Morning,

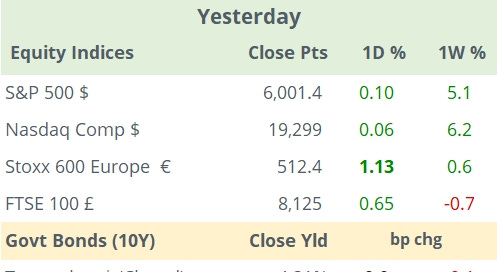

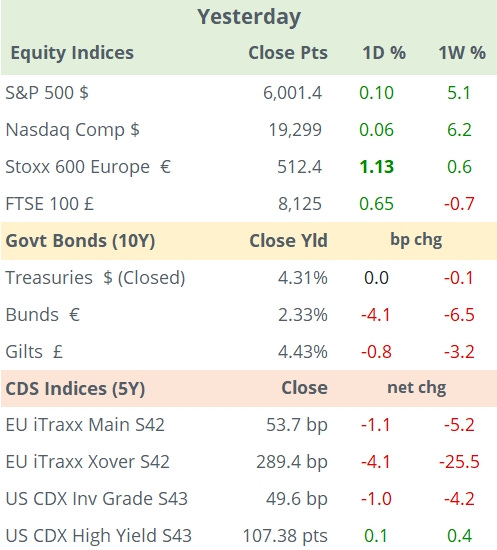

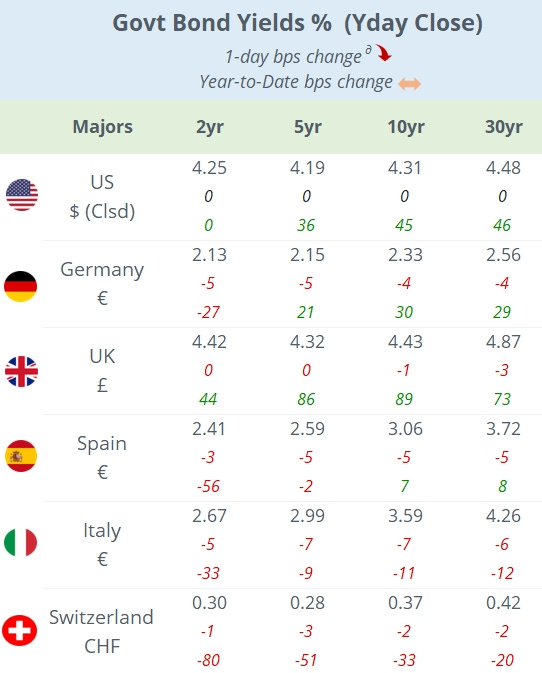

Wall Street finished a touch firmer last night with the S&P 500 closing above 6,000 points for the first time as the momentum for the so-called Trump trades accelerates. Republicans are closer to confirming victory in the House of Representatives, needing just four more seats to secure a majority. Monday was a holiday for US bond markets and €-zone bond yields moved down by ~5bp across tenors.

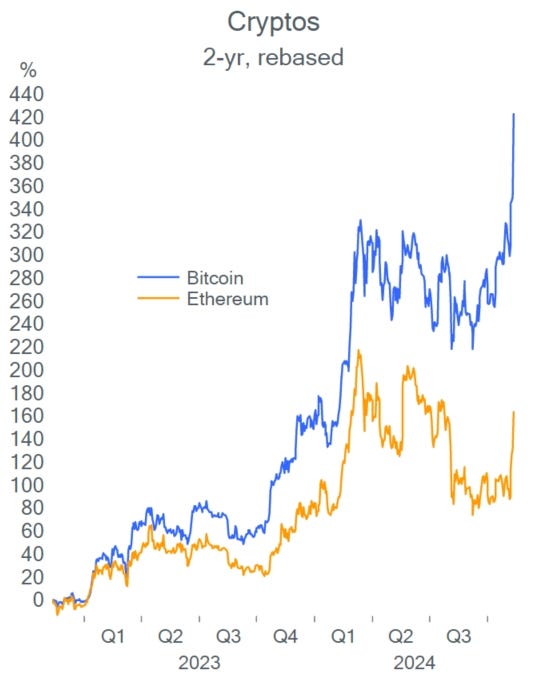

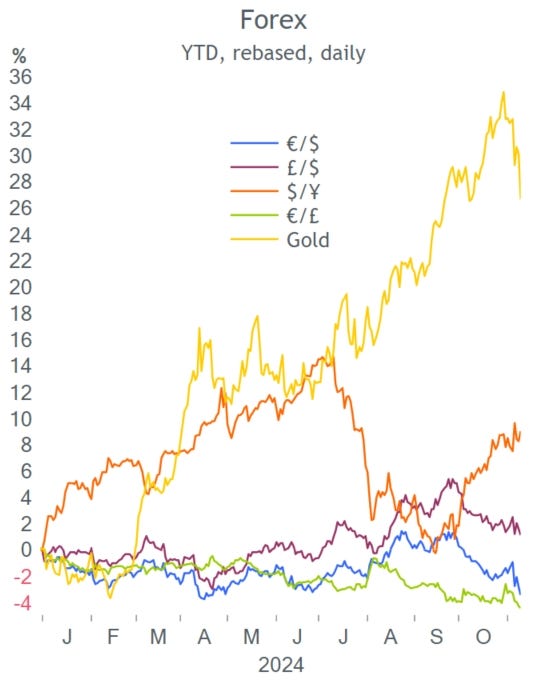

The $ continued to appreciate as the € touches its lowest level since April, gold shifts lower again and cryptos skyrocket. Bitcoin rallied 15% yesterday as is trading at $88k this morning while Ethereum added 13% to $3,335 and is 40% higher in the past week. (see chart). Shares in crypto exchange Coinbase Global jumped 20% to a total market value of $82bn.

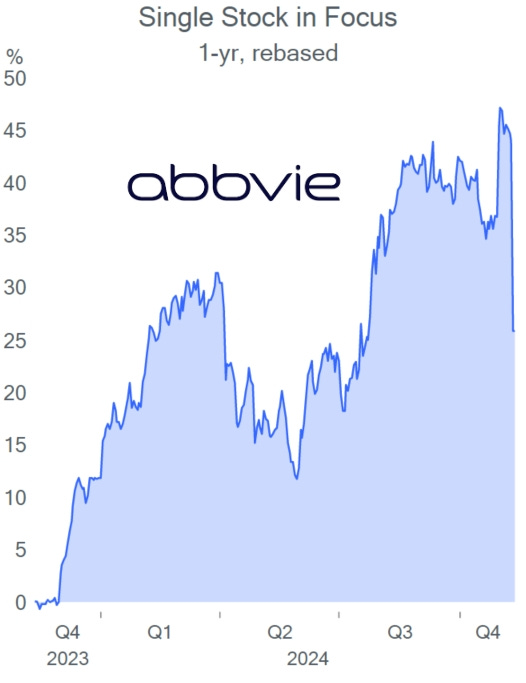

In single stocks, Tesla maintained its upward trend advancing 9% to a total market cap of $1.1tn while biotech giant AbbVie (mcap $308bn) plunged 12%, its worst day in several years, after a key schizophrenia drug, acquired as part of a nearly $9bn acquisition last year, failed in clinical trials. Shares are still 12% higher YTD (see chart).

Equities in Europe added 1% on average, their best day in six weeks, to recover some of the lost territory after the US election. The defence sector reached a record high. EU countries are expected to increase spending in NATO defence following Trump´s warning over cutting US military support for Ukraine.

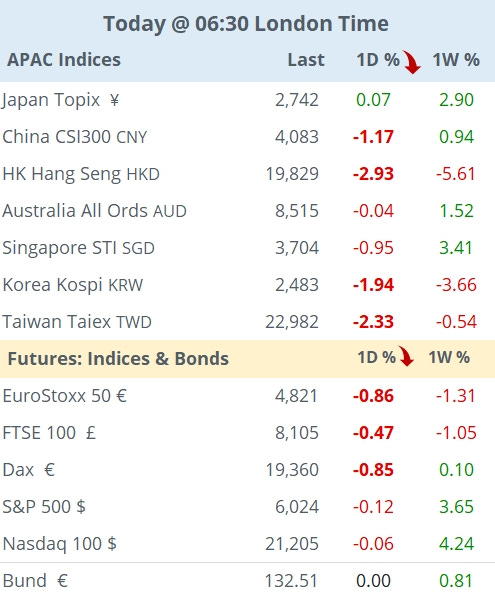

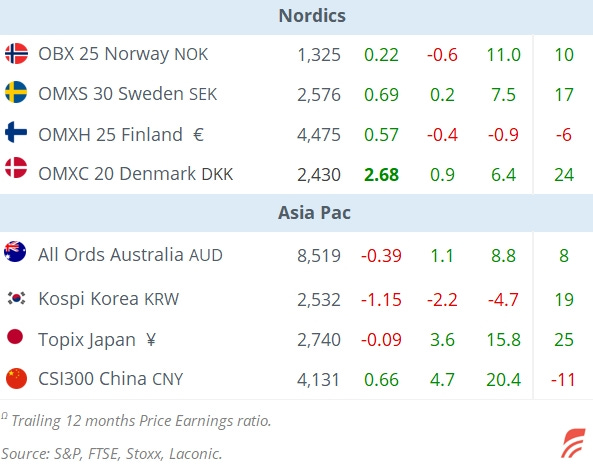

Asian markets are sharply down today led by declines of >2% for Hong Kong and Taiwan benchmarks following reports that the US ordered TSMC to suspend delivery of advanced AI chips to Chinese customers. European stock futures are almost 1% lower in early morning trading.

In deals, news reports suggest that Italian luxury apparel co Moncler Spa (mcap €13bn) is not considering acquiring the Burberry Group (mcap £2.8bn). (Reuters)

Swiss exchange SIX Group acquired UK Aquis Exchange for £207mn. (SIX)

In business news, the Estate Administrator of failed crypto exchange FTX is suing Binance for $1.8bn in an attempt to recover funds. (FT)

In data today, we´ll get the employment report in the UK, the ZEW indicators and final CPI reading in Germany.

There are no scheduled monetary policy meetings for today but the presidents of the Richmond, Philly and Minneapolis Feds will participate at conferences.

Blue chips reporting today include AstraZeneca, Infineon, Flutter Ent, Home Depot, Spotify, Shopify and Softbank.

Thanks for your time, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.