Morning,

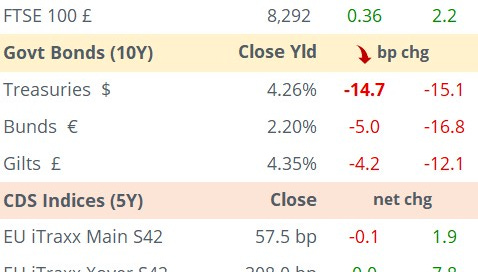

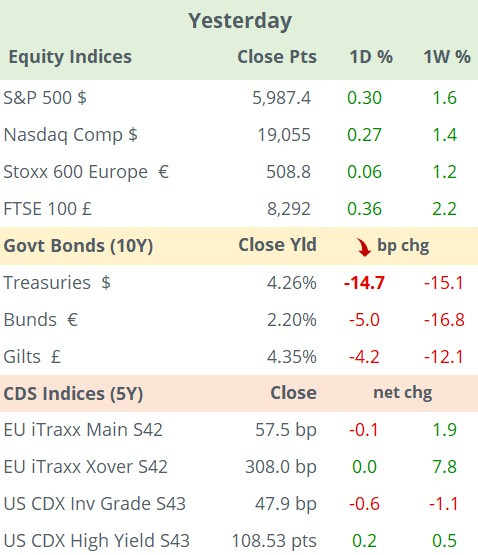

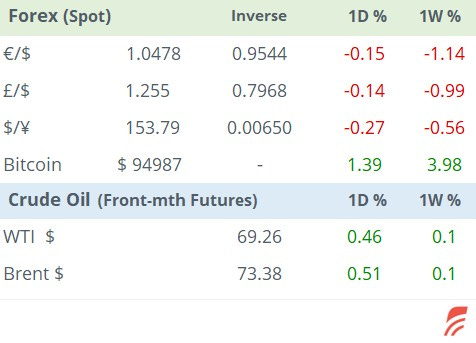

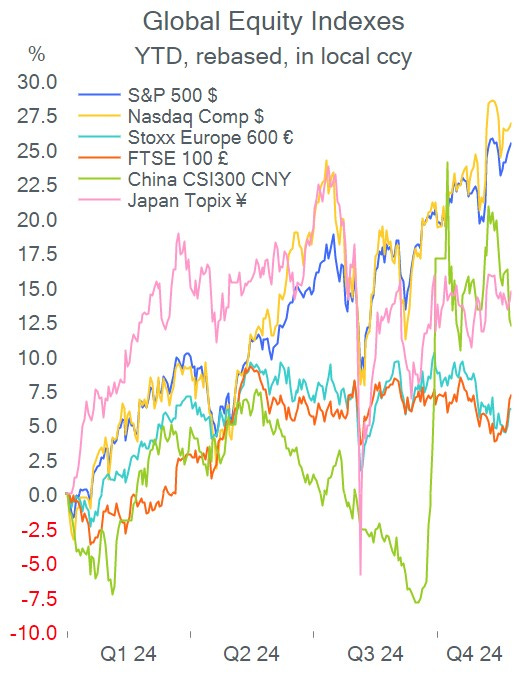

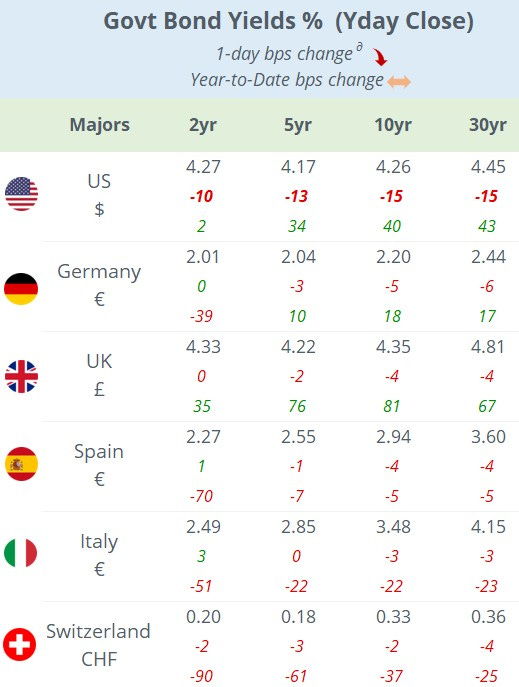

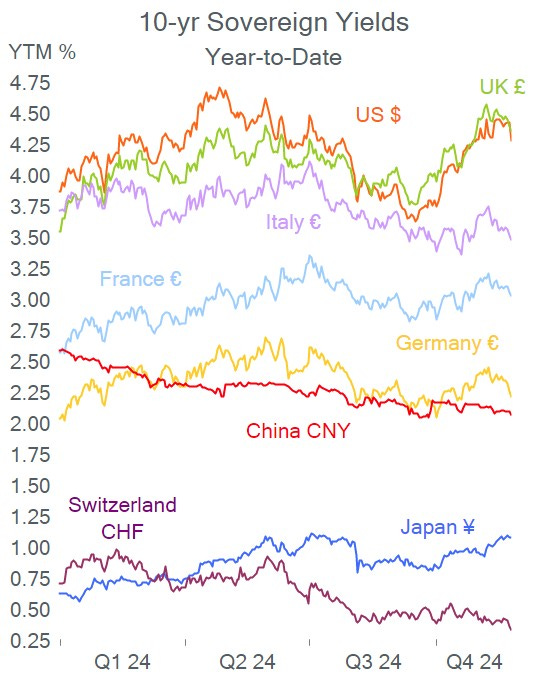

Markets kicked off the week on a positive note on both sides of the Atlantic with equity indices and benchmark bonds trading firmer and a focus on US Treasuries which had one their best days this year. The US yield curve shifted downwards by 10 to 15bp with the 10-yr closing at 4.26%. In Europe, 10-yr Bund (2.2%) and Gilt (4.35%) yields trade at their lowest levels in a month. British Gilt yields have moved the most this year, with the 10-yr yield jumping 81bp compared to just 18bp for Bund yields.

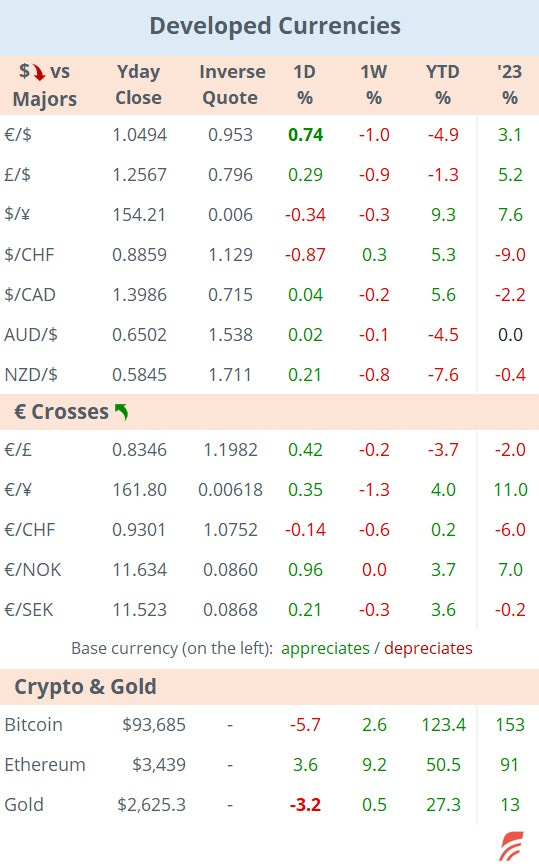

Trump said he would hit China, Mexico and Canada with new tariffs ranging from 10 to 25% on day one of his presidency, mentioning drugs (fentanyl) and immigration as the main reasons. The new tariffs appear to break the terms of the North America Agreement (USMCA) on trade.

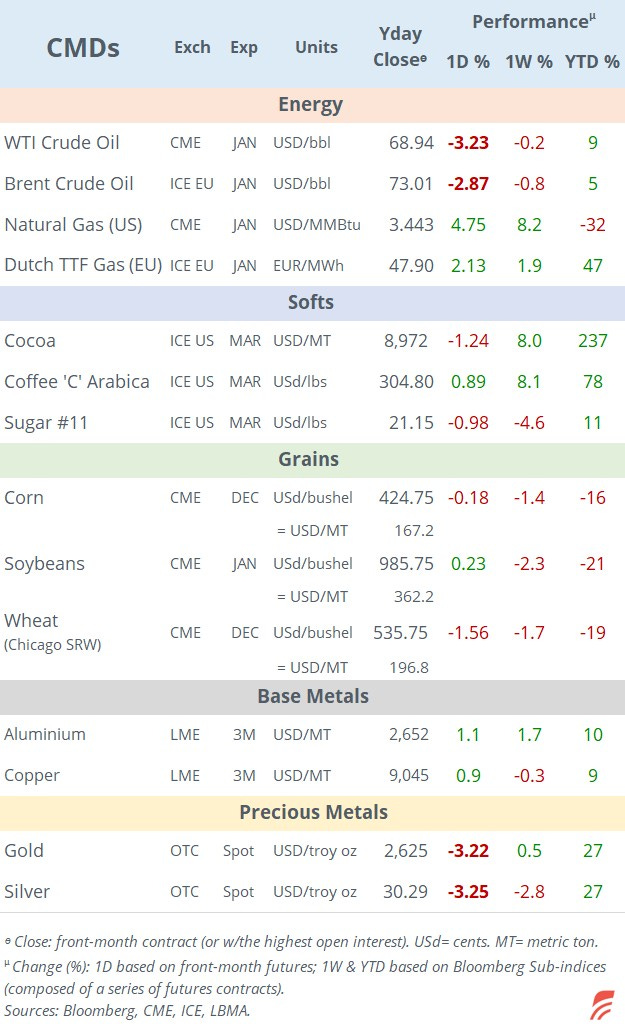

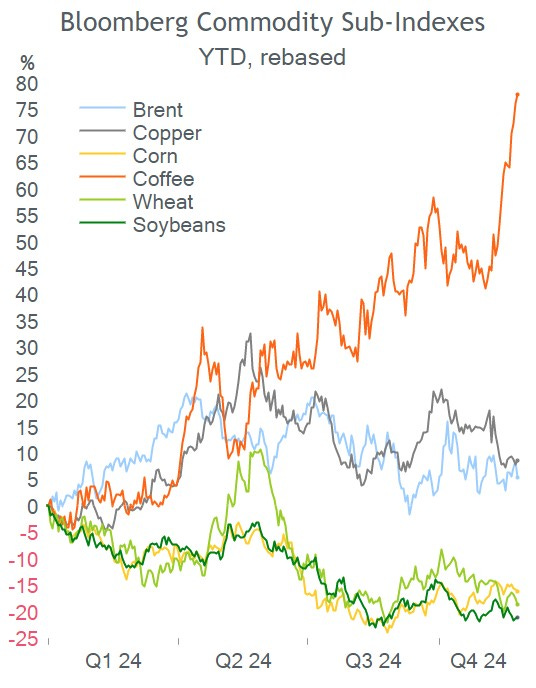

Crude oil prices fell 3% on Monday following headlines that Israel is moving towards a ceasefire in its war against Hezbollah in Lebanon with Washington as mediator. Brent oil is little changed this morning at $73.20.

ECB’s chief economist Philip Lane said that the central bank should not keep monetary policy at restrictive levels for too long or inflation could drop below the official target as the economy will fail to grow. He supported a gradual approach to cutting interest rates. Futures markets are fully pricing in a rate cut of at least 25bp at the Dec 12 ECB meeting (43% for a 50bp).

Bank of England Deputy Governor Clare Lombardelli said she was more concerned about the risk that inflation shifts above the central bank’s estimates and also suggested gradual rate reductions.

In M&A, Unicredit Spa (mcap €59bn) launched an all-stock takeover bid for smaller rival Banco BPM Spa (mcap €10bn) to create Europe’s third-largest bank by market value. BPM shares rallied 5% yday to a 9-yr high.

In the US construction sector, privately-owned Quikrete will acquire rival Summit Materials (mcap $9bn) in an $11.5bn deal.

In mid-market deals, Spanish steelmaker Sidenor is buying a 30% stake in train maker Talgo SA (mcap €426mn). Talgo shares are 21% lower YTD.

In business news, media reports suggest that French asset manager Natixis Investment Mgt (€1.3tn AUM) is in early-stage merger talks with Italian insurer Generali (€660bn AUM).

Also, German steelmaker ThyssenKrupp AG (mcap €2.4bn) announced a restructuring that will lead to steep job cuts and reduced production due to competition from China and domestic oversupply. The news follows recent announcements by other blue-chip German auto-related companies planning to reduce their workforces. Thyssen shares lost 38% this year to an all-time low.

In corporate bond primary markets, Vedanta placed 7-yr $ bonds in the high-yield space while ConocoPhillips sold 5, 7, 10 (at a 5% yield), 30 and 40-yr $ investment-grade bonds.

Credit ratings: Fitch u/g Argentinian banks by one notch to CCC.

Economic data today: US consumer confidence and new home sales; Sweden’s PPI.

Earnings reports: Dell Tech, Analog Devices, HP and Compass Group.

See you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.