Good morning,

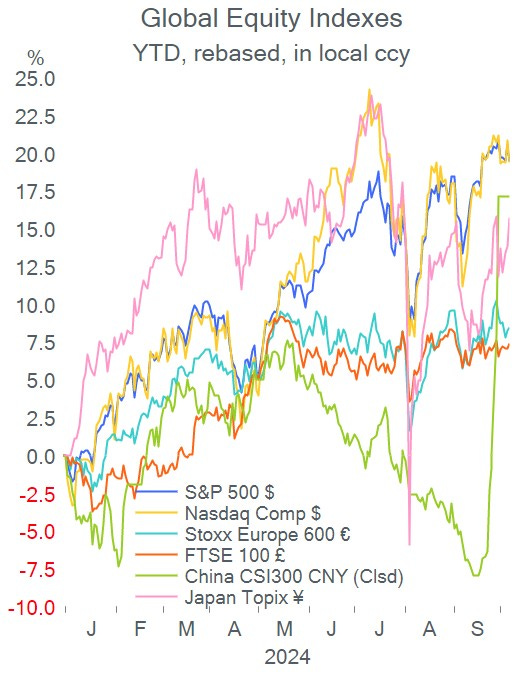

Today’s main story is a sharp rally of 11% at the open for mainland Chinese stocks following a week-long holiday and the subsequent loss of strength as the briefing by the NDRC (National Development and Reform Commission) disappoints. The CSI300 index eased to a 6% gain while HK’s Hang Seng is plunging 6% driven by a sell-off in property stocks.

Investors were expecting additional stimulus measures to those announced a week ago to revive the economic slowdown but the NDRC showed less urgency to expand the stimulus and failed to convince markets. The chairman of the NDRC said that Beijing was fully confident that China will achieve its 2024 economic and social development targets.

Among the measures announced today are the issuance of a CNY 100bn ($13bn) investment plan, an urge for local governments to allocate funds to projects and an increase in subsidies for students. Goldman Sachs raised its forecast on the Chinese equity market and sees another 20% appreciation in the next 12 months on the back of last week’s news.

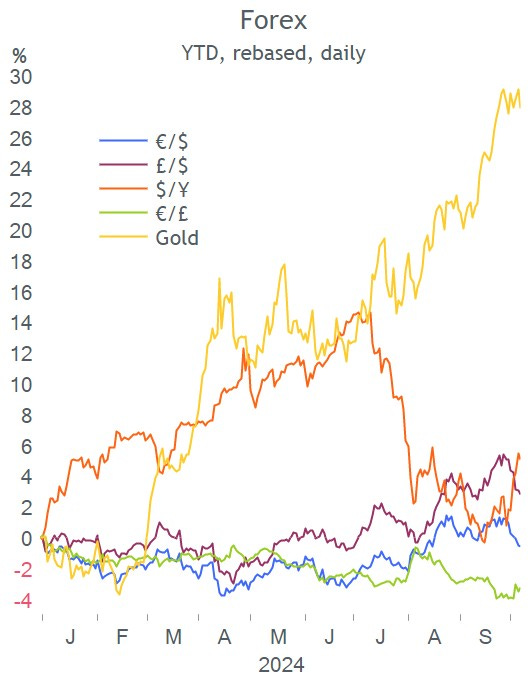

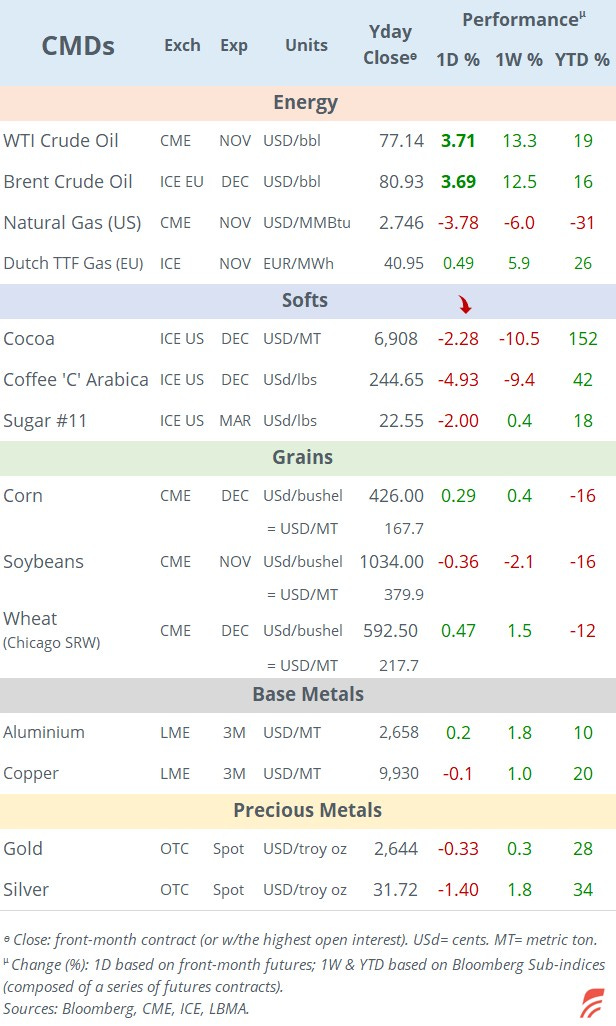

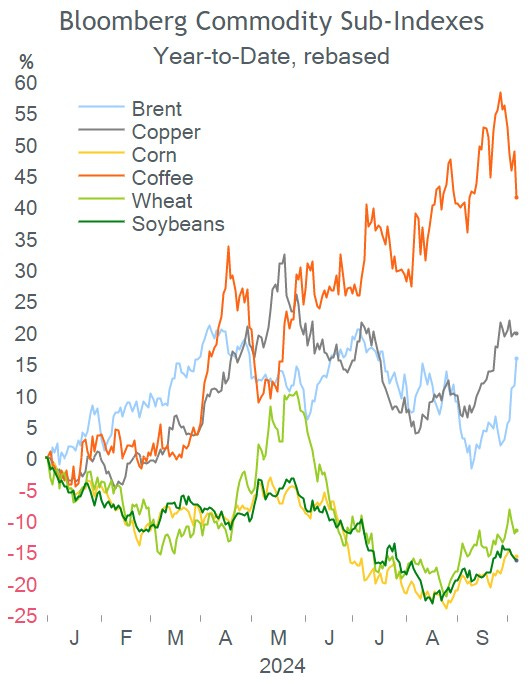

Other Asian equity indices are down between 0.5 and 1%. The yuan is having its worst day in 15 months, down 0.7% to 7.06 against the $ and remains flat YTD. Base metals are falling and Brent is down 1.5% this morning following a strong jump (+3.7%) yesterday.

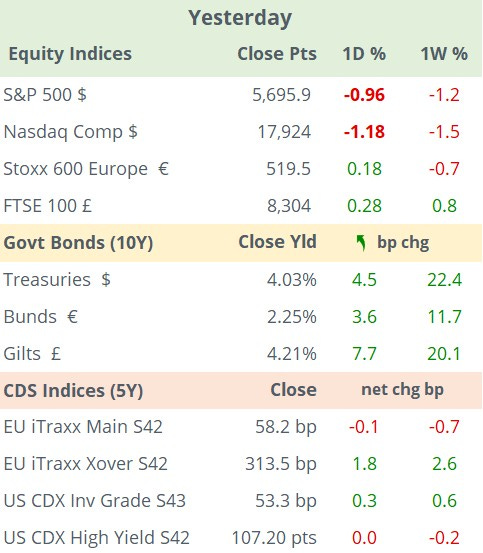

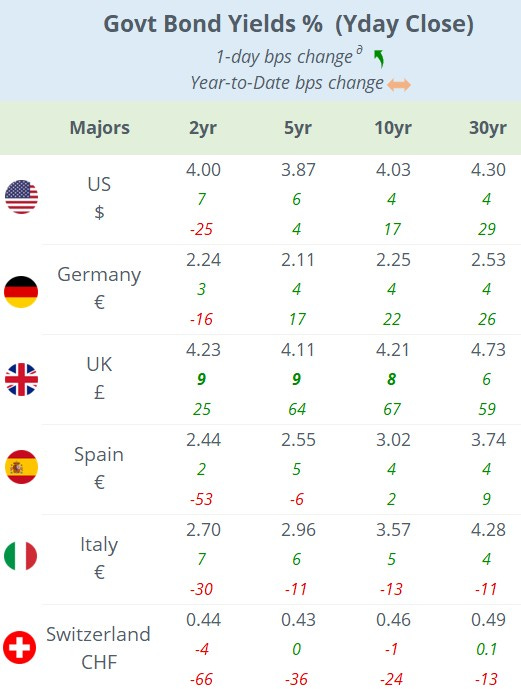

Wall Street stocks ended 1% lower on Monday driven by the crisis in the Middle East that is pushing oil prices higher and the expectations for a smaller Fed rate cut, after the strong labour report on Friday. The VIX volatility index hit a one-month high and closed at 22.6%. A few mega-caps have fallen in the past week including Tesla -8%, Microsoft and Apple -5%.

In the Gulf of Mexico, Hurricane Milton intensified to a Category 5 at a record speed and its path is projected to make landfall near the city of Tampa tomorrow night, triggering Florida’s largest evacuation in years.

In corporate deals: -Chevron is divesting its assets in Athabasca Oil Sands and Duvernay Shale to Canadian Natural Resources for $6.5bn.

-U.S. winemaker Duckhorn Portfolio is being acquired by private equity firm Butterfly Equity for $1.6bn in cash. Duckhorn shares doubled yesterday.

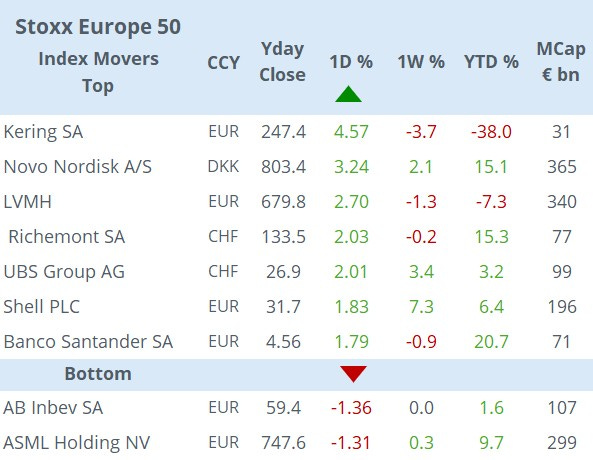

-Swiss luxury firm Richemont has sold its loss-making online fashion business Yoox Net-a-Porter to Mytheresa of Germany.

-Norway’s oil giant Equinor (mcap €66bn) is buying 10% of Danish offshore wind farm developer Orsted A/S for €2.3bn.

Monday was a quiet day for new corporate bond issues with Toyota placing 7-yr senior bonds in $ rated A+, priced at 72bp over UST or a 4.63% yield.

In data today, we’ll get international trade figures in the U.S. and France; industrial production in Germany and inflation in The Netherlands.

Pepsico (mcap $230bn) is due to report earnings before the market opens in New York.

Thanks for your time, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.