Morning, Monday was an uneventful day in equity markets with leading benchmarks ending almost unchanged and little worth highlighting. Equity investors are taking a cautious stance as they await this week's data releases.

The Russell 2000 index fell nearly 1% and the FTSE 100 added 0.5% but every other index finished flat on the day. BT Group Plc (UK, telco, mcap £14bn) gained 8% after Bharti Enterprises of India acquired a 24.5% stake from Altice.

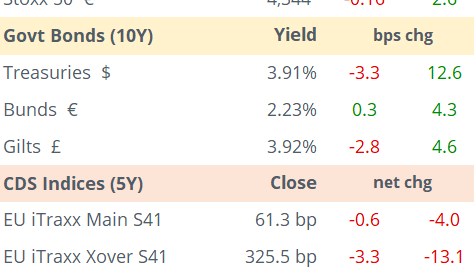

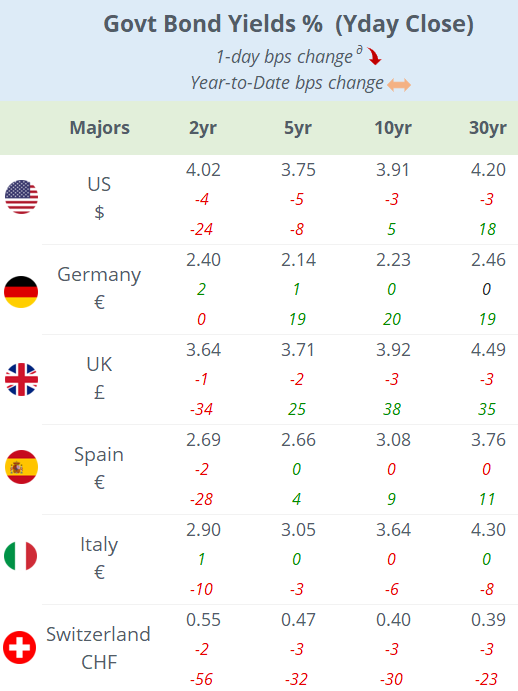

In currency markets, the ¥ resumed its depreciation trend and accumulated a 2% weekly fall against the $ and €. Interest rate markets were also calm and US Treasury yields fell a few basis points (3-4bp) across the curve while other markets barely moved. The short-end of the Danish curve rallied 16bp to 2.52% after July’s CPI inflation reading of +1.1% YoY.

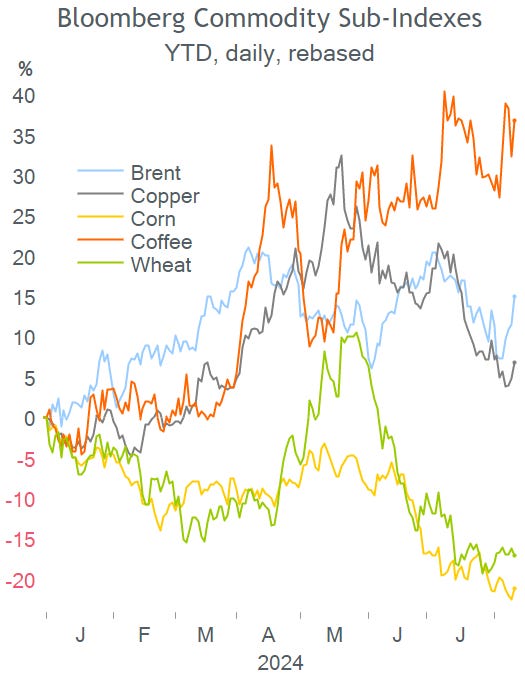

In commodities, crude oil prices rose 3.3% on Monday despite OPEC cutting its 2024 global demand outlook forecast, from 2.25mbpd to 2.11, mainly on lower expectations for Chinese demand. Brent is falling ~1% this morning to $81.50.

In emerging markets, equities in Brazil and Taiwan have recovered sharply from the selloff a week ago with Sao Paolo advancing 9% and Taipei 11% in $ terms in the past five sessions.

Today in Asia: stocks in Tokyo are rallying more than 2%, Singapore is up by 1% and all other markets are a touch weaker. Japan's wholesale or corporate goods inflation advanced at the fastest pace in eleven months, with a 3% YoY increase, hitting its 8th straight monthly record. The ¥ is stable at 147.35.

European futures are firmer in early trading, in line with US stock futures.

Headlines:

-Washington warned of an imminent Iranian attack on Israel in retaliation for the killing of a Hamas leader in Tehran.

-Wildfires in Greece are dangerously approaching the outskirts of Athens, prompting the evacuation of thousands of residents.

-Elon Musk blamed a massive cyber attack on his social media platform X for the technical glitches experienced during his widely publicised interview with Trump.

- UK-based Balderton Capital has raised $1.3 billion in Europe’s largest venture fund for start-ups.

In M&A, Canada’s Bank of Nova Scotia (mcap $55bn) is acquiring a 15% stake in Key Corp (US, regional lender, mcap $15bn) for $2.8bn. Key Corp shares rallied 9%.

UK-based asset manager Janus Henderson Group (mcap $5.5bn) is buying private credit manager Victory Park Capital for an undisclosed amount.

Private equity firm Carlyle and GIC of Singapore are exploring the sale of Nobian, a Dutch salt and chemicals producer that spun out of Akzo Nobel 6-yrs ago.

In credit ratings, Israel was d/g one notch by Fitch to A+. It’s a holiday in Israel today. Home Depot will report earnings before the US market opens.

In corporate debt issues, Eli Lilly (5, 10 (rated A+, at T+70bp), 30, 40-yr) and Caterpillar (5-yr, rated A2 at T+68bp) were active in the $ senior bond space.

Data today: US PPI & Spain CPI inflation; UK employment figures; Germany ZEW indicators.

There are no scheduled central bank meetings for today. Fed official Bostic will participate at a conference.

As a reminder, at Laconic, we believe in not wasting your time—if there's nothing meaningful to report, we keep it even shorter.

That’s all for today.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.