Good morning,

Wall Street ended little changed last night as markets await tomorrow's Fed policy meeting, mega-cap earnings (Microsoft today and Apple on Friday) releases and Friday’s monthly employment report. European stocks ended lower with the €-Stoxx 50 and Cac 40 losing 1% on mixed corporate updates.

The action was centred around fixed income markets with yields shifting lower again and the Gilts market as the notable mover. The UK government announced a series of measures to cut spending and improve public finances. The Gilts curve shifted lower by around 5bp and the 2-yr yield is now 9bp lower YTD at 3.88%, the lowest in 14 months, as traders anticipate a rate cut by the BoE on Thursday.

On the earnings front, Heineken (mcap €47bn) shares plunged 10%, their worst day in two decades to the lowest level in more than 2-yrs after missing estimates and raising its full-year operating profit by less than analysts expected. The world’s second-largest brewer took a €874mn impairment on its 40% stake in China Resource Beer and had an organic beer growth (+2.1% in H1) well below estimates.

Shares of British household products group Reckitt Benckiser (mcap £29bn) lost nearly 9% after its US rival Abbott Laboratories was fined $495mn for damages related to its premature baby formula. Both companies face hundreds of lawsuits on their respective formula products.

In economics, Sweden’s preliminary GDP for Q2 surprised on the downside with a 0.8% QoQ contraction and a flat annual reading despite the mild recovery in June.

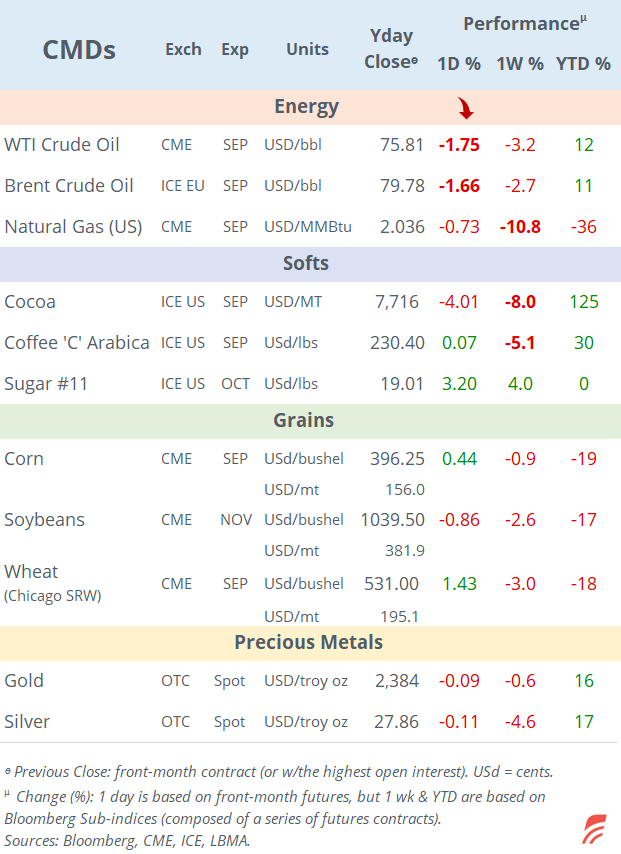

Asian markets are mostly weaker today with equities in Korea and HK down by more than 1%, European futures are flat and US futures are a touch lower. Brent oil broke the $80 support yday and is now around $79.50.

Headlines:

-The EU is trying to anticipate the potential implications of new US trade tariffs should Trump win the election by proposing a deal on certain sectors to limit the impact.

-In Venezuela, Maduro’s opposition claims they have proof that 73% voted against the incumbent president and alleged electoral fraud.

In M&A deals, Bermuda-based reinsurance group Enstar Group Ltd (mcap $5bn) is being taken over by investment fund Sixth Street for $5.1bn in cash.

In mining, BHP Group and Lundin Mining (Canada) have agreed to acquire Canadian copper miner Filo Corp (mcap $2.8bn) for $3bn.

In debt capital markets, the notable corporate issuers in € yesterday were: AstraZeneca’s (mcap £197bn, rated A2/A+) 6-yr and 9-yr (at 100bp over Bunds) senior bonds; Edenred (France, business support services, mcap €9.5bn, rated A-), 8-yr bonds at 150bp over Bunds.

Economic data today: inflation updates in Germany, Spain, Belgium; consumer confidence in the €-zone and the US; GDP in the €-zone, Germany, France, Italy and Portugal.

Blue-chip companies reporting today: Airbus, L’Oreal, BP, Intesa Sanpaolo; Pfizer, Procter (before the US mkt open); Microsoft, AMD, Starbucks (after mkt close).

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.