Morning,

European markets reacted positively to the first round of the legislative election in France despite the far-right National Rally party claiming victory with a final 33.1% support (14 ppt more than 2 years ago), ahead of the NFP left alliance with 28% and Macron’s Ensemble party with 21%. Traders are betting on an “anti-right front” deal between the centrists and the left, to stop Le Pen’s far-right from obtaining a majority at next Sunday’s final round, and a hung parliament becomes the base scenario.

The €Stoxx 50 recovered 0.7%, its first gain in a week, with country benchmarks in France, Italy, Portugal and Spain advancing >1%. The Stoxx Banks index posted its best day in one year, up 2.8% with BNP and Santander as the top performers among Stoxx 50 members. This morning, stock futures are pointing to a weaker open with the FTSE -0.4% and Dax -0.3%.

In Wall Street, growth stocks continue to outperform value names with the Nasdaq 100 adding nearly 0.7% on the back of mega-caps Apple, Microsoft and Amazon gaining between 2 and 3%. Nasdaq futures are also weaker overnight.

Markets in Asia are mixed today, Japanese stocks are rallying more than 1% while Korea and Taiwan are dropping by almost 1%. The ¥ traded as high as 161.74, a fresh all-time low, as Japan’s finance minister said he would closely watch the market but no action was announced.

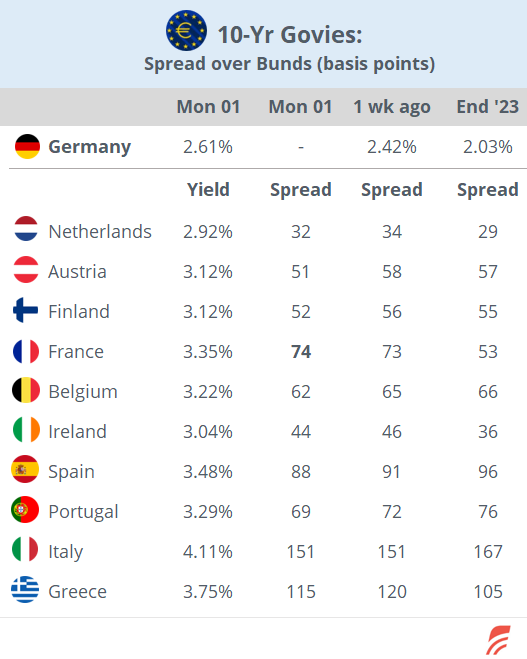

However, the focus was on the bond market with a steep sell-off for benchmark rates specifically on the long end of curves, reducing the yield curve inversions in Treasuries and Bunds. 10-year UST yields jumped 14bp to 4.48%, the highest in four weeks driven mostly by the increasing chances of Trump winning the election. In Europe, Bund and Gilt yields added 12 and 11bp to 2.61% and 4.28%. France’s 10-yr OAT spread to Bunds narrowed to +74bp despite yields increasing 6bp to 3.35%.

It was a bullish day in European credit markets with the Crossover (5Y CDS) index tightening 11bp to 309bp.

ECB’s Lagarde confirmed her somewhat hawkish tone following the rate hike by saying that the central bank needs more time to confirm that inflation is heading towards the 2% target considering the current strength of the labour market. Yet, traders are not ruling out a move as futures are pricing in a 33% chance for another 25bp cut at the July 18th meeting.

In data yday, German headline inflation eased more than anticipated, +0.2% MoM and +2.5% YoY. The core reading also decelerated to 2.9% as price pressure resumed its downward trend ahead of today’s €-zone inflation release.

€-zone’s manufacturing PMI decline worsened in June (45.8 pts) with Germany (43.5) as the weakest member. All block country PMI deteriorated except for Italy. UK’s factory activity slowed down but remained in positive territory (50.9) while the Swiss PMI dropped sharply (43.9). In the US, the ISM manufacturing PMI came in at 48.5 pts, below estimates and slightly weaker than a month earlier. Also, construction spending surprisingly fell in May.

Headlines,

-The US Supreme Court granted Donald Trump wide immunity for his constitutional powers while in office but exempted his private actions, a big win for the presidential candidate as a trial before the election becomes unlikely.

-The latest on Hurricane Beryl, after making landfall in the Grenadines islands and causing serious damage, is that it has intensified into a Category 5 and is heading west in the Caribbean Sea towards the Yucatan peninsula in Mexico. Beryl is the biggest weather system on record for this time of the year.

In corporate deals, Boeing (mcap $112bn) will buy back its former subsidiary, fuselage maker Spirit Aerosystems (US, aerospace, mcap $3.8bn) for $4.7bn in total equity value and an EV of $8.3bn. Terms: $37.25/share paid in stock. Airbus (mcap €104bn) will absorb Spirit’s European operations. Spirit manufactured the 737 MAX door plug involved in January’s mid-air blowout.

BlackRock is acquiring British alternative investments data company Preqin (privately owned) for £2.55bn in cash.

Today’s key data release is (prelim) HICP inflation in the €-zone for June at 10:00 London time. Analysts forecast a small deceleration to 2.5% YoY. Fed Chair Powell will participate in an ECB Forum.

Tesla is expected to report quarterly deliveries today, a proxy to sales, ahead of its earnings release on the 19th. Consensus expects 436k EVs delivered in Q2 (vs 387k in Q1). Shares gained 6% yday.

That’s all for today, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.