Morning,

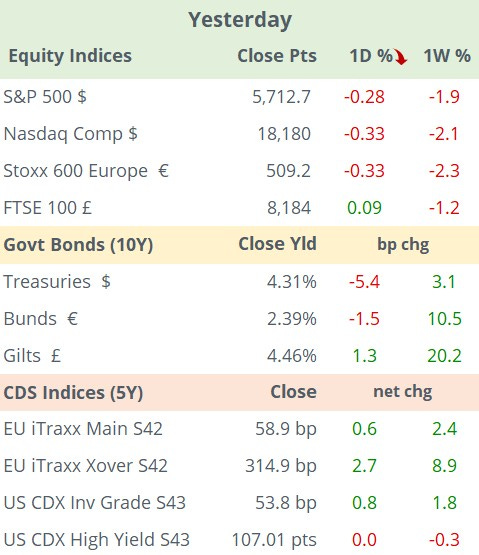

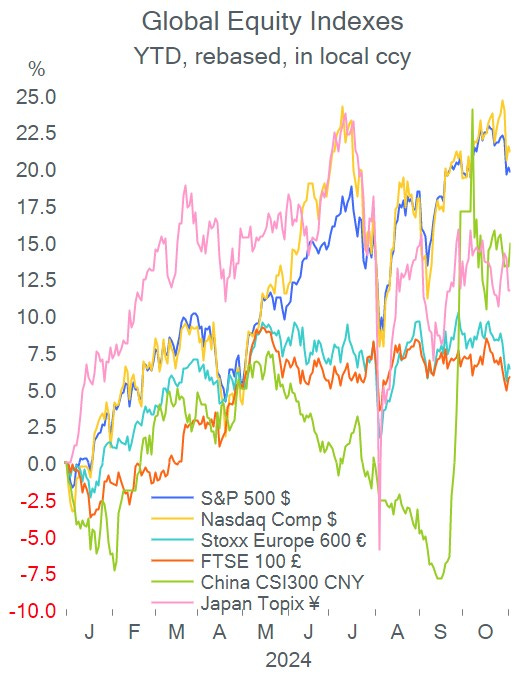

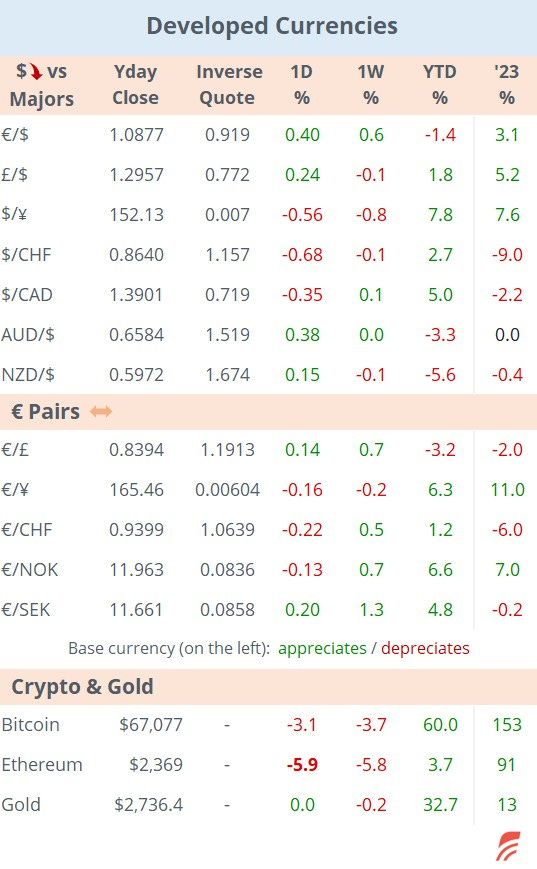

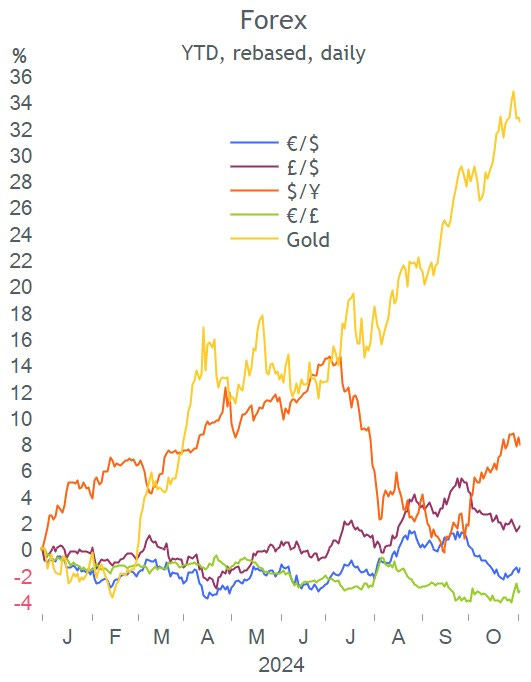

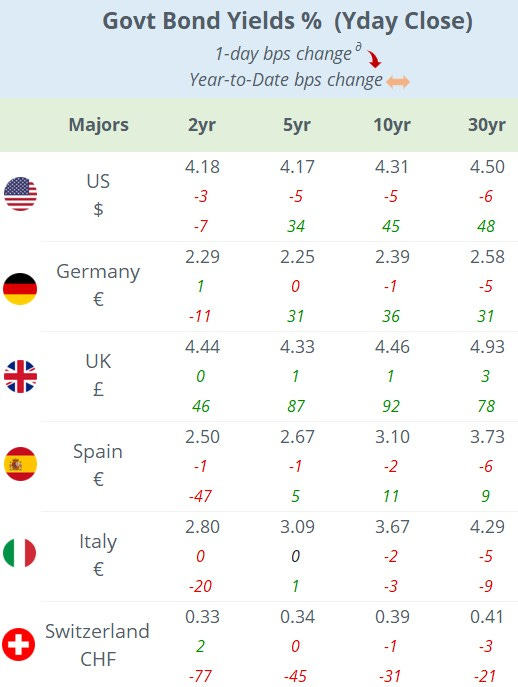

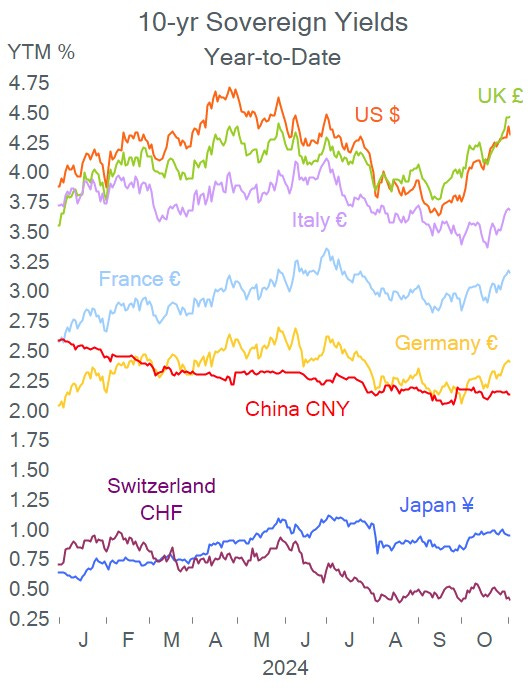

Equities finished a touch lower on both sides of the Atlantic ahead of today’s US election while the $ and Treasury yields shifted lower following a poll that showed an advantage for Harris in Iowa. The DXY $ index lost 0.4% to 103.90 and the 10-yr UST fell 5bp to 4.31%. Benchmark bond yields in Europe barely moved.

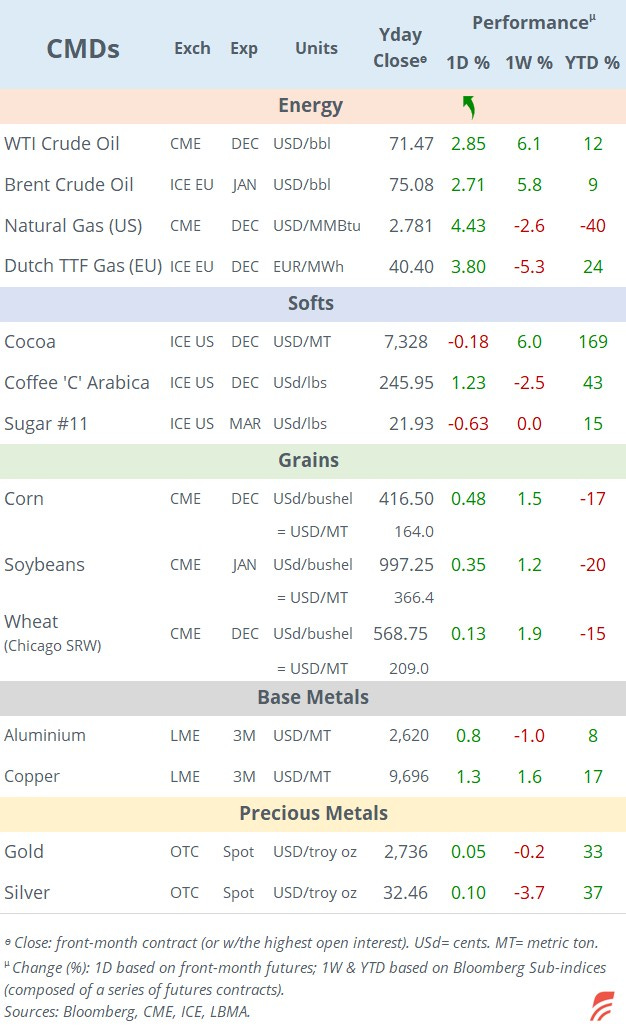

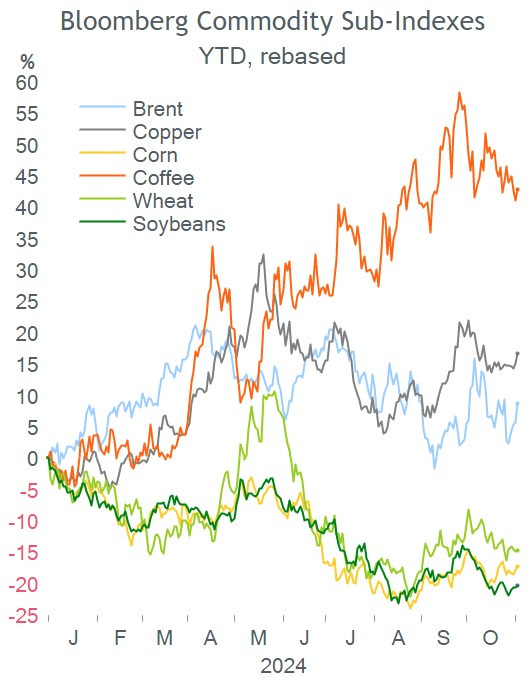

Crude oil ended nearly 3% higher after OPEC+ delayed by one month its planned output hike in December. Brent and WTI accumulate a 6% gain in the past week.

Today’s US election focus will be on Pennsylvania, where Biden won in 2020 and Trump in 2016. The state accounts for 19 electoral votes, the most among so-called swing states which are neither clear wins for Democrats or Republicans. All seven swing or battleground states account for 93 electoral votes, equal to 17% of the total electoral votes. If the results are as close as the surveys predict, it may take several days before a definitive winner is announced, leading to a spike in market volatility.

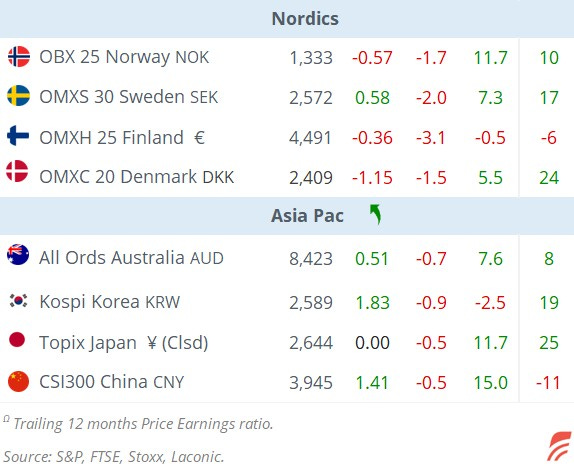

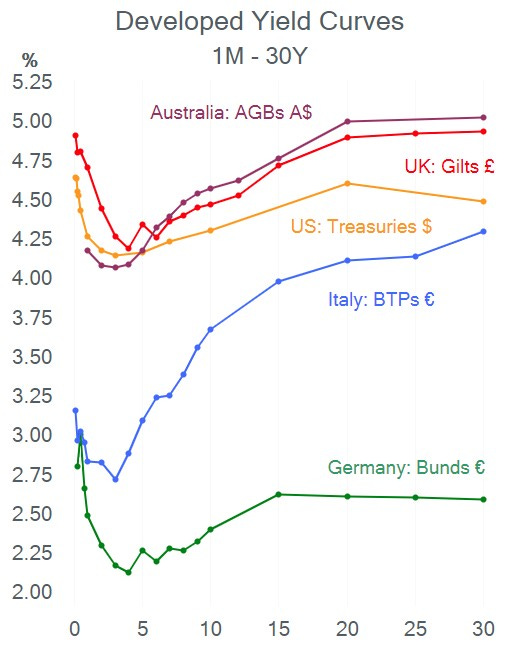

The Reserve Bank of Australia kept its policy rate steady at 4.35%, a 12-yr high for a 12th straight month as inflation remains high. The central bank sees underlying inflation at 3.4% YoY at yr-end. The Aussie dollar (AUD) is little changed and the All Ordinaries index is a touch lower today.

Asian equities are mostly higher today with mainland China advancing >2%, Hong Kong adding 1.5% and Japan gaining 1%. European and US stock futures are flat overnight.

Mfg PMI data released yesterday showed a mixed scenario with a moderate improvement for the €-zone (46 pts, in contraction territory) led by Germany and Spain while Italy and France decelerated marginally.

In credit ratings, BNY Mellon and State Street were upgraded one notch by Moody’s to Aa1 and Aa2.

Data to be released today includes US and UK PMI updates and US international trade.

Large-caps reporting earnings today include Aramco, Ferrari and Deutsche Post.

Thanks for your time, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.