Podcast ↑↑↑↑ Scroll down for the script.

Morning,

There’s a lot to cover today, with Asia selling off sharply. We’ll focus on the macro and relevant information. Yesterday was an active day for US markets with equities falling sharply, the S&P 500 lost 1.2% and posted its biggest two-day fall in more than one year to close at 5,062 points, the lowest level in six weeks. The Nasdaq Composite ended 1.8% lower, its worst day in two months. European equities had already closed with modest gains when the US began to fall, with German and Italian benchmarks outperforming.

The strong US retail sales reading (+0.7% MoM) helped stocks open on a positive note but a spike in Treasury yields reversed the trend. Geopolitical concerns and Fed officials' comments, added to the sell-off sentiment.

Asian markets are following the US trend and are falling sharply today, with Japan, Korea, Australia and Hong Kong all down by more than 2% while Taiwan is plunging by nearly 3%. European stock futures are trading significantly weaker as well, down by almost 1.5%. S&P 500 futures are flat from yesterday’s close.

China’s GDP report today surprised with a solid 5.3% YoY expansion for Q1, exceeding forecasts and in line with Beijing’s full-year growth estimate of 5%. Although the government's recent fiscal and monetary policy measures have supported the economy, some indicators remain soft with retail sales (+3.1% YoY), and industrial output (+4.5%) growing by less than anticipated while property prices declined.

On Friday, San Francisco Fed President Daly made some hawkish remarks that traders priced into bond markets yesterday. He stated that there was still a lot of work to do to make sure inflation was falling to the Fed’s target and that there was “absolutely no urgency to adjust policy rates”.

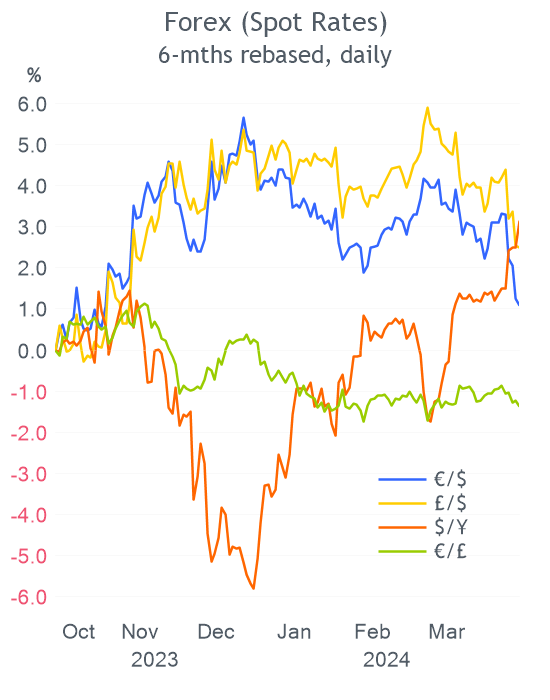

Unsurprisingly, the dollar strengthened again, mainly against the yen, and yields rose. 10-year Treasury yields jumped 13 bps to 4.63%, the highest in five months, Bunds ended 7 bp higher at 2.43% and Gilts added 10 bp to 4.24%. Bund futures are a touch firmer this morning.

Goldman Sachs beat revenue ($14.2bn, +16% YoY) and earnings ($4.1bn, +28% YoY) estimates fueled by trading (+10% YoY) and investment banking (+32% YoY) activity. Shares added 3% and remain near their all-time high. The bank's market cap stands at $130bn.

In corporate deals, Italian electrical equipment company Prysmian Spa will acquire US-based Encore Wire Corp, a manufacturer of electrical cables for $4.6bn, in cash. The combined market value stands at nearly €20bn. Encore’s shares rallied 11% and Prysmian gained 4.5% yesterday. Both stocks are at their all-time high.

In IPOs, British commodities broker Marex Group Plc, launched its initial public offering with a target to raise $323mn on Nasdaq, for a valuation of $1.5bn. The price guidance range is 18 to 21 and it will trade under the symbol MRX.

Also, British private equity firm CVC Capital Partners plans to raise €1.25bn by placing 12.5% of its shares on Euronext Amsterdam, to begin trading within a month.

In credit ratings, French luxury group Kering was downgraded one notch by S&P to A-. Shares closed unchanged. Kering’s 10-year senior bonds barely moved and closed at 116 bp over Bunds for a 3.62% yield. Also, French telecom operator Eutelsat Communications was downgraded one notch by Fitch to B+, deeper into junk.

Today’s economic releases include UK employment and Canada’s inflation. Companies reporting Q1 results include Bank of America, Morgan Stanley, Johnson & Johnson and United Health among others.

That’s all for today, see you tomorrow.