Morning,

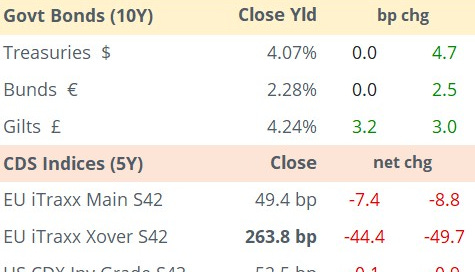

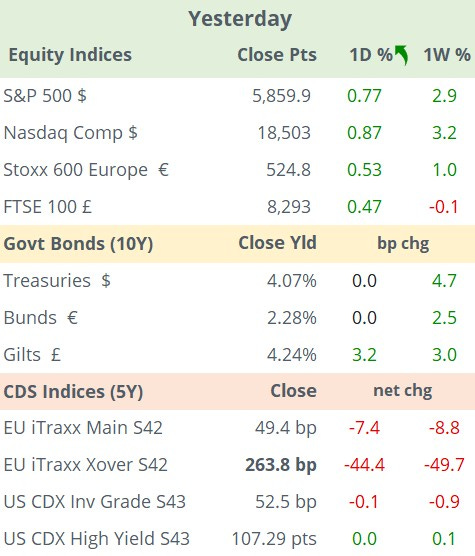

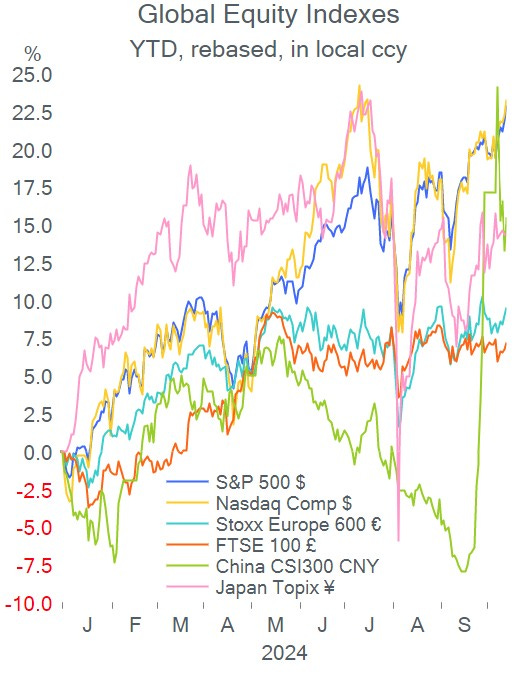

Wall Street indices added nearly 1% yesterday as stocks continue to break fresh records propelled by the IT sector and the strength of Nvidia (+2.4%), which reached an all-time high as investors remain bullish on the artificial intelligence boom.

Nvidia has accumulated a 180% YTD rally to a total market cap of $3.39tn, surpassing Microsoft as the world’s second-largest company behind Apple. It is trading at a trailing price-earnings ratio of 65 times compared to Apple’s 35 times.

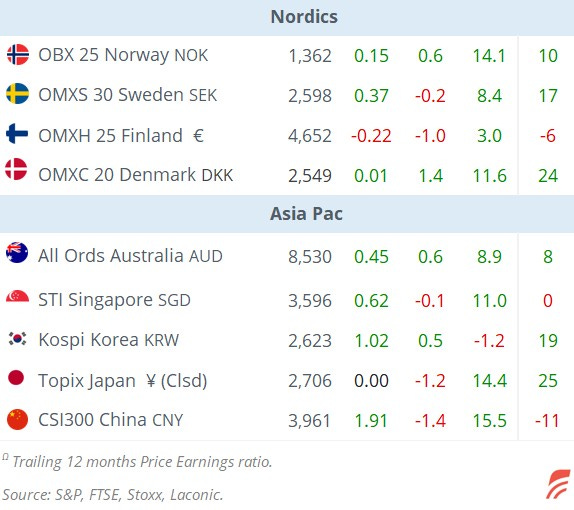

Equities in Europe finished at a 2-week high ahead of corporate earnings and this week’s ECB meeting with Madrid (+1.1%) and Milan (+1.1%) leading the gains. Luxury stocks were the hardest hit yesterday following China’s stimulus update during the weekend with Gucci’s parent Kering (mcap €28bn), dropping 4% to accumulate a 42% YTD decline.

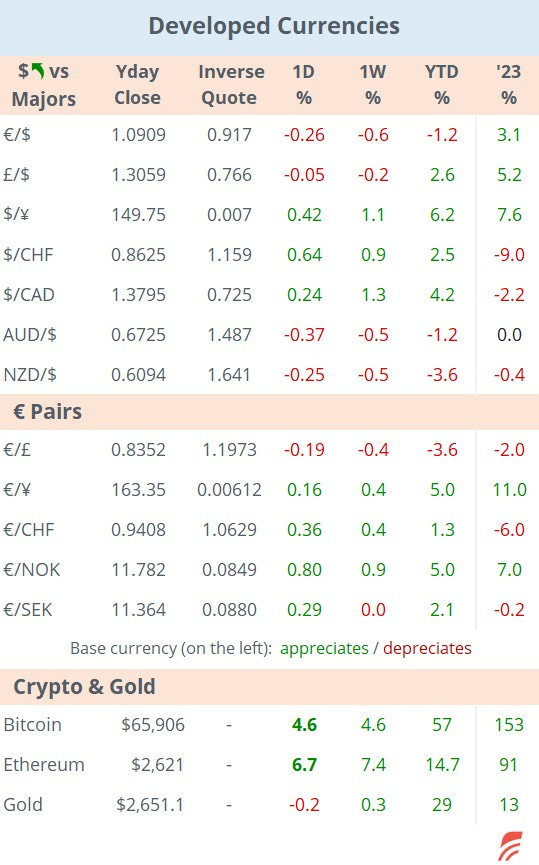

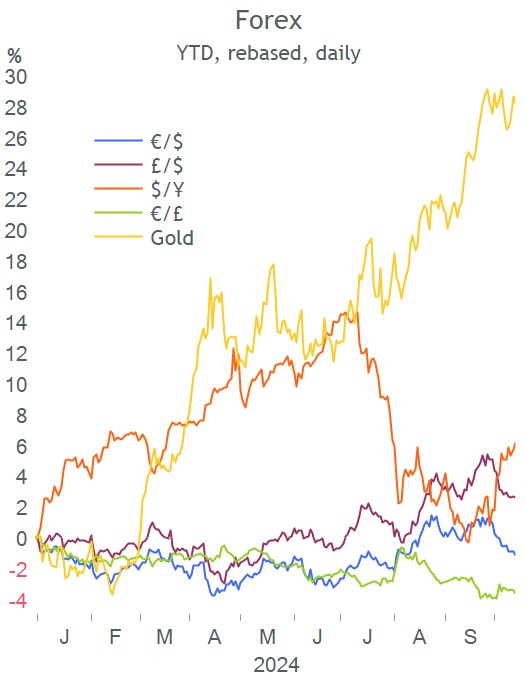

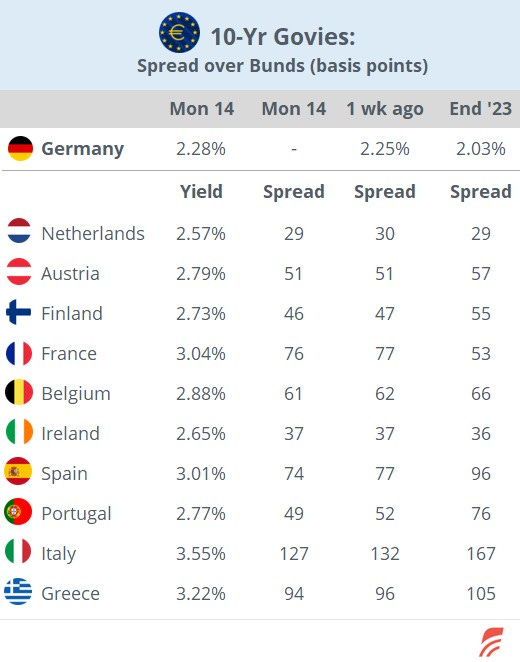

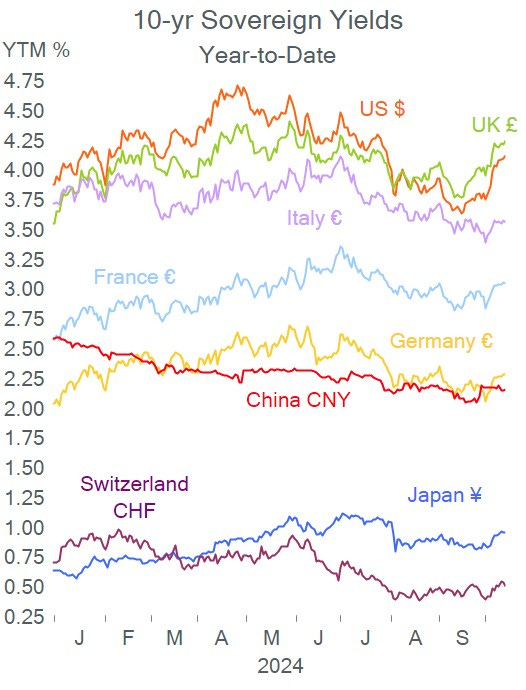

Fixed income markets were quiet due to the holidays in the U.S., Canada and Japan. The $ index hit its highest closing level in nearly three months on Monday, above 103 pts, while crypto leaders, Bitcoin (5%) and Ethereum (7%), continue to march higher.

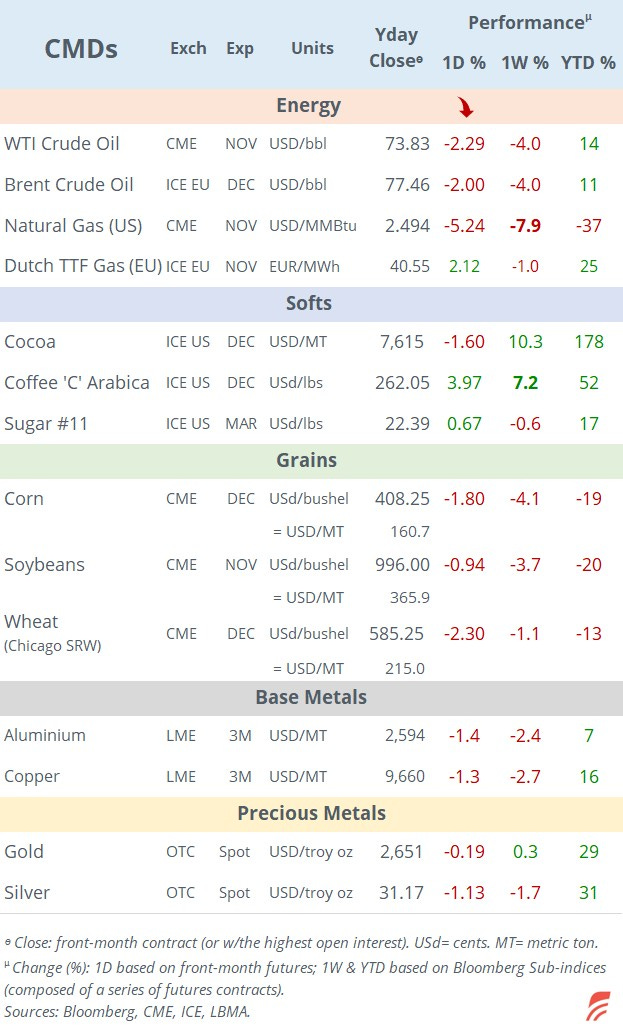

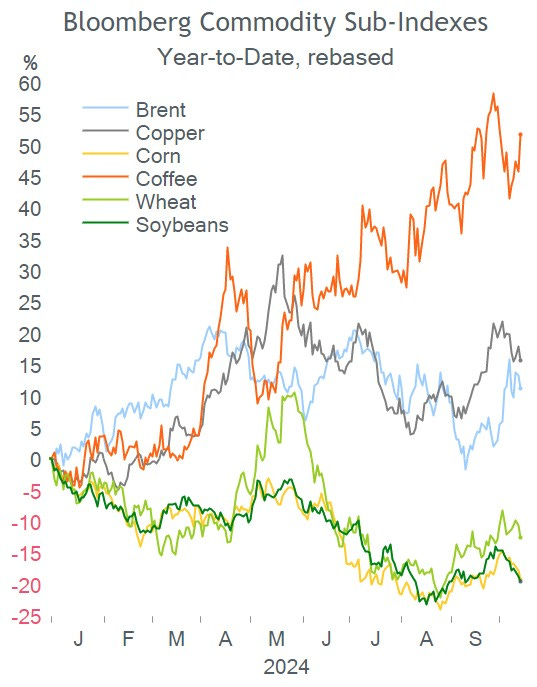

Although Israel persists in striking Lebanon in its fight against Hezbollah, the Washington Post suggested that Tel Aviv is not considering attacking Iran’s oil infrastructure when it retaliates the recent missile attack from Tehran. Crude oil prices dropped 2% on Monday and are extending the decline by 3.6% today to $75.20 after OPEC trimmed its global demand forecast for oil for this year (to 1.93mbp) and next (to 1.64mbp) by around 5%.

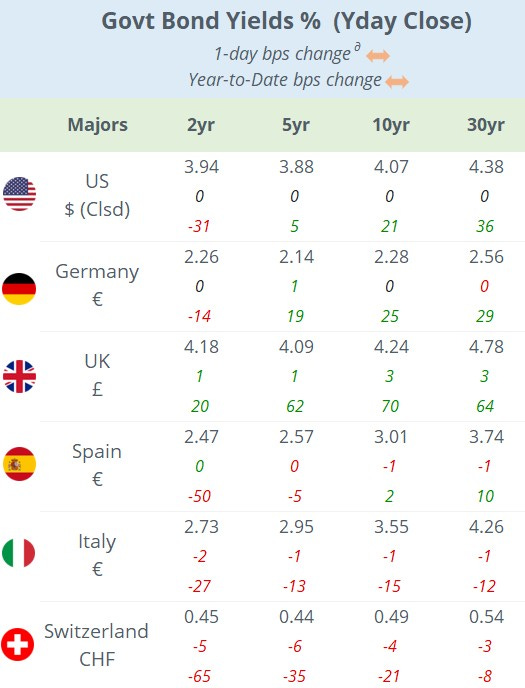

In central banks, Fed Governor Chris Waller called for "more caution" on interest-rate cuts ahead and expects gradual cuts in 2025.

“We are in the sweet spot right now, we got to keep it there, that’s our job," Waller said.

In corporate deals, Denmark’s pharma H Lundbeck (mcap $6.8bn) agreed to acquire biotech Longboard Pharma (mcap $2.3bn) of the U.S. to expand in epilepsy treatments for $2.6bn. Longboard was listed in 2021 and shares rallied 51% yesterday.

Equities in Asian markets are mostly firmer today with Japan and Taiwan gaining more than 1% while mainland China and Hong Kong are dropping by 1%. FTSE and Eurostoxx futures are pointing to another positive opening of around 0.5% in early morning trading.

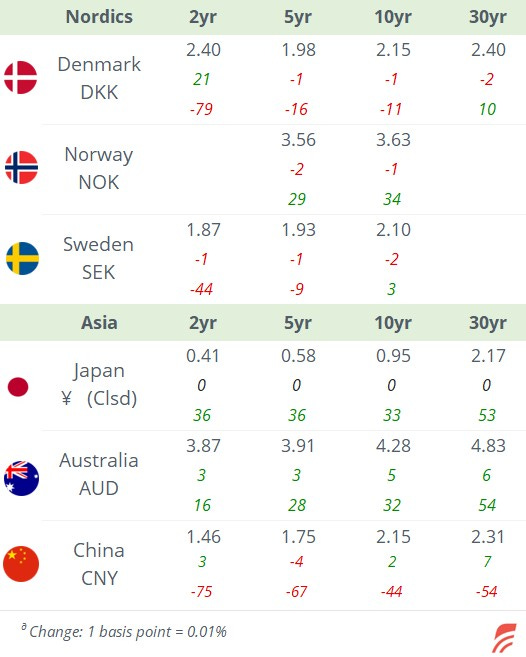

On the data front today, we’ll get the employment report (u/e rate, avg earnings) in the UK; inflation updates in France, Spain, Sweden, Canada, New Zealand and Israel; industrial production in the €-zone; and Germany’s ZEW indicators.

The Q3 earnings season continues today with reports from blue chips LVMH, Rio Tinto, Goldman, Citi, Bank of America, Charles Schwab, United Health and J&J.

Thanks for your time, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.