Podcast script: Estimated reading time ⏲ ~6 mins

Morning,

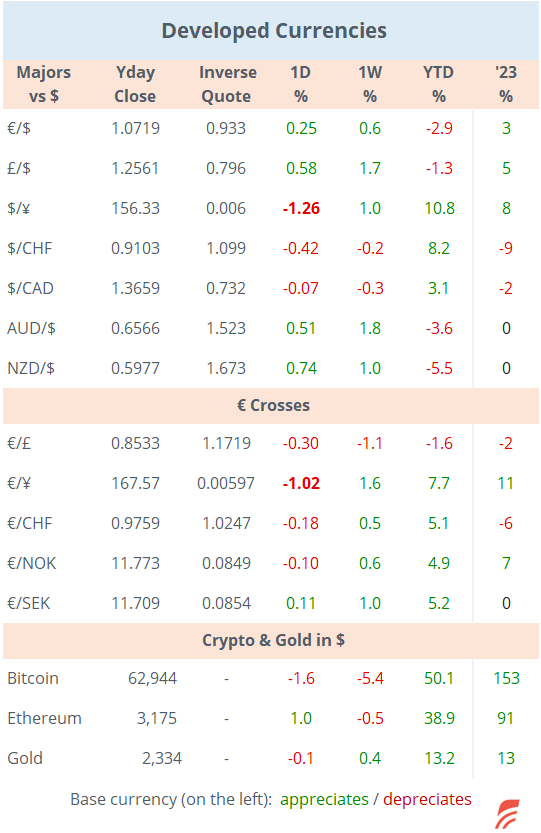

Bond markets traded firmer yesterday ahead of tomorrow’s Fed policy meeting with benchmark sovereign yields in the US, Germany and the UK falling by 5 basis points across the curve. The dollar dropped yesterday mainly against the yen and the pound. Equities finished mixed in European markets and modestly higher in the US driven by a rally in Tesla.

The notable stock mover in Europe was Philips, the Dutch medical equipment and electronics group, with a 29% jump, its best day ever to a two-year high after announcing it settled a long-standing litigation case regarding breathing machines during sleep which led to the recall of more than 5mn machines. Philips reported results that missed revenue estimates.

Also, Deutsche Bank shares dropped 8.6% after making a legal provision regarding its Postbank acquisition.

Headlines,

-Spanish Prime Minister Pedro Sanchez decided to remain in power after taking a few days to reconsider his political career.

-HSBC reported results ($20.8bn in sales; $10.8bn in net profit) that beat estimates this morning but its CEO announced his retirement. Stock is unchanged in Hong Kong.

-Tesla shares rallied 15% to a two-month high after Elon Musk partnered with China’s Baidu to develop self-driving cars in China, the world’s largest vehicle market.

-The Japanese yen ended firmer yesterday after a sharp reversal once it touched 160 against the dollar on unofficial intervention by authorities.

-In commodities, cocoa futures plunged 16% (despite supply remaining tight), their worst day on record as speculators took profits following a massive rally of 140% YTD.

-G7 countries have agreed to phase out the use of coal for power generation by 2035.

In economic data, the Swedish GDP contracted for a fourth straight quarter, deepening the recession. Q1 GDP shrank by 0.1% and 1.1% YoY, against expectations for a modest expansion. Retail sales also fell in March and advanced only 1.1% YoY reflecting the impact that the central bank’s rate tightening cycle had on the economy.

Inflation in Germany rose by 0.6% MoM in April and 2.4% YoY, little changed from a month earlier. In Belgium, inflation in April fell nearly 0.5% and rose by 3.4% YoY, while in Spain it accelerated marginally to 3.4% YoY. Sentiment indicators in the €-zone, mainly economic and industrial, printed weaker than anticipated.

In corporate deals, US-based Deciphera Pharmaceuticals is being acquired by Japan’s Ono Pharma for $2.1bn in cash, to expand its oncology portfolio and grow its presence in North America. Deciphera rallied 72% yesterday.

In IPOs, Spain’s beauty group Puig launched its public offering with a target price of €24.5 and an expected market cap of €14bn. It should be priced today for a trading debut on Friday.

Also, Coca-Cola is preparing to list its African subsidiary on the Amsterdam and Johannesburg exchanges for an estimated valuation of $8bn.

In debt capital markets, Swiss pharma Roche issued benchmark-size senior bonds rated Aa2, with 6 yrs (at 3.23% yield) and 20 yrs (at 3.56%) tenors. French beverages Pernod Ricard placed 6.5 yrs and 10 yrs senior bonds rated Baa1. In US markets, Boeing raised $10bn in several senior tranches across maturities rated BBB-. The 10-year benchmark was priced at 90 bp over Treasuries for a 6.53% yield.

Today will be active on the data front with €-zone inflation for April, GDP updates across €-zone nations, consumer confidence in the US and retail sales and import prices in Germany. The Fed starts its two-day FOMC policy meeting today.

It will also be an active day for earnings releases. Blue-chip companies reporting today include VW, Mercedes Benz, Adidas, HSBC, Santander, Unicredit in Europe and Amazon, PayPal, AMD, Coca Cola and McDonald’s in the US among others.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. It is prohibited to copy and paste, forward, or set up auto email forwarding rules to give access to others. Please share the publication using the button below, as access is free to all.