Est reading time: 5 min

Good morning,

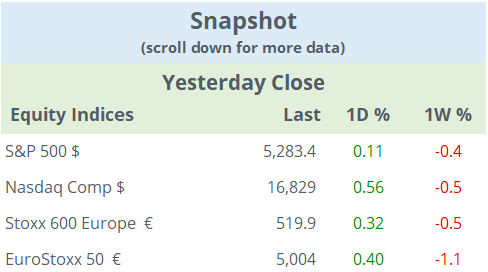

Equities ended somewhat firmer yesterday on both sides of the Atlantic with factory activity or manufacturing PMIs as the main driver. US activity fell for a second straight month (48.7 pts) while the €-zone showed signs of recovery (47.3 pts) but remained in the contraction zone. The Stoxx 600 added 0.3% and the S&P 500 added just 0.1% with the energy sector as the biggest loser.

A notable mover in European markets was British pharma GSK (mcap £66bn) which plunged 9.5%, after a US judge allowed >70k lawsuits, alleging that Zantac caused cancer, to go forward. GSK will appeal and banks estimate the potential losses at >$3bn.

The action was on fixed-income markets with bonds rallying across developed markets and yields falling sharply ahead of the ECB’s meeting on Thursday. 10-year US yields fell 11bp to 4.40%, Bunds closed 6bp lower at 2.59% and Gilts 10bp lower at 4.23%. Yields for Eurozone and Nordics bonds fell by a similar amount.

Currency markets were also active with a steep drop for the dollar against all majors as the DXY dollar index closed at a two-month low (104.1 pts).

In commodity markets, crude oil hit a four-month low after falling 4% yesterday following OPEC’s decision to extend voluntary cuts but allow members to suspend those cuts later this year. It remains weak this morning, down 0.8% at $77.80.

Also, European gas prices rallied 13% intraday yesterday to €38 /megawatt-hour, its highest level this year, due to an outage at a processing plant in Norway. Prices later retreated to close at €36.15, a 5% daily increase. Norway became the EU’s single largest gas supplier after Russia stopped supplying.

Asian markets are trading mixed today, with Chinese and Hong Kong stocks firmer while all other markets are around 0.5% weaker. European futures are little changed to a touch lower. Bitcoin is at $69k.

Headlines:

-Israel faces internal political turmoil as the far-right finance minister aims to remove Netanyahu if he accepts the ceasefire deal proposed by Washington.

-Investors in emerging markets cut their exposure to Mexico following the landslide election victory for left-wing and ruling party candidate Sheinbaum, the country’s first female president. The wide winning margin (>30 pct points) may trigger constitutional changes. The stock market plunged 6%, its worst day in four years, to the lowest level since November. It’s down 13% YTD in dollar terms, among the worst performers in EM. The Mexican peso depreciated nearly 4% yday to 17.67.

-Tension rose between South and North Korea following the garbage balloons sent from the north side. Seoul suspended the military agreement.

-The NYSE experienced a technical glitch during yesterday's market opening that led to erroneous trades later cancelled, and trade halts, in several stocks including Berkshire’s Class A shares.

There are a few corporate deals in the US worth highlighting. Waste Management (US, environmental services, mcap $84.5bn) acquiring smaller rival Stericycle (mcap $5.4bn) for $7.2bn of enterprise value. Waste is bidding $62/share in cash, a 20% premium to Stericycle’s previous close. Stericycle shares rallied 15% while Waste Mgt dropped 4.8%.

Edwards Lifesciences (US, advanced medical equipment, mcap $52bn) is selling its critical care products division to Becton Dickinson (US, medical equipment, mcap $67bn) for $4.2bn in cash. The unit develops and sells advanced blood and heart monitoring systems.

US hedge fund Pershing Square Capital Mgt raised $1.05bn by selling 10% of the company to a group of institutional investors and family offices including Iconiq, Arch Capital and BTG Pactual.

Blackstone confirms its interest in acquiring Hipgnosis Songs Fund (UK, music rights investment fund, mcap £1.22bn) after it improved its bid to £1.23bn.

KfW of Germany sold €2.5bn worth of Deutsche Telekom (mcap €112bn) shares, equivalent to 2.2% of the company, to invest in the railway network. Shares were placed at €22.13 and closed 1.6% higher on the day.

In IPOs, Chinese e-commerce fashion group Shein is expected to file its intention to float on the London Stock Exchange. The company was last valued at $66bn and last year reported $2bn in profits.

In debt capital markets, Volkswagen (A3/BBB+) and Philip Morris (A2/A-) placed senior euro notes with a 6-year maturity, both priced at ms+110bp.

Large caps reporting earnings today are Crowdstrike Holdings and Hewlett Packard in the US.

Data expected for today include US factory orders, Swiss inflation and German unemployment.

That’s all for today, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Please share using the button below, as access is free to all.