Morning,

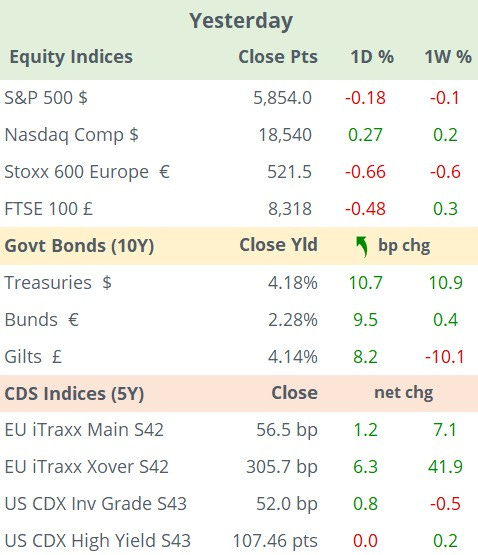

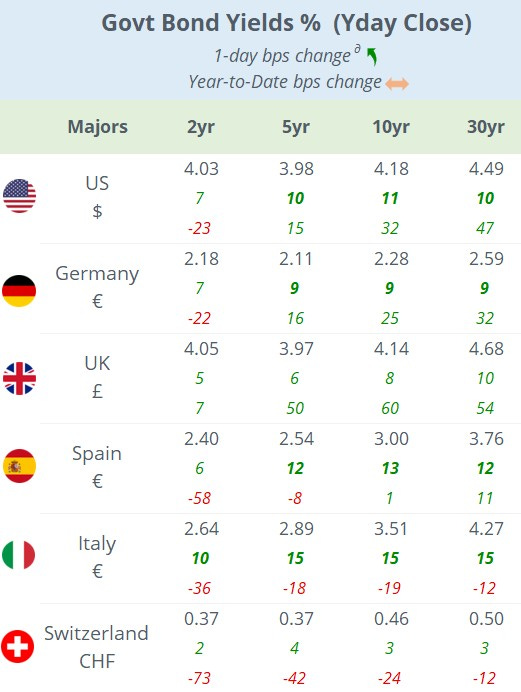

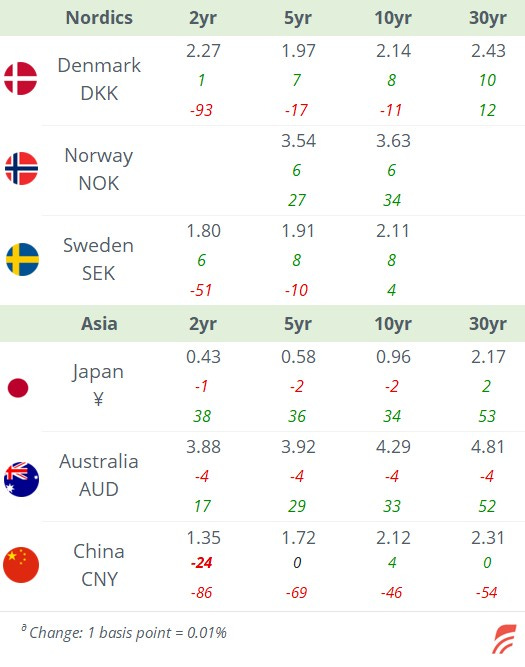

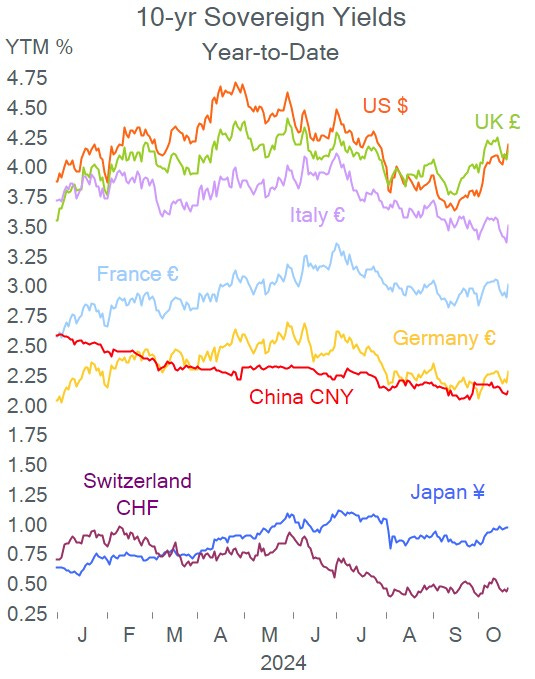

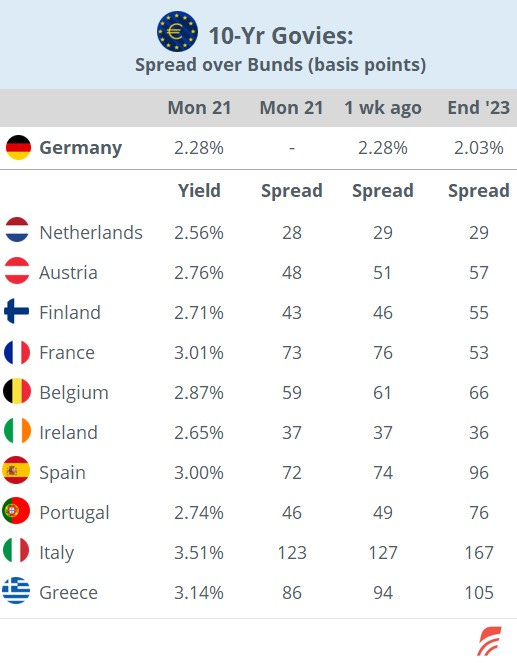

Treasury yields shifted upwards yesterday driven by expectations for a stronger US economy and a less dovish Fed. 10-yr yields added 11bp to 4.18%, a 12-week high and pulled the Bund and Gilt yield curves higher by a similar amount. Futures are now pricing in 41bp of Fed rate cuts by year-end to an effective interest rate of 4.42%.

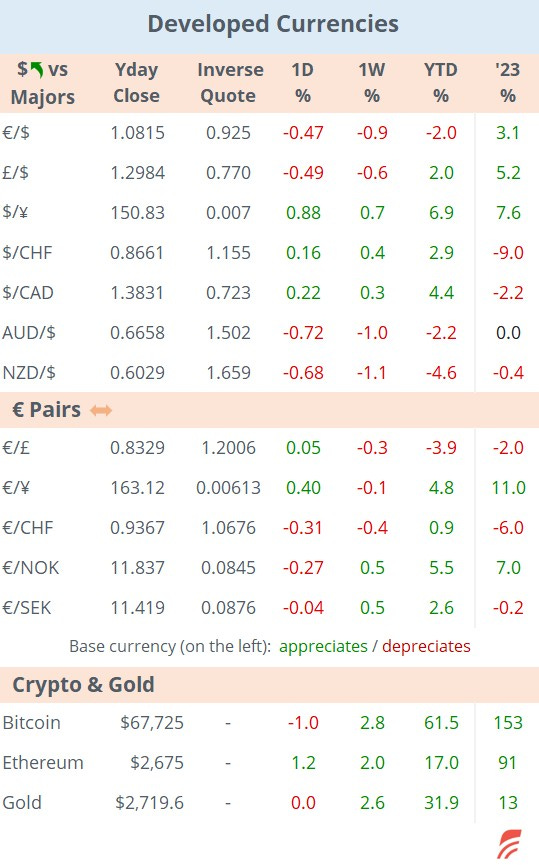

The move in the bond market led to an appreciation of the $ against majors with € and £ falling by 0.5%.

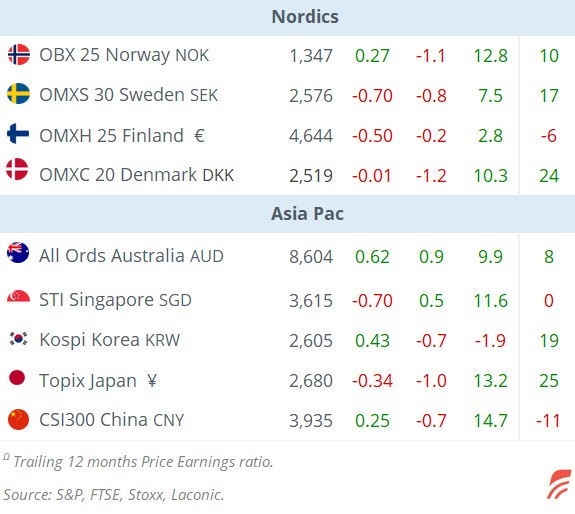

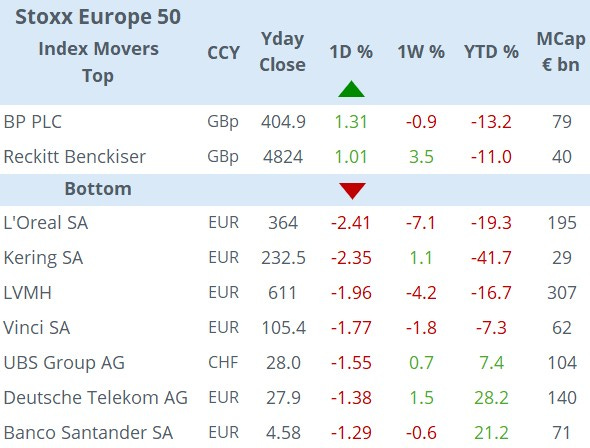

On the equities front, Wall Street ended mixed last night as Nvidia’s new all-time high kept Nasdaq benchmarks on green. More than 20% of S&P 500 companies are scheduled to report earnings this week. Stocks in Europe fell across markets with the Dax losing 1% from an all-time high. The interest rate-sensitive Real Estate sector was the weakest on both sides of the Atlantic. The worst single stocks on Monday were French luxury names L’Oreal, Kering and LVMH with drops of ~2%.

Asian markets are trading lower today by more than 1%, except for mainland China and Hong Kong which are a touch firmer. European futures are mixed with the Dax pointing to a partial recovery from Monday’s decline.

Fed officials made mixed comments about the path of policy rates yesterday with San Francisco Fed President Daly leaning towards more rate cuts as inflation slows to stop the labour market from weakening further. Dallas and Minneapolis Fed Presidents made less dovish remarks stating that the central bank should proceed carefully considering the economic uncertainty using terms such as ‘gradual’ and ‘modest’ to refer to interest rate reductions.

In Europe, ECB’s Kazimir stated he was increasingly confident in the €-zone’s disinflation path and the central bank should be in a comfortable position to continue the easing cycle.

In economic data, Germany’s producer prices fell more than anticipated in September, down 1.4% YoY, mostly on the back of lower energy prices which declined 6.6% YoY.

Two weeks ahead of the US election, a Washington Post-led survey showed a virtual tie between Harris and Trump in the swing states that will define the election. Other recent polls also found a recovery for Trump and the difference between candidates now falls within the polling margin of error.

In corporate deals, US asset manager Neuberger Berman is partnering with Sweden’s EQT and Canada’s CPPI to acquire international schools operator Nord Anglia Education (private), for $14.5bn including debt.

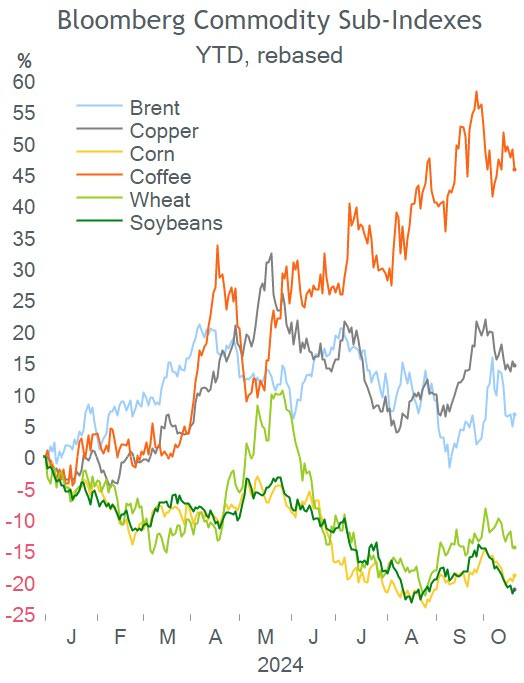

Also, shares in Dutch coffee maker JDE Peets (mcap €10.8bn) rallied 16% after Germany’s JAB said it will buy Mondelez’s 17% stake in a €2.2bn deal.

In DCM, the notable corporate issuer in € on Monday was Nestle with 6 (B+67bp) and 12-yr (B+78) bonds rated AA-.

In credit ratings, Fitch upgraded Italy’s sovereign rating outlook to positive (BBB).

Day ahead: Hungary’s central bank meets with the policy rate expected to remain steady at 6.5%. Earnings announcements: GE, Danaher, Philip Morris, Verizon and Texas Instruments among others.

It will also be a busy day for central bankers as Fed, ECB and BoE officials are participating in conferences and TV interviews in the US.

See you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.