Morning,

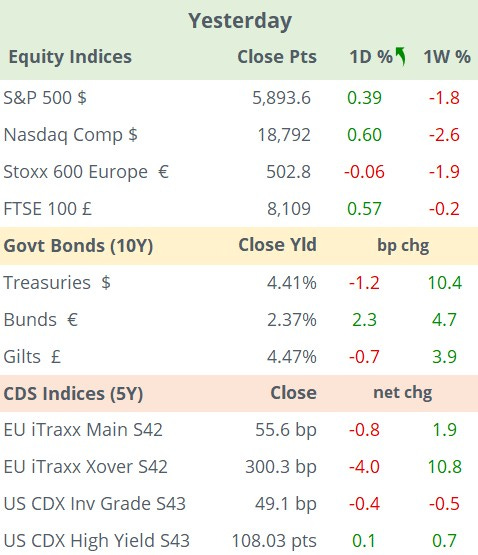

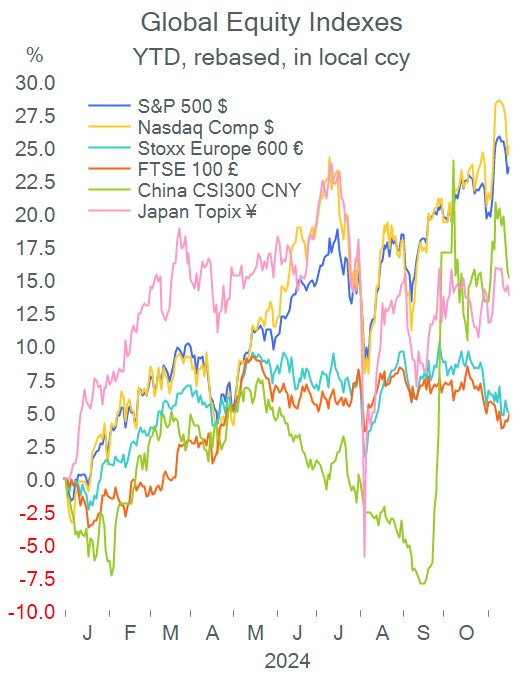

US equities traded firmer at the start of the week and partially recovered from Friday’s steep drop ahead of Nvidia’s earnings report tomorrow after the close. European indices were little changed with no major moves among large caps and some weakness in the Real Estate sector ahead of ECB policymakers’ speeches. ECB Vice-President de Guindos and Bundesbank President Nagel signalled concerns about the damage that Trump’s expected trade tariffs could do to the €-zone’s growth prospects.

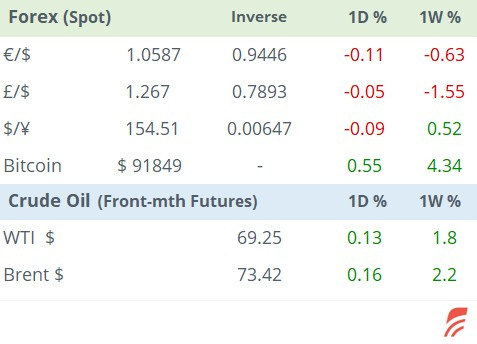

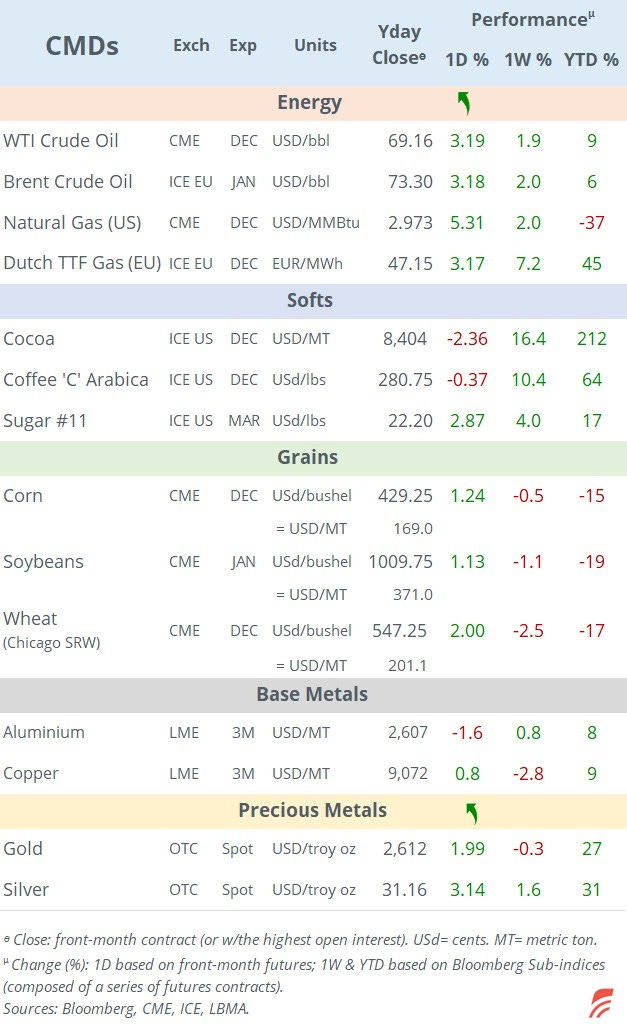

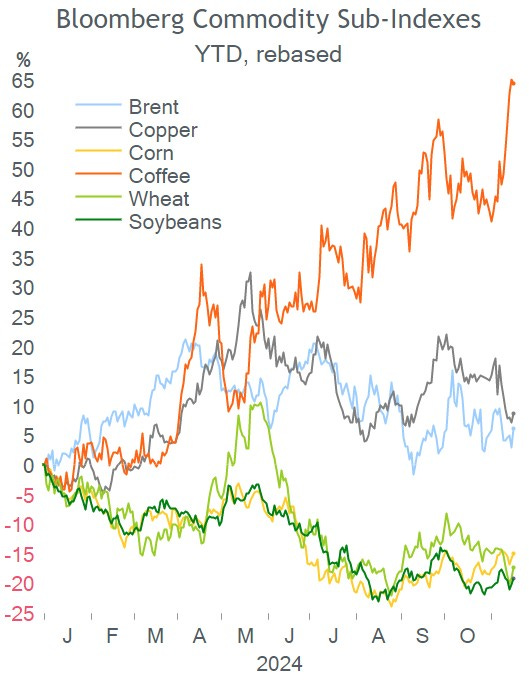

Crude oil jumped >3% yday on supply concerns triggered by a production halt due to a power outage at Norway’s largest oilfield managed by Equinor and a disruption at a Kazakhstan oilfield. Brent is little changed this morning at $73.40.

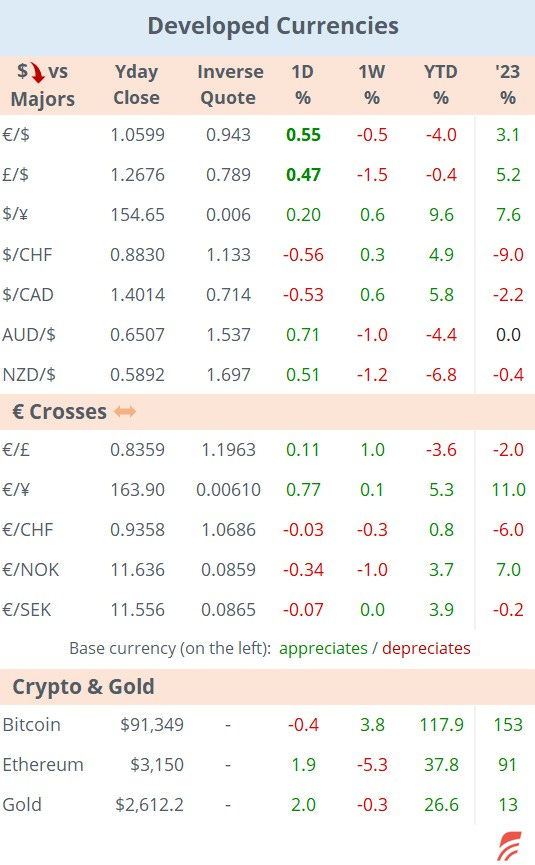

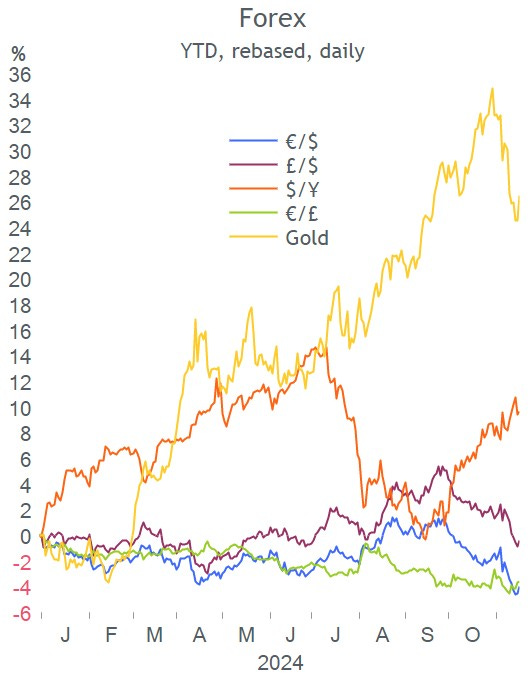

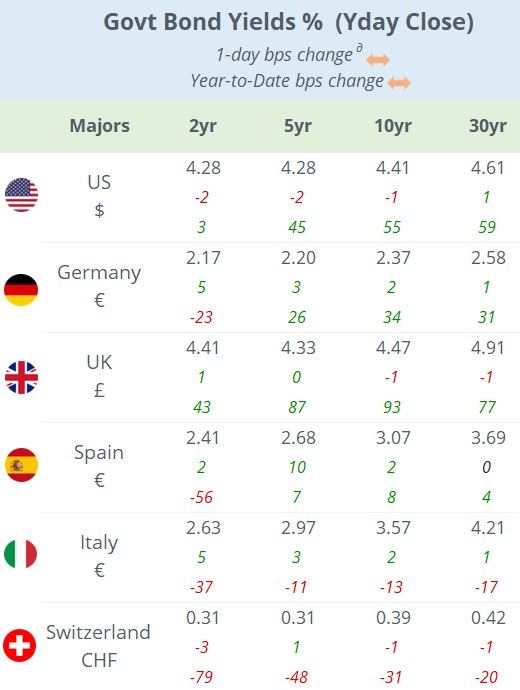

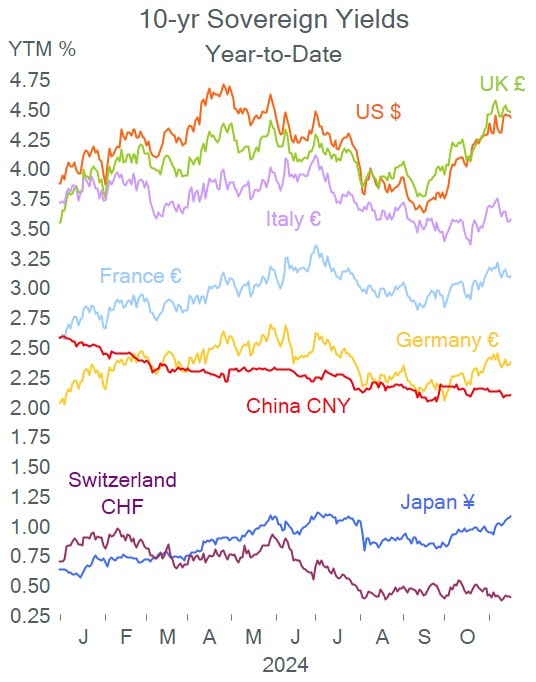

The $ reversed some of its recent gains against all majors with the € and £ appreciating 0.5% on Monday. Benchmark interest rates remained little changed with the 5-yr sector for Spanish sovereign bonds as the main mover, up 10bp to 2.68%.

In business news, Bloomberg reports that the US DoJ may push for Google to sell its Chrome browser to break its online search monopoly. Alphabet shares ended 1.6% higher yday and were a touch weaker in extended hours.

In M&A, Spanish news reports suggest that drugmaker Grifols SA (mcap €6.8bn) may receive a €7bn takeover bid from Canadian fund manager Brookfield after completing its due diligence. Grifols shares are down 30% YTD.

In the primary bond market in € yday, Booking Holdings placed 8-yr (at 3.33%),13-yr (3.75%) and 20-yr (4%), A- rated senior bonds and National Grid (BBB+) placed 5 and 10-yr bonds from of its US subsidiary.

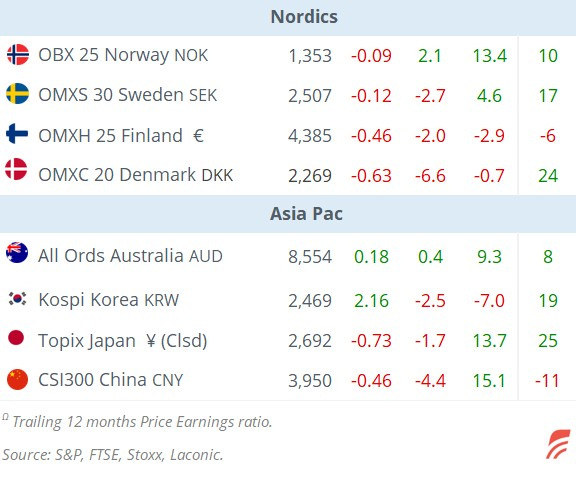

Asian stocks are trading mostly higher today with mainland China as the only market in red, losing 1%. European futures are pointing to a positive open. Developed currencies are little changed this morning while Gold, which gained 2% yday, is slightly higher again at $2,624.

Data to be released today: €-zone’s final inflation reading in October; inflation in Canada; house building stats in the US.

Hungary’s central bank will hold a policy meeting today with rates expected to remain steady at 6.5%.

Blue-chips reporting today: Walmart, Lowe’s Companies and Imperial Brands Plc.

The Hong Kong Monetary Authority Investment Summit is taking place today with the participation of CEOs of several global banks and asset managers.

Thanks for your time, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.