The political turmoil in France escalated on Monday after PM Michel Barnier activated a constitutional article to bypass parliament to get his budget approved, subject to a no-confidence vote that could happen tomorrow. (FT)

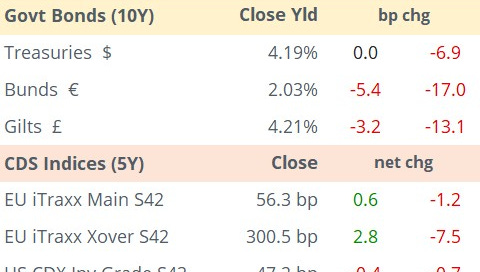

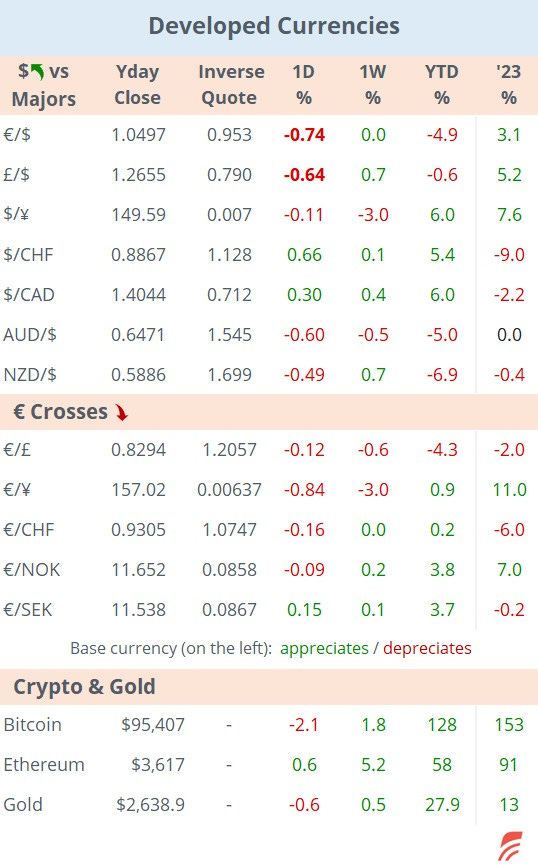

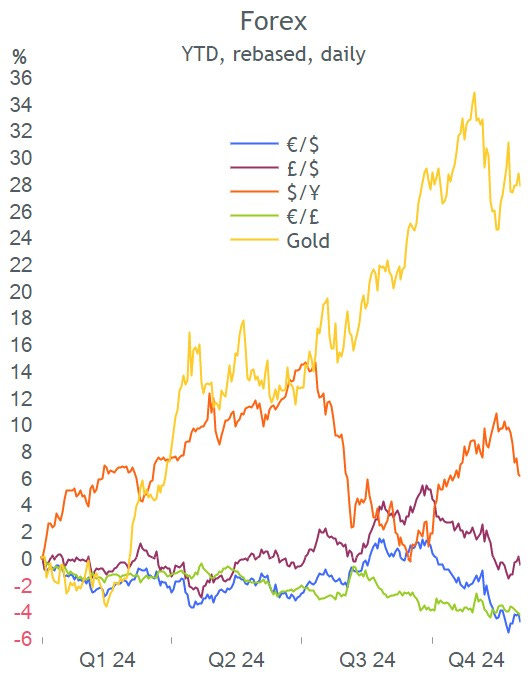

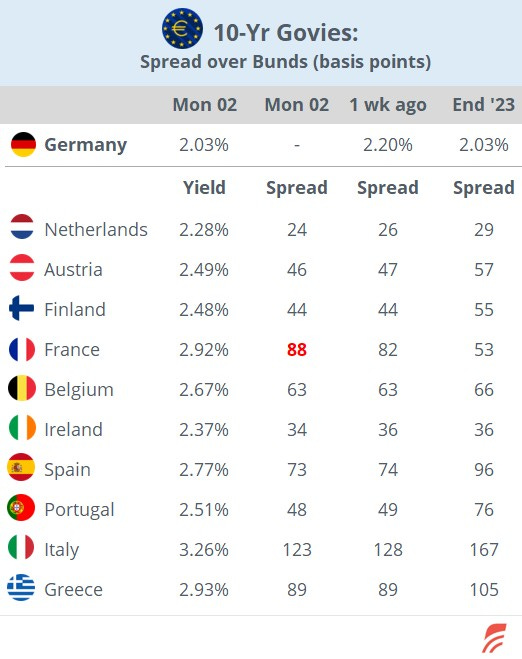

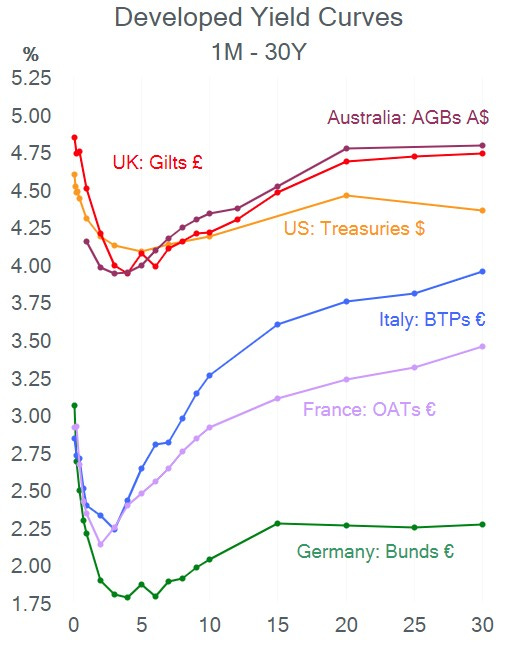

The far-right and left opposition parties have indicated they will vote the ruling coalition down which will result in the first government collapse by a no-confidence vote in 62 yrs. The weak ruling coalition had relied on the support of Marine Le Pen’s National Rally party to maintain power but the planned tax hikes and public spending cuts are threatening the relationship. 10-yr French bond yield spread to Bunds widened to 88bp for a 2.92% yield, in line with Greek bond yields.

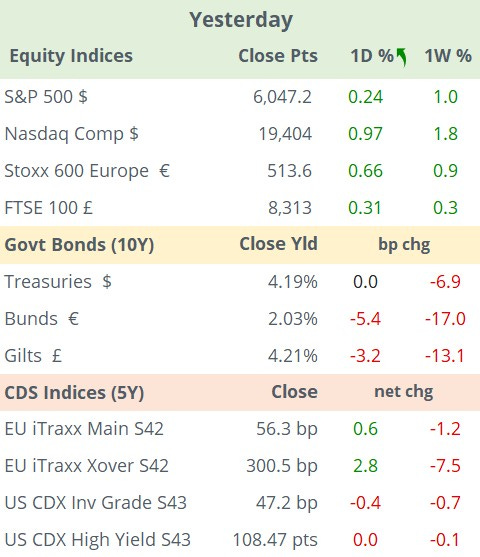

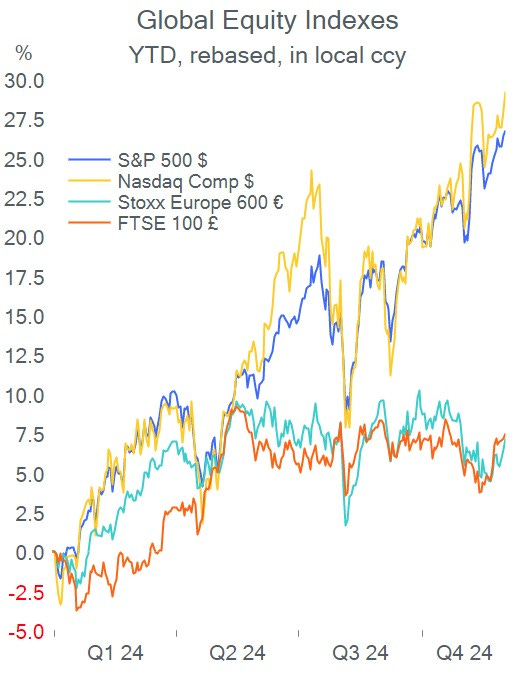

Risk assets continue to march higher with US and German equity indices closing at fresh records. A notable single stock mover was Stellantis NV with a 6% drop following the CEO’s axing. (Reuters)

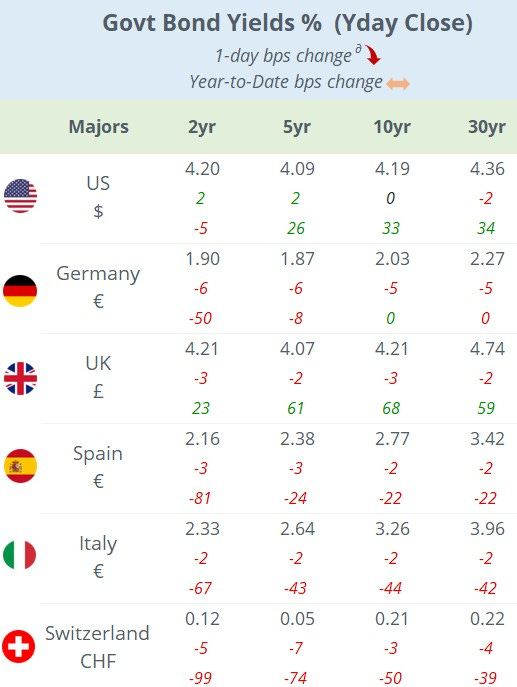

European bonds traded firmer across markets with 10-yr Gilts dropping to a 5-wk low and the € plunged 0.7% to <1.05 again as the $ recovered from last week’s decline.

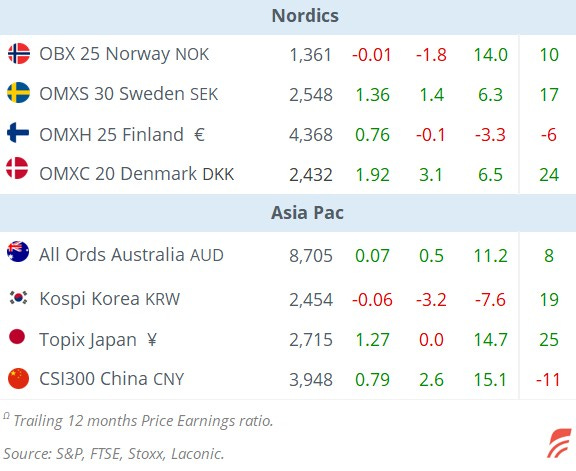

Asian markets are rallying today driven by Monday’s strength for the tech sector on Wall Street. Indices in Japan, Korea, Taiwan and Singapore are advancing between 1 and 2% while Chinese stocks are a touch weaker. European futures are trading firmer (+0.5%) this morning.

In Fed policy talk, Governor Chris Waller made dovish remarks supporting another rate cut at the Dec 18 meeting which increased traders’ expectations of a 25bp rate cut to a 73% probability. Waller said that even after another rate cut, the level of interest rates will remain at restricted levels. Jerome Powell will participate in a debate in New York tomorrow. (WSJ)

In data yesterday, UK house prices accelerated more than anticipated, climbing 3.7% YoY to a two-year high. Also, the final manufacturing PMI reading for November was revised upwards in the US while the readings for Germany, Italy and France were marginally less than originally reported, extending the period in contraction territory to two years.

In M&A, the Italian government stated that it reserves the veto power to block Unicredit’s €10bn takeover approach for rival Banco BPM if it considers it goes against the national interest.

In credit ratings, Disney was u/g to A by S&P and Geberit AG was d/g to A.

It will be a light day on the data front with Swiss inflation and US JOLTS job openings as the main releases. Blue chips reporting earnings today include Salesforce, Marvell Tech and Bank of Nova Scotia.

Thanks for your time, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.