Morning,

Wall Street finished firmer last night driven by dovish comments by the Fed’s boss and Trump’s improved odds of winning the election. Powell said that the latest data provided more confidence that inflation was returning to the central bank’s 2% target. Traders increased bets that the Fed will almost certainly cut rates in September.

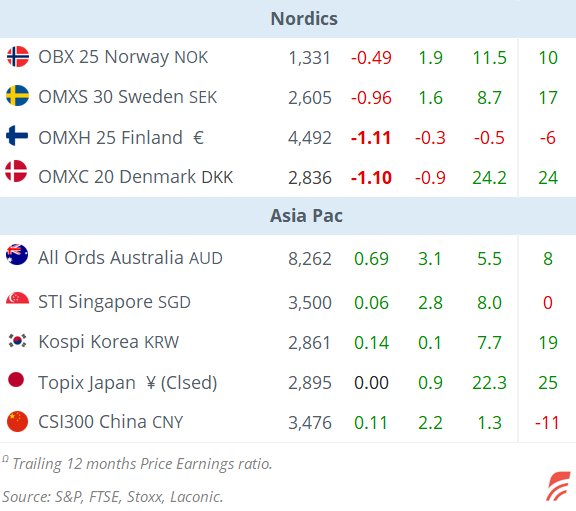

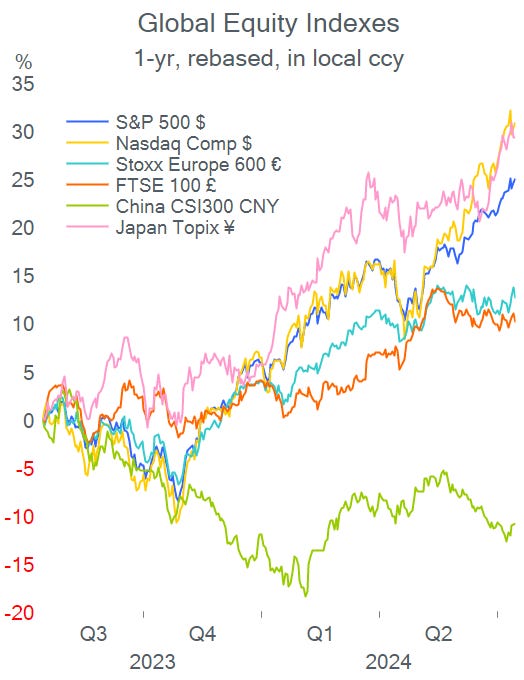

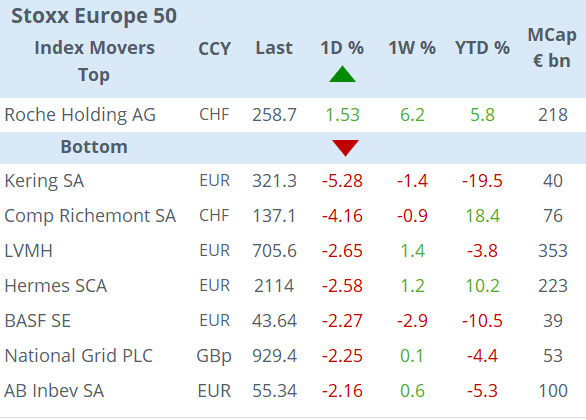

European risk assets fell sharply following disappointing earnings results by Nordea Bank and Swatch Group and luxury stocks dropped on weaker Chinese demand. Yesterday’s worst Stoxx 50 index members were French luxury companies. The Stoxx 600 index is 8% higher this year, 10 percentage points less than the S&P 500 in local currency.

Goldman Sachs (mcap $159bn, P/E 19x) beat Q2 revenue ($12.7bn, +17% YoY) and earnings ($3.04bn, +150%) estimates with fixed-income trading ($3.2bn) as the highlight of the release and investment banking ($1.7bn) slightly weaker than expected. The Fed stress test showed Goldman needs more capital and will moderate its share buyback programme. Shares gained 2.6% to an all-time high.

Finland’s Nordea Bank (mcap €37bn) reported Q2 results broadly in line with estimates (net profit €1.3bn) but disappointed investors with a buyback delay announcement. Shares ended down 3.8% and accumulated a 6% drop YTD.

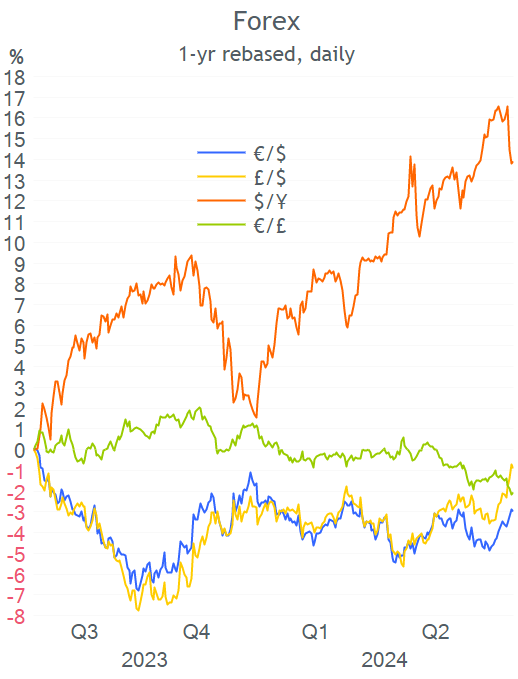

In forex markets, the $ was a touch firmer, gold is trading at a nominal record high and Bitcoin rallied 11% yday. Benchmark bonds ended mixed with European sovereign yields dropping by a few basis points while the Treasuries curve added 4-5bp.

Industrial production in the €-zone declined less than anticipated, -0.6% MoM and -2.9% YoY in May.

Asian markets are trading mixed today with Hong Kong stocks dropping sharply again (-1.4%) while Japan, Korea and mainland China are a touch higher. European stock futures are pointing to another weak opening, bond futures are flat, and Brent oil slipped below $85.

Headlines today:

-Trump added another legal victory after a judge dismissed a criminal case over his handling of classified documents. He also announced that 39-year-old Ohio Senator J.D. Vance will be his running mate, at the start of the four-day Republican National Convention in Milwaukee where Trump surprisingly appeared with a bandaged ear. Shares in Trump Media and Technology Group, 60% owned by Donald Trump, jumped 31% to a $7.7bn valuation.

-In French politics, the left alliance that won the most seats at the parliamentary election failed to agree on a candidate for prime minister, suspended internal negotiations and Macron increased his chances of retaining power.

There were a few corporate credit rating changes yday: French utility Engie was d/g one notch to BBB+ by Fitch; Pirelli was u/g one notch to BBB by Fitch; French banks Natixis, BPCE and Credit Foncier were u/g one notch by S&P; and Swiss chemicals co Syngenta was d/g by Fitch.

Notable bond issues include: $Pepsico 5-yr (at T+40bp), 10-yr (+60) and 30-yr (+80); Italian infrastructure €Mundys 5.5-yr (B+220bp); German utility €EnBW 7-yr (B+121bp), 12-yr (+145).

In M&A, media reports suggest that Google’s parent, Alphabet, is in advanced talks to acquire cybersecurity start-up Wiz for ~$23bn, which would become the company’s largest takeover ever.

In IPOs, OneStream Software of the US, backed by KKR, filled its listing plans and aims to raise $465mn at a $4.4bn valuation with a guidance range of $17-19/share. Also, US healthcare company, Concentra Group (a Select Medical subsidiary) plans to raise $585mn at a $3.3bn valuation.

Data today will be Canada’s inflation; US retail sales, import and export prices; German ZEW indics; and Italian final inflation reading.

Companies reporting earnings today include Ocado Group, Richemont, Bank of America, Morgan Stanley, Charles Schwab and United Health, all before markets open.

EU’s ECOFIN meeting is taking place with the participation of ECB’s board member Luis de Guindos.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.