Morning,

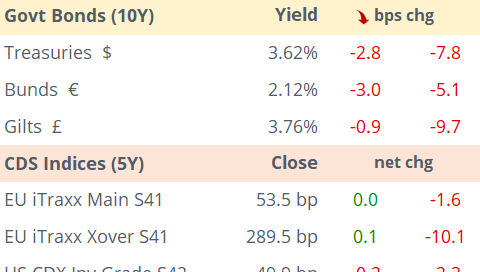

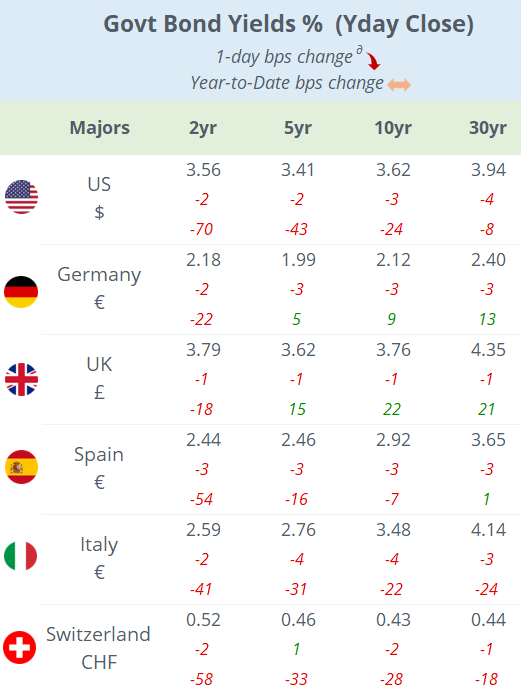

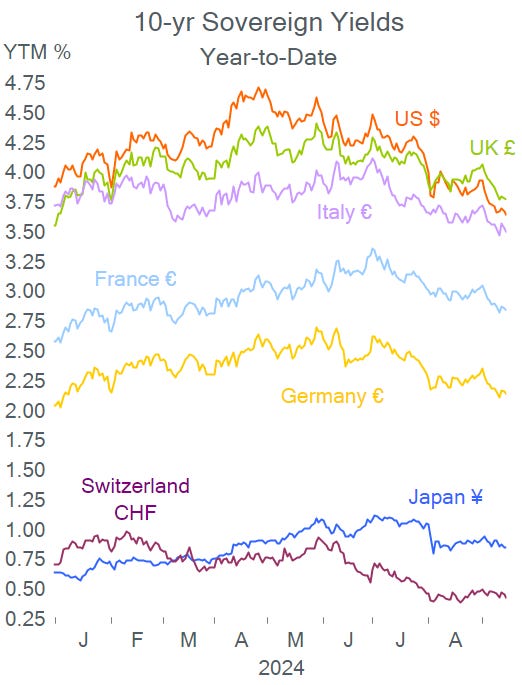

Bond yields continue to shift lower across regions with 10-year Treasury yields reaching a 14-month low of 3.62%, ahead of tomorrow's widely awaited Fed meeting. On the short-end of curves, bond yields have fallen sharply this year, with 2-year Treasury notes down 70bp, German Schatz down 22bp and Gilts down 18bp.

The $ fell yesterday with cable as the biggest winner, advancing 0.7% to 1.3216 to become the best-performing currency among majors this year (+3.8%).

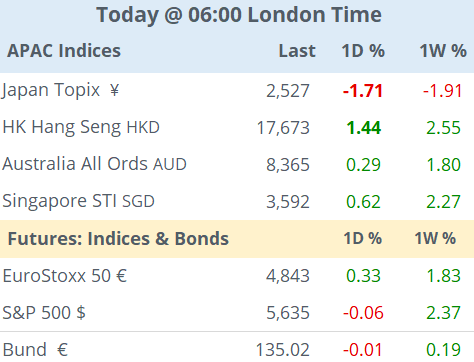

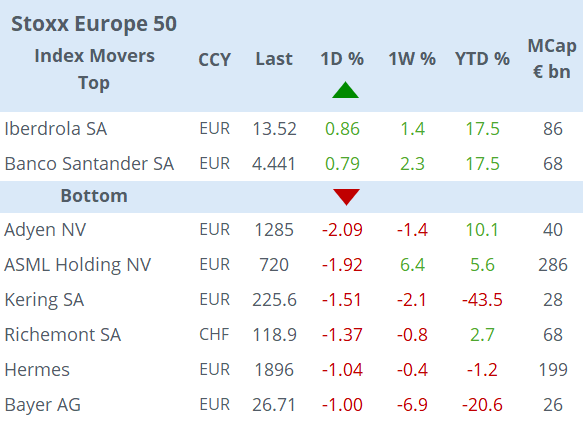

Stocks on Wall Street ended mixed last night with the Nasdaq Composite dropping 0.5% while the S&P 500 and the Dow Jones Industrials closed at or near their all-time highs. Technology was the weakest sector with Apple falling nearly 3% after an analyst said that demand for the iPhone 16 was lower than expected. A notable mover was Intel which rallied more than 6% after qualifying for government grants to supply chips to the U.S. military. European equities were little changed on Monday without notable moves among large caps.

Asian markets are mixed today with Japanese stocks falling 1.7% on concerns about a stronger ¥ should the Fed cut rate by 50bp tomorrow. The Hang Seng is gaining 1.5% while mainland China, Korea and Taiwan markets are closed today.

In corporate deals, French electrical equipment supplier Rexel SA (mcap €7.4bn) rejected a takeover approach by U.S.-based IT services firm QXO (mcap $5.6bn), which valued Rexel at €8.5bn. Shares rallied 9% yday.

Also, BP (mcap £66bn) is selling its onshore wind energy division in the U.S. for an estimated $2bn, to focus instead on a new solar energy project. BP shares have lost 13% YTD.

Media reports suggest that Deutsche Bank is exploring merger alternatives with rival Commerzbank to stop Unicredit from acquiring the smaller German bank.

In IPOs, Chinese home appliances manufacturer Midea Group (mcap $62bn) raised ~$4bn in its dual listing in Hong Kong, the city's largest share offering in four years. Shares gained 10% at the open.

In debt capital markets, yesterday’s notable corporate bond issuers include $Novartis (5, 7, 10 and 30-yr in $) and €Coca-Cola U.K. (7.5-yr) on the investment grade space and $Royal Caribbean (7-yr) in high yield.

Data to be released today includes retail sales and industrial production in the U.S.; inflation in Canada; and ZEW indicators in Germany.

That’s all for today, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.