Est reading time: 3 min

Morning,

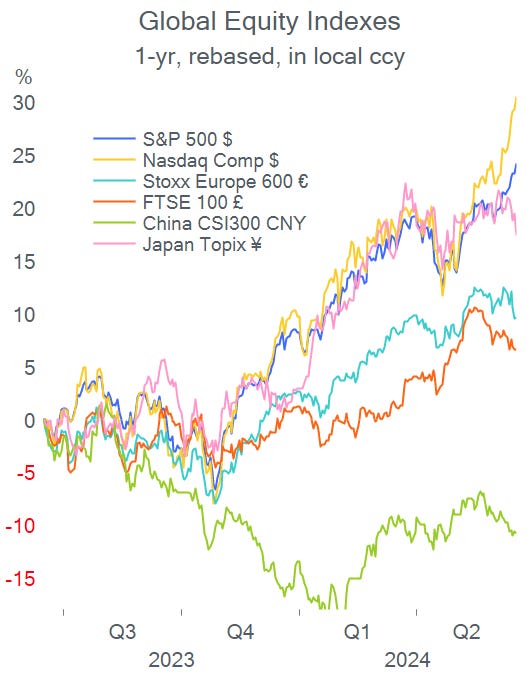

Markets in Asia are trading firmer today following another record high for stocks on Wall Street. Australia, Taiwan and Korea are leading with gains of 0.8% or more. The Nasdaq 100 added 1.2% with mega caps continuing to outperform with Tesla and Broadcom up by more than 5%. The index accumulated an 18% YTD gain. Goldman Sachs’ lifting its year-end S&P 500 target by 7% to 5,600 points also helped market sentiment.

Australia’s central bank maintained its policy rate at 4.35% as widely anticipated, the highest level in 13 years as inflation remains above target (2-3% tgt) and is proving persistent while the labour market is still tight. The Aussie $ is unch.

European stock futures are also firmer this morning by 0.3% while currencies are a touch weaker against the $. Brent is almost unchanged at $84.16, the highest in a month.

Bond markets continue to trade range-bound as yields shifted higher yday by 5-7bp across tenors for major yield curves. French 10-yr government bonds closed at 3.17% or 75bp over Bunds.

Headlines,

-French corporate leaders establish links with Le Pen’s far-right party, in an attempt to avoid at all costs a victory from the new anti-capitalist left alliance, seen as worse for business than the R.N. party.

-Netanyahu has dissolved Israel’s six-member war cabinet following the resignation of Benny Gantz and will make decisions only with a couple of close allies.

-Putin visits North Korea for the first time in 24 years while Washington raises concerns about the deepening relationship of the two countries.

-Philly Fed President Harker said that just one rate cut this year is appropriate considering his outlook as progress on inflation has been modest.

In deals, Finnish insurer Sampo (mcap €19bn) is acquiring Topdanmark (Denmark, property insurer, mcap €4.2bn) in an all-share deal at a 27% premium. Sampo already owns 48% of Topdanmark which saw shares rally 22% yday.

In debt capital markets, the notable issuer yday was Home Depot (mcap $346bn) which placed $6bn of senior notes (A2/A) in 5-yr (UST+60bp), 7-yr (+70), 10-yr (+80), 30-yr +100) and 40-yr (+110) maturities. Daimler Truck Finance also placed several tranches in $.

Today’s events include monetary policy meetings in Chile and Hungary; retail sales and industrial production in the US; the final inflation reading for May in the €-zone and Germany’s ZEW sentiment indicators. It will be an active day for Fed speakers with several officials participating in conferences, ahead of tomorrow’s holiday. US Treasury futures for June expire today.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Please share using the button below, as access is free to all.