Podcast script: Estimated reading time ⏲ ~4 mins

Good morning,

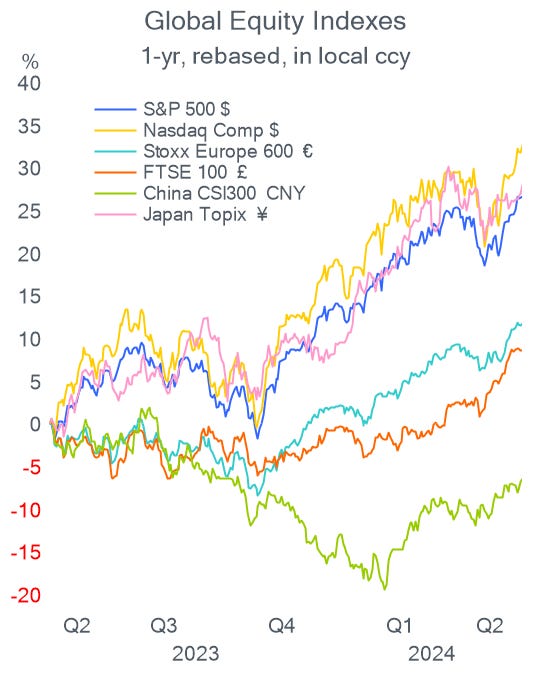

It was another positive day for risk assets as US leading indices reached fresh record highs, both the S&P 500 and Nasdaq accumulated an 11% gain YTD. Yesterday’s notable single stock mover was JP Morgan’s 4.5% drop from its ATH, after holding its Investor Day and despite raising its annual forecast for net interest income, investors were disappointed at the size of future share buybacks. Shares are still 15% higher YTD after announcing the bank’s largest profit ever in Q1 and market cap stands at $561bn.

There were no notable movers among European blue-chip names with country benchmarks ending a touch firmer except for Italy’s Mibtel which fell sharply (-1.6%) driven by weak bank stocks.

Markets in Asia are falling today with Hong Kong underperforming with a ~2% decline on the back of electric vehicle maker Li Auto’s weakness. Li shares plunged 19% on a poor profit update. European futures are also trading around 0.5% lower this morning. Bund futures are firmer and Bitcoin is nearing $71,000.

Interest rates and currency markets were little changed yesterday with benchmark yields shifting upwards by a few basis points. Fed Vice Chair Michael Barr said that the latest inflation data was disappointing and called for rates to remain high for longer. Cleveland Fed President Mester expects inflation to drop as she considers the current policy rate level as restrictive and forecasts fewer than three rates cut this year.

Bank of England’s Deputy Governor Broadbent made dovish remarks by saying that a rate cut was possible by this summer, subject to the next inflation and wage readings.

A notable mover worth highlighting is Gold’s rally to its all-time nominal and inflation-adjusted high as it nears $2,450. Gold has rallied 17% YTD and Silver 34% to $31.8, its highest level in 12 years. Sticky inflation, geopolitical risks and concerns about the size of the US national debt are the drivers of the appreciation of precious metals.

Regarding today’s headlines, an International Criminal Court’s prosecutor requested the arrest of Israeli Prime Minister Netanyahu and Hamas leaders accusing them of war crimes. The ICC lacks the power to enforce the arrests.

In corporate deals, Swedish private equity firm EQT is trying to acquire video game services company Keywords Studios Plc for £2bn of total equity value, after rejecting several approaches from the same bidder in the recent past. Keywords, a Dublin-based and London-listed company, is a provider of creative technology solutions for the video game industry. Shares rallied 55% to GBp 2282, a one-year high.

In the US regional banking sector, SouthState Corp will acquire smaller Texas-based rival Independent Bank Group for $2bn in an all-stock transaction. Independent Bank shares rallied 8%.

In new corporate bond issues, the dollar market was active yesterday with UPS (10, 30, 40-yr), Comcast (5, 10, 30-yr), Staples (5yr) and Entergy (30yr) issuing $1bn+ notes.

Economic data to be released today include producer prices in Germany, inflation in Canada, GDP in Denmark and the trade balance for the €-zone. On the earnings front, Italian insurer Generali, UK’s Kingfisher and Smiths Group reports today.

That’s all for today, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Please share using the button below, as access is free to all.