Good morning,

A magnitude 5.9 earthquake struck 600km south of Tokyo today in the Pacific, leading to a tsunami warning that was later lifted as no serious damage was reported. The event had no impact on Japanese markets as they return from yesterday’s holiday.

China’s central bank announced broad monetary stimulus measures and support to the real estate market to revive its economy which continues to face deflationary pressures and is so far missing the official growth target. The PBoC reduced the reserve requirement ratio for banks by 50bp and signalled more reductions ahead, cut the 7-day repo rate to 1.5% and also eased mortgage rates to boost growth.

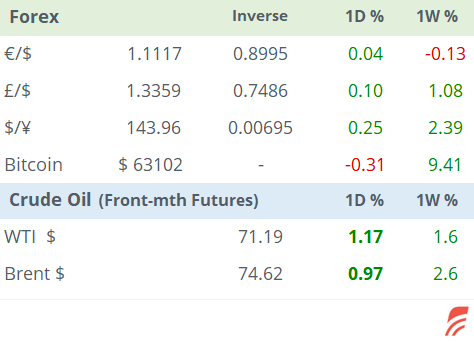

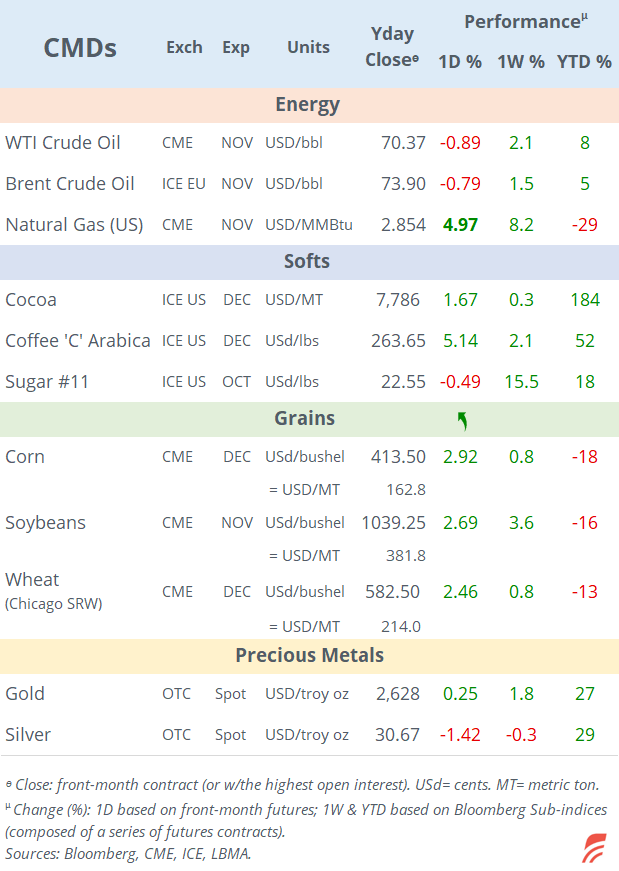

Stocks in mainland China and Hong Kong are rallying 3% today while most other Asian markets are mixed and little changed. The Reserve Bank of Australia left its policy rate on hold at 4.35% today, as expected. The Aussie dollar is firmer vs $. Crude oil is firmer with Brent advancing ~1% to $74.50.

The crisis in the Middle East intensified yesterday after Israel increased its air strikes on Lebanon causing 500 deaths.

Equity markets in the US and Europe ended a touch higher yesterday despite weaker than anticipated manufacturing PMI readings in the US (47 pts), UK (51.5) and €-zone (44.8) with Germany’s (40.3) factory activity at a 1-yr low. The sentiment was driven by Fed officials' dovish comments with Bostic, Goolsbee and Kashkari supporting the FOMC’s rate cut of last week and more easing before year-end.

The € fell against most pairs yesterday and short-end German yields dropped 9bp to 2.16% as traders anticipate another rate cut by the ECB next month.

In M&A, Unicredit has doubled its stake in Commerzbank (mcap €17.6bn) to 21% and applied for approval to increase it further. Berlin opposed any hostile intentions by the Italian bank. Commerzbank shares fell 5.7% on Monday. Also, BNP Paribas is acquiring HSBC’s private wealth division in Germany.

In the new issue corporate debt market, the notable issuers were in the investment grade space with Comcast, placing € and £ senior bonds, Iberdrola in €, T-Mobile and Hyundai in $.

In economics today, we’ll get US consumer confidence, Germany’s Ifo indicators and Japan’s PMIs. Hungary’s central bank holds a policy meeting (-25bp to 6.5% exp).

It’s a holiday in South Africa.

See you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.