increasing tensions between Canberra and Beijing. The report was supported by intelligence agencies of the US, UK, Germany and Japan.

Monday was an active day in corporate deals: Skydance Media (US, entertainment, privately owned) is merging with Paramount Global (US, broadcasting, mcap $7.9bn) to create a technology-media hybrid company in an ~$8bn deal.

Grifols (Spain, pharma, mcap €6.2bn) announced that its founding family and largest shareholder has teamed up with Canadian fund Brookfield to explore a potential deal to acquire and delist the company from the Madrid exchange. Grifols jumped 10% yday.

Also, Eli Lilly & Co (US, pharma, mcap $872bn) is taking over Morphic Holding (US, biotech, mcap $2.8bn) for $3.2bn in cash. Morphic, which specializes in inflammatory bowel disease drugs, saw shares rally 75% yday.

Carlsberg A/S (Denmark, brewery, mcap $17bn) will acquire Britvic (UK, soft drinks, mcap £3.1bn) for £3.3bn and Martson’s Plc (UK, pubs, mcap £220mn) to create a UK beverage powerhouse.

In IPOs, US healthcare provider Ardent Health Partners (ARDT) targets a valuation of more than $3bn in its listing on the NYSE and aims to raise $315mn.

In debt capital markets, the notable issuer yday was Toyota’s US subsidiary which placed €1bn of 7-yr senior bonds, rated A+, at 121bp over Bunds for a 3.64% yield.

Fitch upgraded the credit rating of Germany’s regional banks to A+ (Bayerische, Baden Wuerttemberg and Norddeutsche Landesbank). On the sovereign front, Moody’s downgraded Kenya to Caa1.

Today will be light on economic data with inflation updates in The Netherlands and Greece. The main event will be Jerome Powell’s semi-annual monetary policy testimony before Congress this afternoon.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.