Est reading time: 5 min

Morning,

European markets reacted to the results of the EU elections, the advance of far-right parties and Macron’s snap parliamentary election announcement. All European stock benchmarks dropped with the CAC 40 as the clear underperformer with a 1.4% decline to its lowest level in four months after dropping as much as 2.4% at yday’s open. French banks and insurers sold off sharply with SocGen down 7.5%, BNP nearly 5% and Credit Agricole 3.6%.

The latest vote count shows that Marine Le Pen’s RN party got more than double the votes for the EU parliament than Macron’s centrist alliance. The French President set the two-round surprise snap election for June 30 and July 7, a move seen as a gamble as he no longer holds a parliamentary majority and is struggling to form an alliance to face Le Pen.

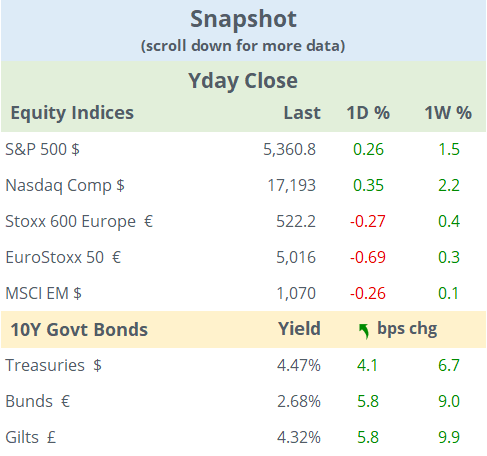

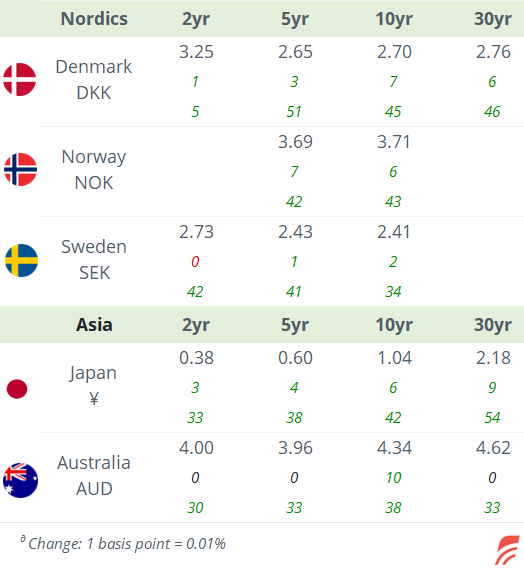

French bonds fell sharply with 10-year OATs yields closing at 3.24%, the highest since November, or 56bp over Bunds, the widest spread in six months.

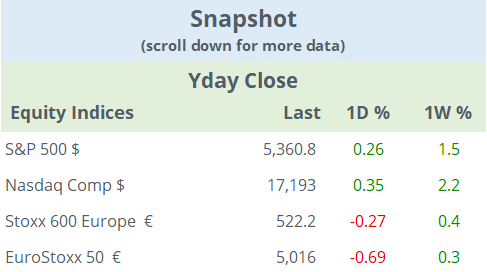

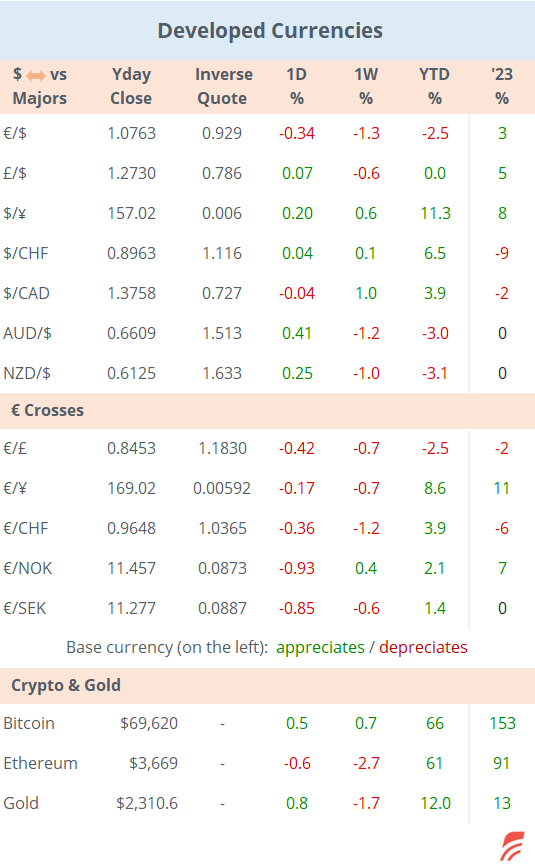

The € ended weaker yday at 1.0763 and is down 2.5% YTD against both the $ and £. Benchmark yields continued to climb, closing a few basis points higher across maturities with Bunds at 2.68% and Treasuries at 4.47%.

In Brussels, EU Commission president Ursula von der Leyen secured a second five-year term after her centre-right EPP party won 25% of the seats and will face increasing pressure from the far-right parties.

Wall Street closed firmer last night ahead of tomorrow’s Fed meeting and inflation update with the S&P 500 and Nasdaq Composite closing at fresh record highs.

Apple unveiled a long-awaited A.I. strategy at its annual developer conference, with the integration of Apple Intelligence with an improved Siri voice assistant as well as a partnership with OpenAI, to bring ChatGPT to its devices. The stock fell 2% as it slightly disappointed investors who expected more meaningful news.

Nvidia’s (mcap $2.97tn) 10-for-1 stock split became effective yesterday, and the giant chip maker was rumoured to be a candidate to replace Intel in the Dow Jones Industrials index, which is a price-weighted index.

Southwest Airlines (US, mcap $18bn) shares jumped 7% after activist investor Elliott Mgt disclosed a $2bn stake.

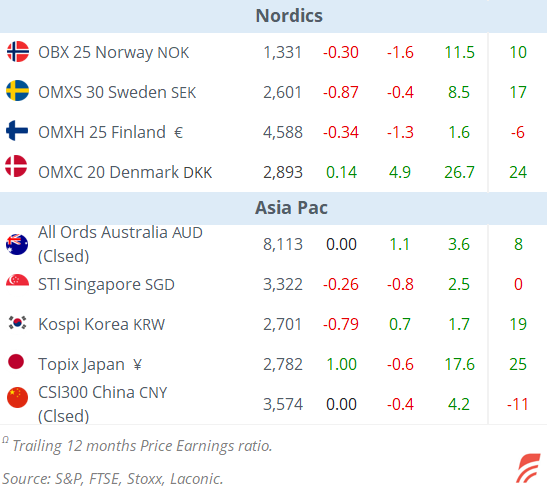

Asian markets are trading mixed today with Chinese and Australian indices back from the long weekend and posting losses of more than 1% while other benchmarks are little changed. The yen is a touch weaker above 157; Brent oil is unchanged at $81.50 following yesterday’s 2.5% gain. Eurostoxx 50 futures are trading firmer this morning while the FTSE and Dax are unch. Bitcoin is losing 2.5% today at $67,900.

A few European countries reported mixed inflation updates. Denmark’s CPI for May was 2.2% YoY, well above the 0.8% recorded a month ago. Norway's headline inflation was 3.0%, below estimates and lower than in April while core CPI was 4.1%, a touch higher than expected. Greece’s came in at 2.4%, marginally below estimates and below April.

In credit ratings, Aeroports de Paris (France, airport operator, mcap €12bn) was downgraded one notch by S&P to A-. It is rated BBB+ by Fitch. 10-year senior bonds are trading at 112bp over Bunds for a 3.75% yield. Shares closed 4% lower but went ex-dividend yesterday.

The main data point today will be employment figures in the UK and Dutch inflation. In emerging markets, we’ll get inflation updates in Brazil and the Czech Rep as well as Mexico’s industrial output. Oracle (US, software, mcap $346bn) reports today. It’s a holiday in Israel.

That’s all for today, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Please share using the button below, as access is free to all.