Morning,

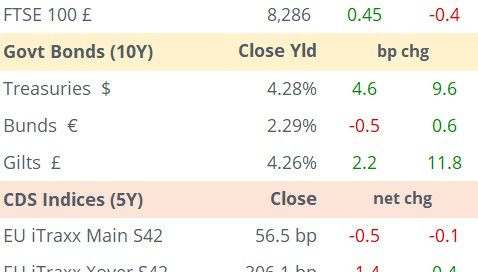

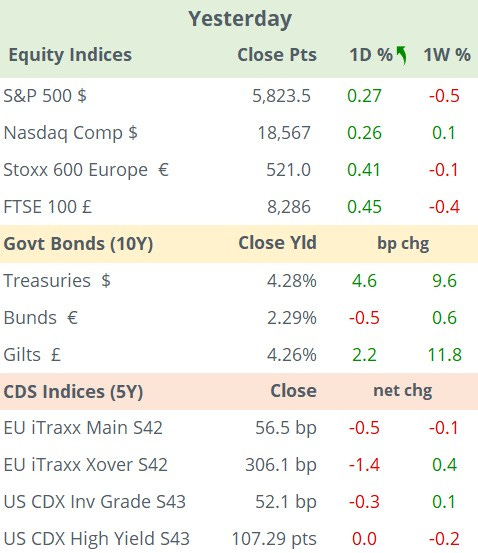

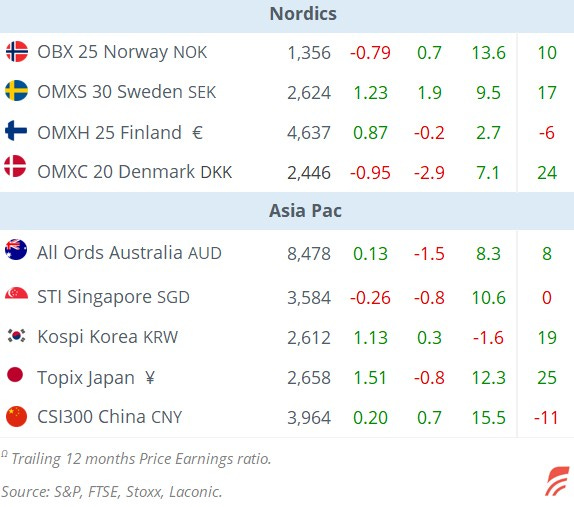

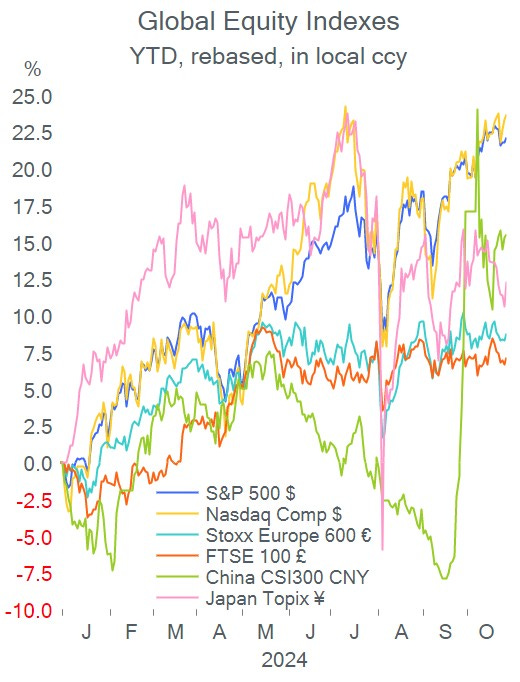

Wall Street finished a touch firmer last night ahead of today’s busy schedule for earnings announcements. European equities also ended firmer on Monday despite disappointing results from Dutch technology group Philips NV (mcap €22bn) which missed revenue (€4.4bn) estimates and slashed full-year guidance on weak demand in China. Shares posted their worst day in 25 years with a 17% decline to a 3.5-month low.

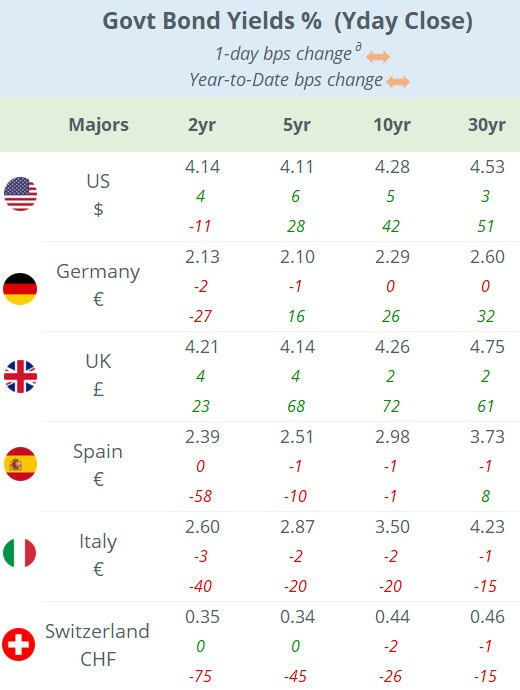

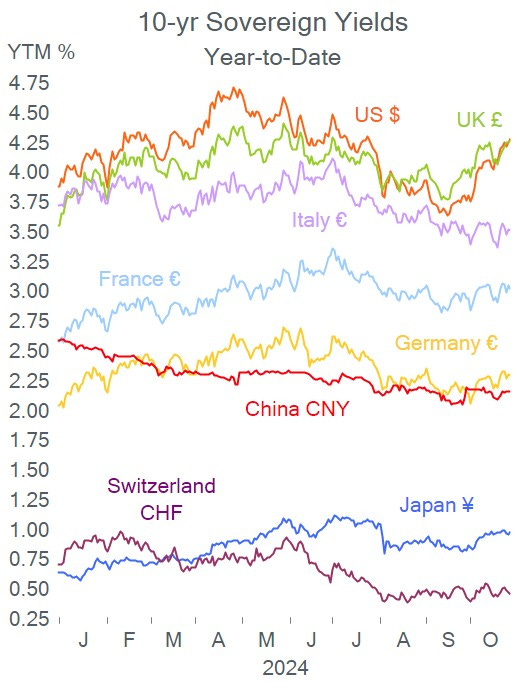

Bond prices in the US and the UK maintain their downward trend ahead of Friday’s non-farm payrolls report and the UK’s Budget tomorrow. At 4.28%, 10-yr Treasury yields are at a 3-month high and markets are pricing an almost certain chance of a 25bp rate cut by the Fed on November 7, just two days after the general election.

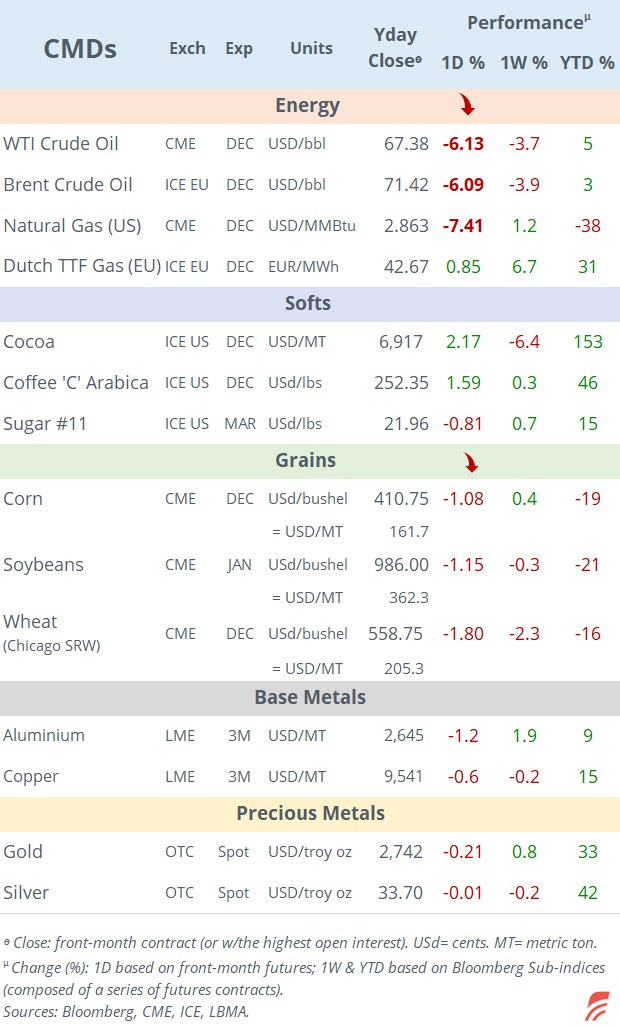

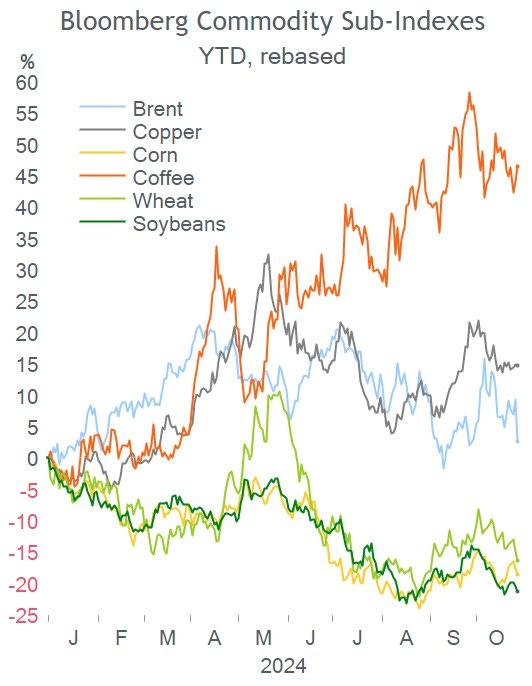

Crude oil ended 6% lower yesterday, its worst daily drop in 2-yrs, following Israel’s air strike on Iranian military facilities during the weekend which avoided hitting energy infrastructure. Brent is flat in early morning trading at $71.50. Citigroup cut its Brent price target for the next three months to 70 from 74.

HSBC (mcap £125bn) reported results this morning, beating estimates with a 10% YoY Q3 pre-tax profit rise to $8.5bn and increased its share buyback program by 50% or $3bn. Shares are 11% higher YTD.

In business news, Volkswagen (mcap €47bn) faces one of the biggest restructurings ever with plans to close 3 factories in Germany and cut thousands of the country's 300k jobs as it faces increasing competition from China. Shares are trading at their lowest in 13 years after a 19% drop in 2024.

Also, Boeing (mcap $93bn) began its capital raising exercise to raise $22bn via a share and convertible securities sale as it tries to improve its finances and avoid a credit rating downgrade. Boeing is rated one notch above junk at BBB- by S&P and Baa3 by Moody’s. Shares have lost 43% YTD.

In deals, US pharma AbbVie (mcap $335bn) is acquiring privately-held biotech Aliada Therapeutics for $1.4bn to expand in experimental Alzheimer drugs.

US air conditioner maker Carrier Global (mcap $68bn) sold 12-yr senior €bonds, rated BBB, at 126bp over Bunds or a 3.70% yield.

In Asian markets this morning, equities are mixed with China and Taiwan losing ~1% while Japan is higher by 1%. Western stock futures are unchanged overnight.

Data today: consumer confidence in the US; GDP in Belgium and Sweden.

Earnings announcements: Novartis, Santander, Adidas, BP and Alphabet, Visa, AMD (after the US close).

It’s a holiday in Turkey.

Thanks for your time, see you tomorrow

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.