Morning,

Markets had a strong start of the week on both sides of the Atlantic with the €-Stoxx 50 and the Nasdaq 100 rallying 1.5% as investors buy mega-cap stocks following last week’s steep sell-off. The notable mover among European benchmarks was the Irish benchmark which plunged 3.5%, its worst day in 16 months on the back of Ryanair’s weakness.

Ryanair Holdings (airlines, mcap €15.5bn) disappointed analysts with a profit miss that sent shares down 17% to an 18-month low, its weakest day since the 2008 GFC and pulled the whole airline sector lower. Earnings fell 46% YoY as average passenger fares dropped 15% and the company forecasts they will continue to deteriorate. Ryanair shares lost 28% this year.

SAP (Germany, software, mcap €228bn, P/E 84x) beat revenue (€8.29bn, +10% YoY) estimates as its cloud business reported a 25% jump in sales to €4.15bn. Shares advanced just 1.5% but are 31% higher YTD.

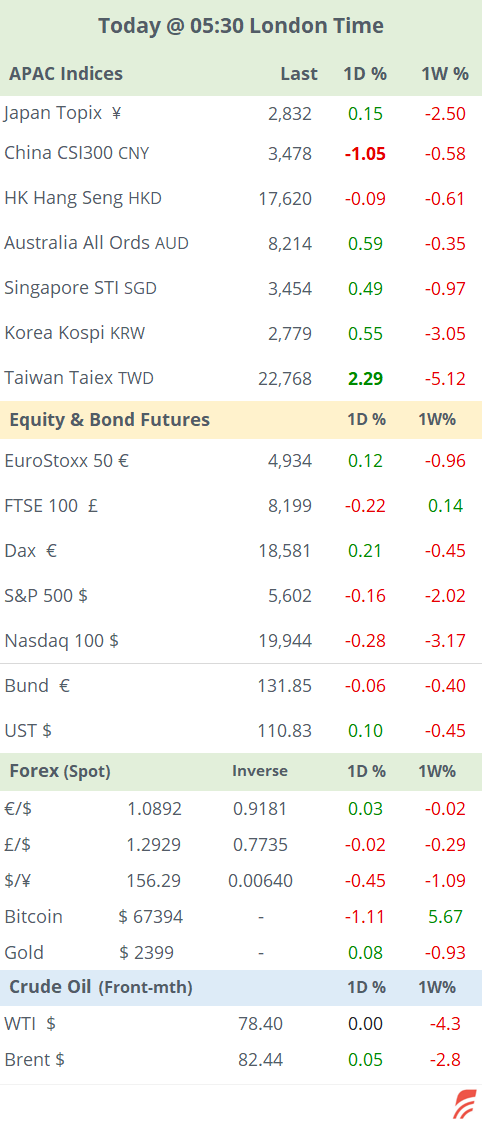

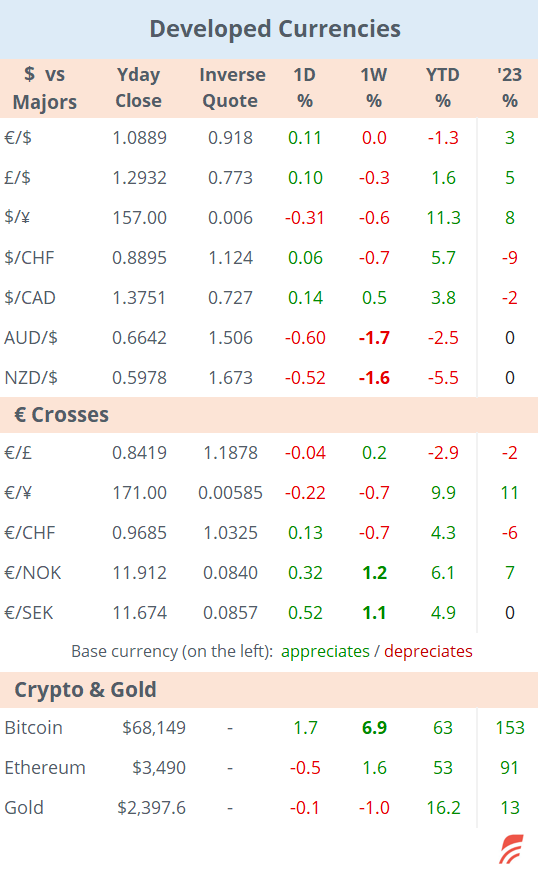

Currencies were little changed yesterday and the $ remains weaker against majors during July as the €, £ and ¥ appreciated month-to-date. There’s little to report in interest rate markets as Treasury yields added a few basis points, Bund yields traded sideways and Gilts added 7bp to the short-end of the curve.

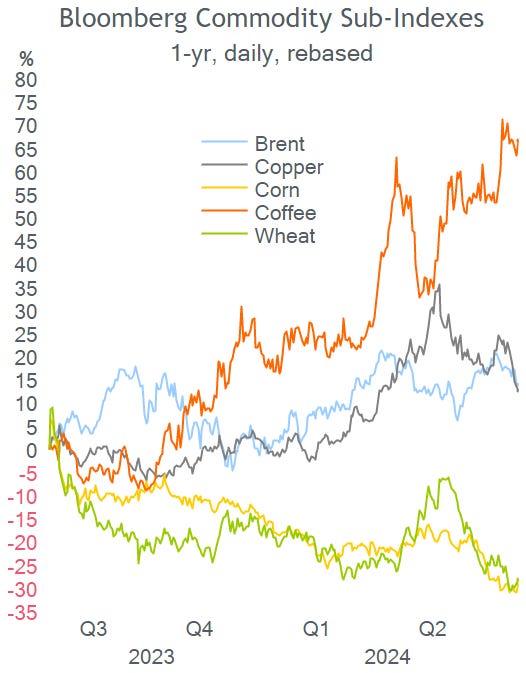

Crude oil dropped to the lowest level in six weeks as supply rises while demand weakens. Brent is trading at $82.40 overnight.

Asian stock markets are mostly firmer today with Taiwan rebounding 2.1% but Chinese stocks are weaker in mainland markets. European equity futures are mixed in early trading with the FTSE a touch lower while the Dax is firmer. Nasdaq futures are nearly 0.3% lower.

Headlines:

Kamala Harris gains support from Democrats, gets closer to winning the nomination with a majority of delegates, and prepares to face the shortest presidential race in US history.

Ukraine is close to obtaining a more than 30% haircut in a $20bn debt restructuring, a sign of creditors' support as Kyiv faces increasing spending to finance the war. The $Ukraine ‘34s, rated Ca/CC, are trading in the low 30s for a 31% yield.

Cybersecurity start-up Wiz rejected Google’s takeover interest for ~$23bn and will consider an IPO.

The SEC has approved the first Ethereum-backed ETF and Grayscale Investment Trust will convert to an ETF while giants BlackRock and Fidelity will also launch ETFs. Ethereum’s market cap stands at $418bn, equal to a third of Bitcoin’s total value, and is up 53% YTD.

Reuters reported that L Catterton, the French private equity firm funded by LVMH founders, has approached US toy maker Mattel (mcap $6.4bn) for a potential acquisition and shares jumped 15%, their best day in 5 yrs.

Hammerson Plc (mcap £1.5bn) , the British shopping mall owner, will sell its 42% holding in luxury malls Value Retail for L Catterton for an enterprise value of £1.5bn.

In credit ratings, Netflix (mcap $278bn) was u/g one notch to A by S&P. The $NFLX ’30 senior bond is trading at 78bp over UST for a 5% yield.

It’s a light day for economic updates with US housing market figures and €-zone consumer confidence. Turkey’s central bank will hold a monetary policy meeting.

It will be an active day for corporate earnings reports. Alphabet, Tesla, Visa, Chubb and Texas Instruments will release results after the US market closes. Coca-Cola, GE, Danaher, Philip Morris, Comcast, UPS, GM, Spotify and Lockheed Martin will report before the market opens. In Europe, only LVMH will be the notable large-cap reporting today.

See you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.